Table of Contents

1. Introduction

Consensual emotions from market participants are more significant than many realize/admit. They impact price moves uniquely, which should always influence trading decisions.

Thus, continue reading this article to understand market sentiment better and how pros respond to it. You’ll also receive an exclusive indicator for such accurate & stress-free assessments in live conditions.

2. An Overview of Market Sentiment

Market (or investor) sentiment refers to the overall perspective or feeling of investors/traders towards the market. Such attitudes influence price movement through sustained trends, increased volatility, or prolonged consolidation.

Against common conception, market sentiment doesn’t wholly rely on fundamentals (like economic indicators) or technicals (like chart patterns). Some traders have even subscribed to a new belief – sentiment analysis for better assessments.

Investors’ feelings are the main drivers here. Hence, several behavioral and psychological factors are always in play.

Market news, economic data, geopolitical events, trading volume, support levels, and social media are a few of the many influencers of investors’ moods.

Eventually, the sentiment can finally pan out as bullish or bearish:

- Bullish sentiment: Market sentiment is bullish when the prices keep rising, breaking new swing highs for a sustained period. Market participants have an optimistic outlook on the instrument(s) during such periods.

- Bearish sentiment: Contrarily, a negative market perception & lower confidence from investors and traders may influence price falls. It is known as a bearish sentiment.

Bullish or bearish sentiments can also be strong or weak.

3. How Market Sentiment Impacts Trading Decisions

One way or another, your decisions should always align with the market sentiment for the best result. You’re only one retail trader in a tremendously large pool of investors.

You can’t be trading against a bearish sentiment if you’re not a reversal strategist or going short (as a swing trader) when the long-term sentiment is bullish.

Thus, here are some of the decisions to ponder after understanding the underlying market sentiment:

3.1. Trading With the Trend

When the sentiment is strongly bullish or bearish (for any reason), the most adopted strategy is to trade in the direction until it fades. It ensures the least resistance, guaranteeing profits throughout the price run.

That said, successful trend trading demands more than knowing when the market sentiment is bullish or bearish. Trade entry and exits must be excellent, market and timeframe selection should be favorable, and one needs ideal psychology to pull it off, among many more factors.

3.2. Contrarian Trading

After confirming the investor sentiment as bullish or bearish, some investors prefer trading in the opposite direction.

The goal is to enter potential trades earliest (at the tops or bottoms) when expecting reversals. Thus, they wait for overbought (extremely bullish) or oversold (extremely bearish) conditions to open new positions.

It takes extensive practice and experience to do this confidently and profitably. However, the results are outstanding when done right.

3.3. Long- or Short-Term Trading Contemplation

Market sentiment can also influence flexible traders to deliberate the duration of their trades, whether scalping, swing, or position entries will be best.

Like in Investopedia’s real-world example of bearish sentiment, swing CFD traders could have capitalized on the stock prices fall spanning weeks in December 2018.

Regardless, scalpers and day traders still found suitable opportunities to go long during the period.

Your goals, strategies, and risk tolerance will also play significant roles in this decision.

3.4. Risk Management Implementation

Market sentiment also holds significance in risk management decisions.

Assuming the overall sentiment is uncertain (like during an economic data release), expert traders adopt stricter risk management techniques. They could tighten their stop-loss orders, trade with small position sizes, or completely close open positions for the period.

The first Friday of the month is a well-known example because of the Non-Farm Payroll (NFP) release in the United States.

When the sentiment becomes stronger in any direction, traders can be more liberal with risk management for the better.

4. Assessing Market Sentiment Like a Guru With the Market Emotion Switch

Understanding the underlying sentiment can be as easy as confirming a lasting bullish or bearish trend at a glance. Traders also strive to make it objective through tools like the Moving Averages.

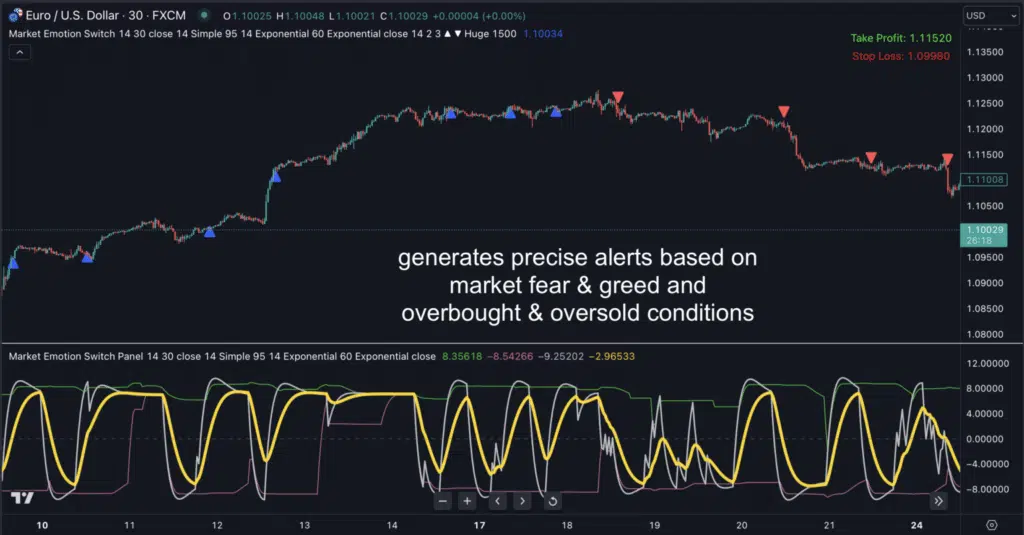

However, the most recommended and stress-free method is using the Market Emotion Switch system for TradingView. It combines the power of multiple chart parameters and classical indicators.

Each user boasts several advantages of its application, including:

- A clear understanding of the current market sentiment, whether optimistic or fearful

- Earliest knowledge of potential reversals due to the oversold and overbought levels’ revelations

- High trade success rate from pinpoint entry signals on any market

- Immediate capitalization of every promising opportunity due to timely notifications within and outside TradingView

Give it a try here ASAP. You’ll be amazed by the results.

5. Final Thoughts

Investor sentiment is one of the most essential topics every trader must understand for success. It guides you to make informed decisions based on the market’s ‘mood.’

When it is bullish, bearish, or uncertain, traders can prepare to trade with or against the trend in different timeframes at varying risk management levels.

If you still need assurance of the type of sentiment, the Market Emotion Switch for TradingView is your go-to indicator for the fastest and most accurate results.

Please share your thoughts, questions, and trading results in the engaging Comment Section below. Also, remember to promote this article on social media to boost awareness of this delicate subject that could make or break every aspiring trader.