PRODUCT OF THE WEEK - 10% DISCOUNT OFFER

Catching Reversals at the beginning

Are you tired of late signals and bad entries? Price Consensus Reversal gives you the confidence to know exactly where to enter. It helps you avoid bad trades and weak signals by identifying true statistical extremes in the market.

Scroll down to see how this indicator solves the problem of lagging and false signals in live trading and get a special discount on Price Consensus Reversal before the offer ends.

Nail Reversals at Exact Tops & Bottoms by Identifying When Price Has Stretched Too Far from Market Consensus

Flawlessly time your entries with new Volatility-Adaptive algorithm inside the Price Consensus Reversal indicator for Tradingview.

Your reversal trading isn't working.

How many times have you seen RSI hit “oversold,” entered a trade, and watched price continue dropping through your stop loss?

How often have you waited for MACD to confirm a reversal, only to realize you’ve already missed 30-40% of the move by the time it signals?

If you’re trading reversals, you’re facing two painful realities:

- You’re getting stopped out by false signals

- You’re missing the best parts of genuine reversals

And it’s expensive. Each false signal costs you money. Each late entry robs you of potential profits.

Deep down, you know something isn’t right. The indicators you’re using aren’t working as well as they should.

Your account is growing slower than you’d like… if it’s growing at all.

Here's The Fundamental Flaws in Your Indicators

The truth is, you’re fighting with outdated tools that were never designed for today’s markets. Tools with fatal flaws built into their very design.

The Range Compression Problem

RSI, Stochastics, and other range-bound oscillators squeeze all market conditions into arbitrary ranges (0-100), creating what professional traders call the “stickiness problem.”

During genuine trends, these indicators get stuck at extreme levels, giving you the same signal over and over while price continues moving.

And each false signal costs you money.

The Lag Problem

MACD and moving average systems suffer from severe lag. By the time they signal a reversal, the move is already well underway.

The best entry points – and the best profits – are long gone.

But there’s a better way.

Introducing: Price Consensus Reversal for TradingView

The all-new Price Consensus Reversal indicator uses a new statistical approach that:

- Establishes true market consensus

- Adjusts for specific market volatility

- Measures meaningful price deviation

The result? Clear signals at the exact moment price has stretched too far from consensus – the precise points where reversals are most likely to occur.

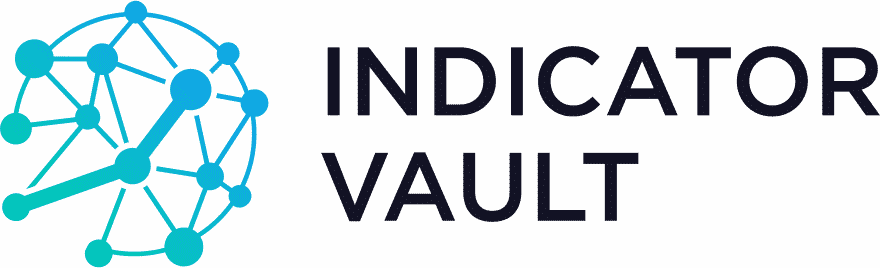

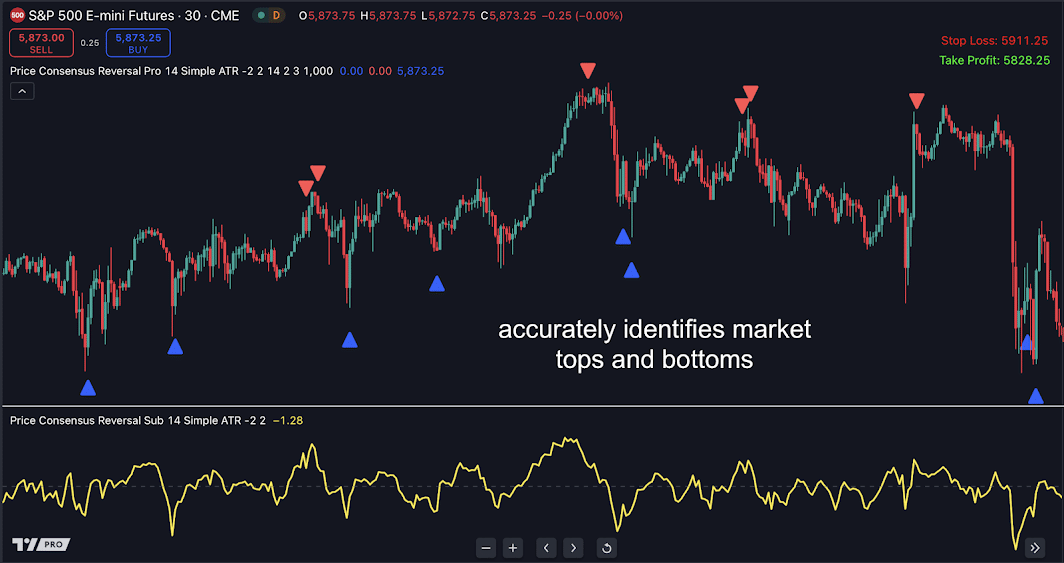

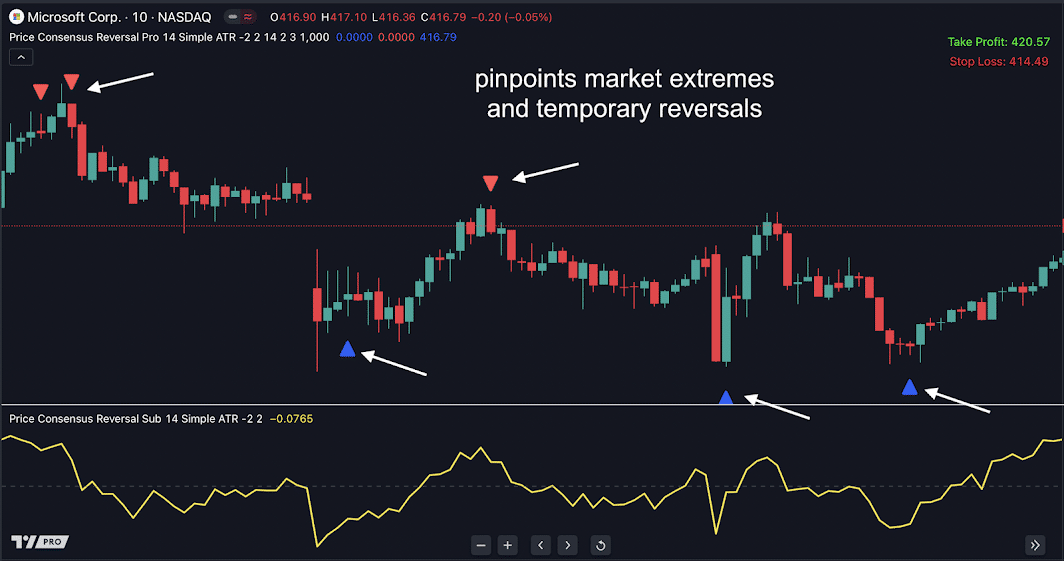

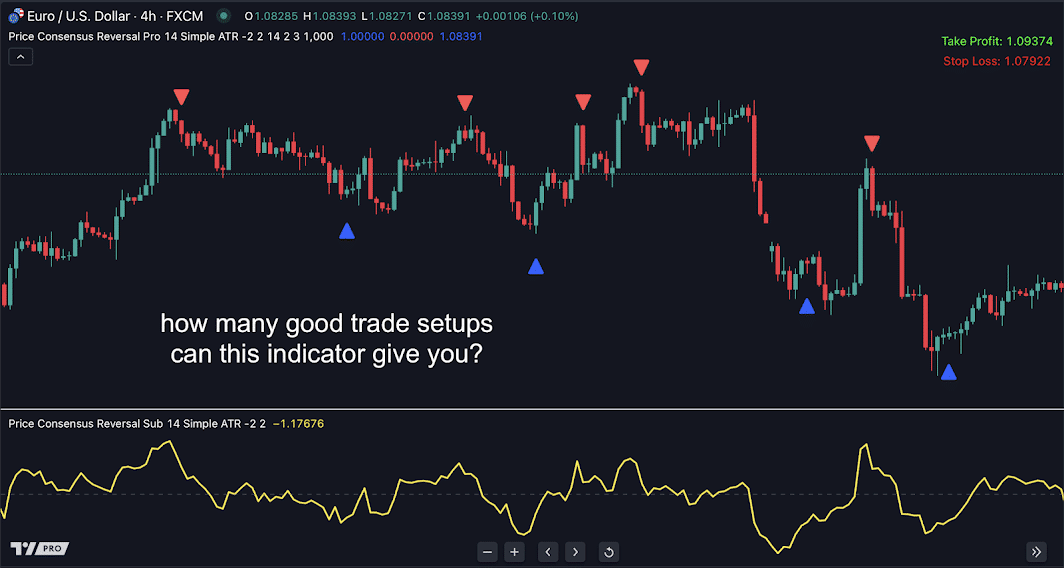

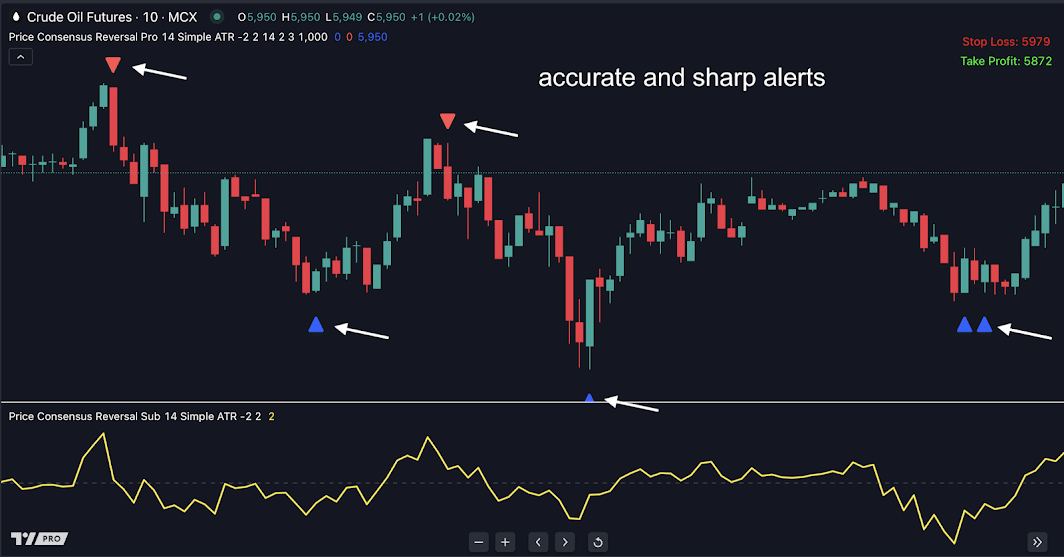

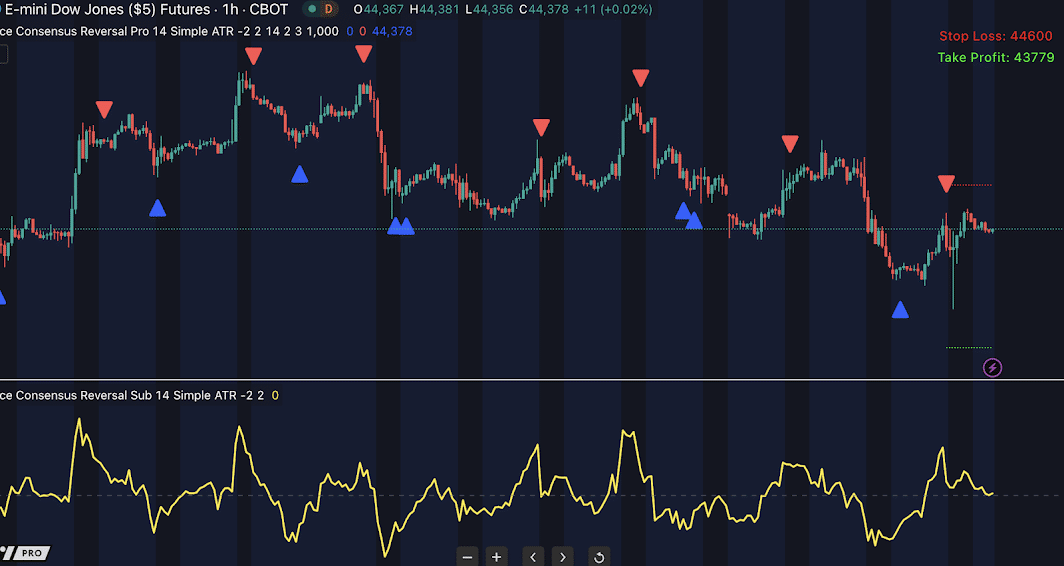

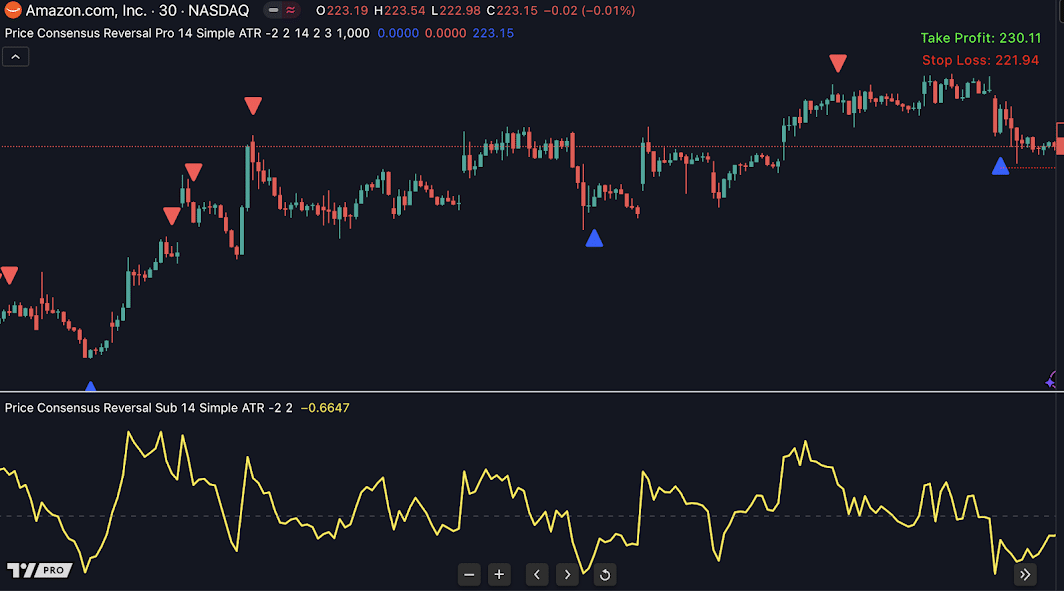

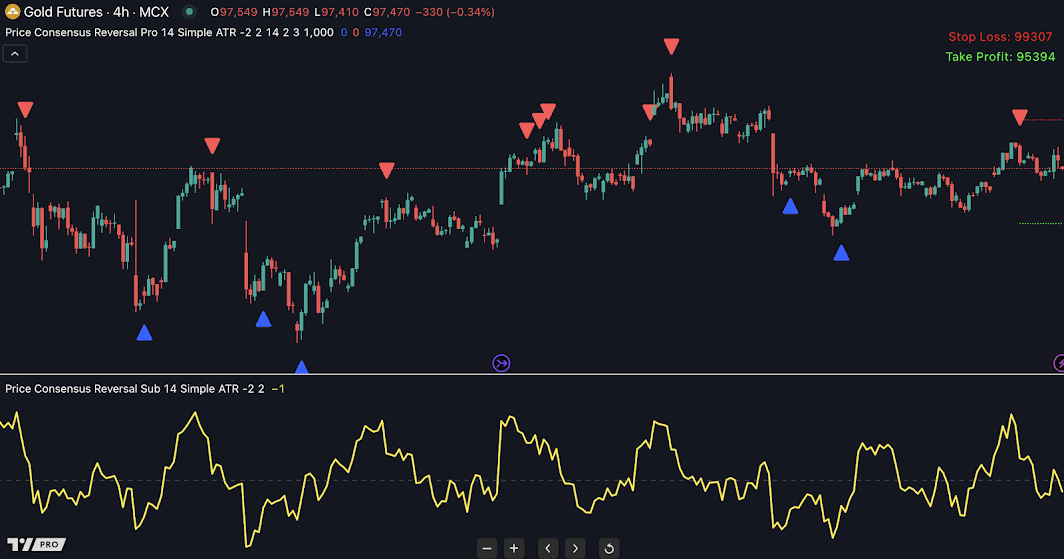

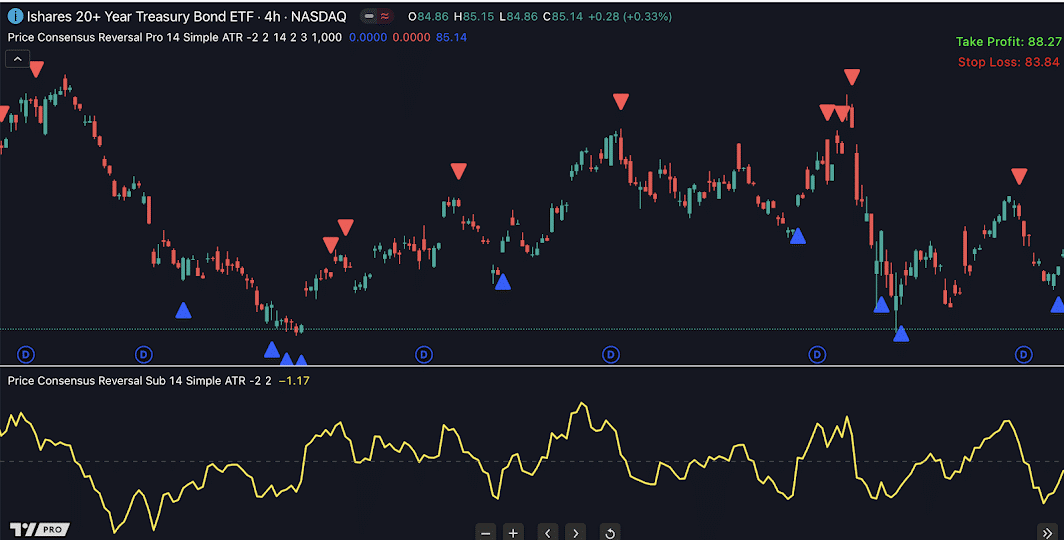

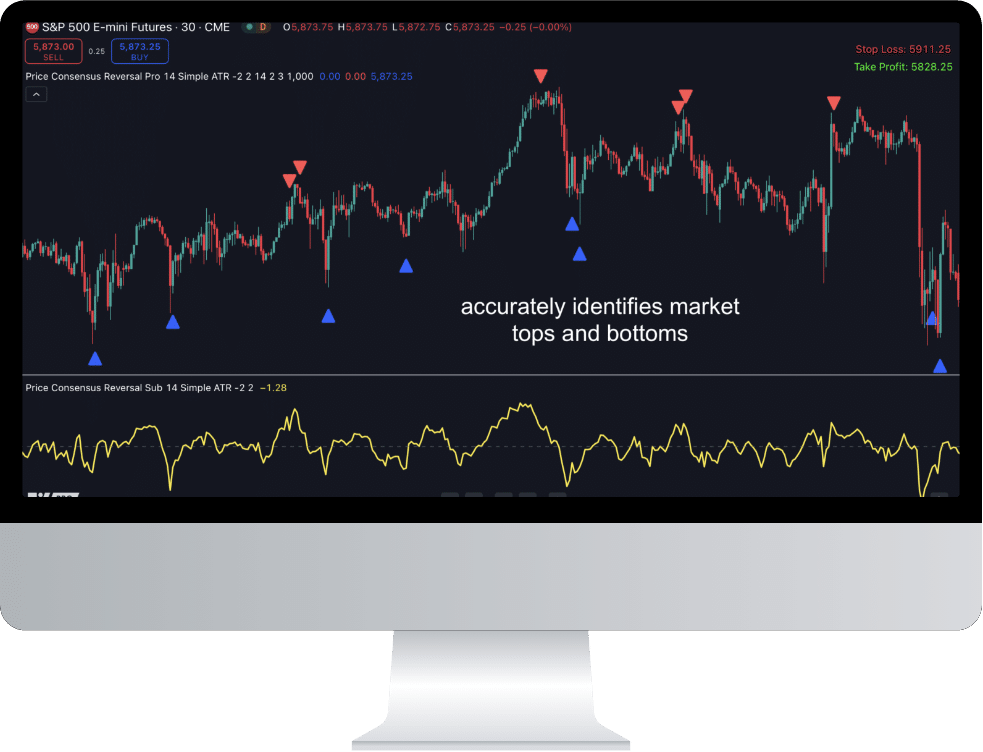

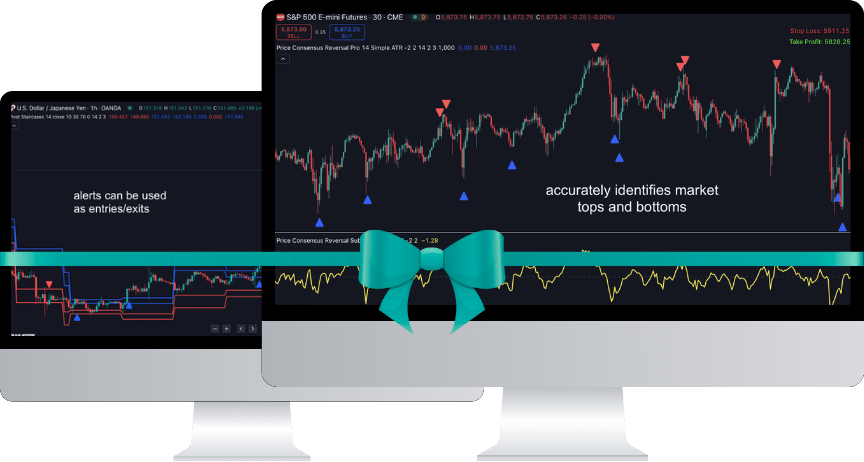

Take a look at these near-perfect reversal catch with Price Consensus Reversal:

Unlike indicators that use arbitrary ranges or lagging averages, Price Consensus Reversal uses a revolutionary statistical approach that adapts to any market condition.

Let me walk you through exactly…

How Price Consensus Reversal works

The “magic” behind Price Consensus Reversal lies in its three-part statistical framework:

Step One: Establish market consensus

First, the indicator calculates the fair price that the market collectively “agrees” on right now.

This value shows where the price would settle if no new forces influenced the market.

This is not just a simple moving average. It is a complex calculation. It looks at the whole price structure – highs, lows, and closes. And then finds the real market consensus.

Step Two: Adjust for specific market volatility

Next, Price Consensus Reversal measures your market’s volatility. It uses True Range to create a volatility factor that adjusts to changing market conditions.

This adaptive approach makes sure that the indicator works well in both calm or volatile markets.

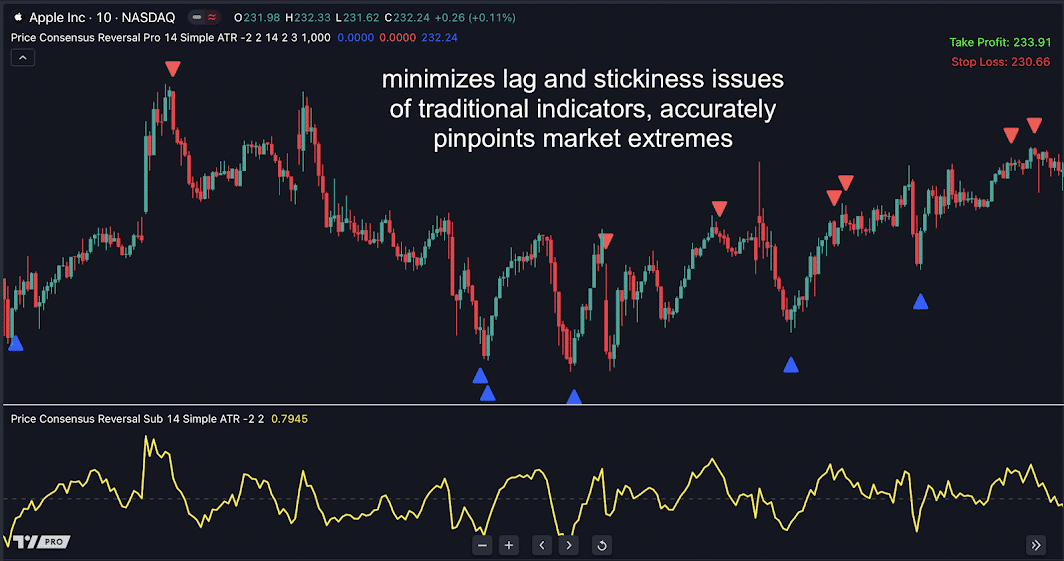

Step Three: Measure meaningful price deviation

Finally, the indicator calculates exactly how far price has stretched from consensus relative to current volatility.

The formula is elegantly simple yet powerful:

(Close Price – Consensus Value) / Volatility Factor

When this value crosses above -2, it signals a buy opportunity.

When it crosses below +2, it signals a sell opportunity.

These levels aren’t random. They are significant deviations that help spot high-probability reversal points across all market types.

Watch Price Consensus Reversal in action

Now that you’ve seen exactly how the Price Consensus Reversal indicator works, let’s take a look at some real-life trading applications… across all markets and timeframes:

Futures Trading

Stock Trading

Gold Futures

ETF Trading

Price Consensus Reversal works for ANY trading style

For Scalpers: Precision Timing on Lower Timeframes

Price Consensus Reversal instantly identifies statistically valid short-term reversals. Plus, it filters out the noise that plagues lower timeframes.

For Day Traders: Clear Intraday Reversal Points

Price Consensus Reversal tells apart small pullbacks from real intraday reversals.

And it adapts to changing volatility during the trading session. Stays quiet in choppy times but signals clearly when real opportunities arise.

For Swing Traders: Catching Major Market Turns

Price Consensus Reversal finds true statistical extremes that indicate major market turns. It won’t get stuck at overbought or oversold levels during trends. And clearly tells normal pullbacks from real trend changes.

Beyond Theory: Explore Price Consensus Reversal's Practical Applications

Want to see it in action before you dive in? Check out the video guides, good trade alert examples below.

Useful Videos

Special Offer: Get " Price Consensus Reversal" indicator for $269 (that's 10% off the official price of $299)

$299

$269

(Save $30)

- Lifetime access to Price Consensus Reversal

- Find reversals with a new statistical advantage.

- One-time payment - no recurring fees

The ultimate tool for finding real trend changes.

$598

$478

(Save $120)

- Lifetime access to Price Consensus Reversal

- PLUS: Get Lifetime access to Pivot Staircases (View full details...)

- Pinpoint key zones and breakouts with precise timing

- One-time payment – save $120 compared to buying both separately

The perfect duo to find the real reasons for market reversals.

Common Questions

Customer Reviews

Get Weekly Product Discount - Straight to Your Inbox

Join our email list to get notified of new products, 10% discount on Product of the Week, and smart trading tips. Everything is delivered in one quick email each week.