Regrettably, position sizing is easy to overlook among novices. This article highlights its critical essence and the best methods for improved results.

Table of Contents

1. Introduction

Although one of the most critical factors of every trade, position sizing is easy to overlook, especially among the inexperienced. Some even regrettably take the make-or-break decision in the final moments of analysis, among other ill-advised actions.

Fortunately, this article highlights its significance regarding risk management and how to best calculate it based on one’s tolerance. Readers will receive a bonus technical tool to dramatically improve trading results from any trending market.

2. An Overview of Position Sizing & Its Significance

Position sizing involves determining the most suitable position size for every trade. In turn, the position size is the amount of capital invested in any opportunity in the financial market.

Most traders, platforms, brokers, and online calculators express it as ‘lot size’ or ‘units.’

Typically, an established trader with more capital will use a higher position size than others with limited funds. However, the sizing depends on many more factors than one’s financial condition.

Nowadays, leverage has even allowed traders with significantly low capital to participate in the market with a much larger position size. It entails borrowing funds from a broker to magnify the potential returns (and losses, inadvertently).

Position sizing is vital for risk management, which is imperative for successful trading. The high-stakes calculation has several approaches, as traders try to get it right to align with their risk tolerance.

2.1 Techniques

Position sizing should not be a random or hurried procedure. It should not depend on a trader’s confidence level or emotions from the analysis’s outset.

Instead, seasoned pros take a comprehensive approach for maximum potential profits while mitigating the risks.

Many retail traders must understand that a lot is at stake with this value.

Thus, below are some of the most recommended calculation techniques to consider today:

Risk-Based With Stop Levels

This method entails deciphering suitable chart levels to place a stop order for a particular position.

The level will depend on one’s analysis that proves the market won’t test it for the forecasted trade direction to be correct.

Eventually, the stop level influences the position size.

For instance, assume the stop level for a hypothetical trader is 25 pips from an entry point in the EURUSD currency pair.

Such a trader, willing to risk only 0.5% of their $10,000 account, can take the chance with only $50.

Hence, they can take a mini-lot as the position size based on the 25-pip stop level.

Another expression for a mini-lot is 10,000 units or 0.1 of a standard lot.

Fixed Dollar Amount or Equity Percentage

Unlike the risk-based calculation, this method uses a fixed amount in the account’s currency or a percentage of its equity.

The former may be a value, like $500, and the latter 2%, depending on one’s account size and risk tolerance.

Imagine a currency trader with a leveraged account worth $500,000 wishes to risk $1,000 on a new trade with a stop level for a new trade at 50 pips. Such a person will need to take 20 mini-lots (200,000 units).

Another trader with a similar account size and stop level but a fixed percent of 0.2 will also use a similar position size.

Any slight change in the equity value may render position sizing for fixed equity percentage traders more tasking.

Volatility-Based

Veterans also consider an asset’s volatility for position sizing, using the Average True Range (ATR). With this, more volatile markets employ smaller position sizes. Less volatile markets use bigger ones.

The technique seems logical because markets with higher volatility are riskier. Hence, a small position size keeps participants safe.

Assume a trader risks $100 per trade with a $10,000 account, and the ATR of one’s preferred currency pair (e.g., EURUSD) over a defined period is 90 pips. After calculating the stop level (usually a multiple of the ATR), e.g., 135 pips, one can get the position size with this formula:

Position size = Risk in dollar / (Stop loss in pips x Pip value)

Hence, the position size for this case scenario will be 0.74 mini-lots (7,400 units or 0.074 standard lots).

2.2 Importance of Managing Position Size

The essence of a position size is to determine how much profit or loss one will incur when the market moves for or against a forecast.

A larger position size magnifies these values, and a smaller one diminishes it.

Therefore, it demands extensive calculation to be ultimately successful due to the following reasons:

- Proper Risk and Money Management: Position sizing with stop loss, take profit, and risk-reward ratio are the chief factors influencing risk and money management.

- Improved Capital Protection: Position size calculations also help to preserve capital, whether borrowed or self-funded, as one is always open to losing it to the markets.

Increased Consistency: A systematic approach to trading is always more fruitful with an established method to determine the position size for every trade opportunity.

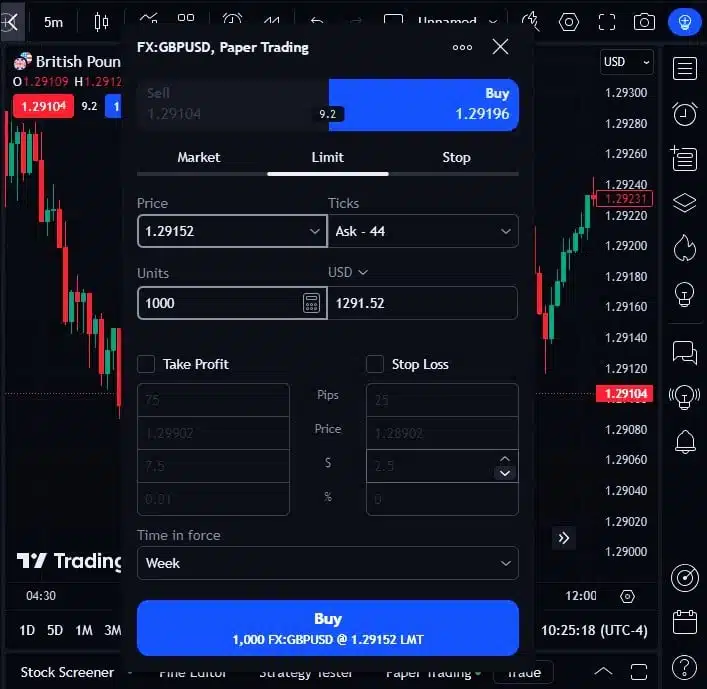

3. Catching Every Significant Trend With the Trend Focus Indicator for TradingView

Beating the odds of risk and money management with the correct position size is one thing; discovering an opportunity for that is another.

Usually, the latter comes before and highly depends on the former, and that’s where Indicator Vault’s Trend Focus becomes invaluable.

Many consider the discovery an improved version of the Moving Average (MA) owing to their similarities.

In short, here are some benefits it offers every user:

- Quicker reactions to market changes due to its boosted speed compared to the MA

- Improved awareness of buy/sell opportunities in any timeframe

- Ability to automate one’s strategy owing to the tool’s customizable nature

- Freedom to explore various markets and timeframes

- Confidence of never missing promising opportunities, credit to instant alerts from within and outside TradingView

Get the indicator here now, sit back, and watch your equity grow exponentially.

4. Conclusion

Position sizing is vital for every novice aspiring for success in the financial markets.

Veterans who understand its significance in risk and money management have devised several approaches, including those discussed in this article.

However, traders need to uncover perfect opportunities to use it first.

The best companion for this is the Trend Focus, a groundbreaking improvement to the traditional Moving Average.

It reveals approaching trends while reducing noise and lags.

Please share this article with every ambitious trader on social media to understand this critical topic with a significant influence on their long-term success.

Also, remember to leave your queries, results, or suggestions below to spark interesting conversations.