After years of extensive study, analysts have categorized pullbacks into regular and two-legged versions. What is the difference and why does it matter?

Table of Contents

1. Introduction

The ubiquitous nature of pullbacks in the charts makes exploiting them for trade entries reasonable. After years of extensive study, analysts consensually categorize them into regular and two-legged versions. What is the difference?

Keep reading this concise article to learn the contrasts between the regular and the two-legged pullback, including each’s distinct quality and approach. Readers will also receive exclusive access to their mind-blowing products for a more straightforward and fruitful trading session.

2. Highlighting the Differences & Similarities Between the Regular Pullback and the Two-Legged Pullback

A pullback is a minor price retracement typically experienced during a significant bullish or bearish trend. Most traders expect it moments from the outset of the move but it can occur at any point multiple times.

A bearish pullback appears as red candlesticks in an uptrend and bullish ones are green candles (when prices fall).

This scenario describes a regular pullback.

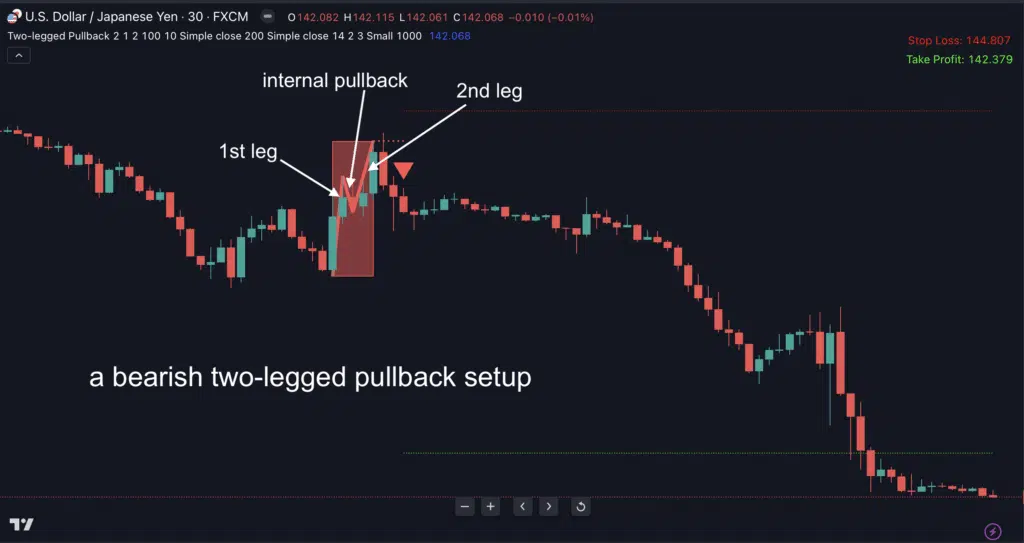

A two-legged pullback, on the other hand, features a double retracement in quick succession. That means another drawback follows the first (regular) a moment later.

Subscribers to this strategy always wait for the second retracement before considering the opportunity.

Below is a case scenario of the double-legged pullback:

2.1 Differences Between the Regular Pullback and the Two-Legged Pullback

The most significant difference between the regular and two-legged pullbacks is the number of retracements necessary to consider a trade entry.

A single drawback is enough for a regular pullback trader to open a new position in the direction of the underlying trend. The drawback may test a moving average, support/resistance, or Fibonacci retracement level.

However, another retracement must follow the first one for two-legged drawback traders to consider entry opportunities. Although the second pullback may return to the same level (moving average, resistance level, etc.) as the first, it isn’t always the case.

The market price sometimes halts at a less extreme level during the second pullback before the reversal to resume the underlying trend.

As shared in this detailed article, the two-legged pullback has three elements:

- The first pullback which is the ‘fake’ initial retracement in a trending market

- The brief bounce which is a move in line with the underlying trend

- The second pullback which finally confirms the pattern for an entry

Therefore, two-legged pullback traders are deemed more patient than regular pullback subscribers in the public eye.

If they also practice position or swing trading, they wait more hours and even days for a green light.

That said, a regular pullback trader is at risk of a slight drawdown if the security retraces a second time for a two-legged opportunity. Such scenarios will demand sound risk and money management to ensure positions (if taken) become profitable.

Then again, there is never a guarantee of a second drawback. If the market never retraces once more, only the regular pullback trader will relish the potential profit when the trend continues.

Many see this as a serious disadvantage, especially when the bullish or bearish trend prolongs without any double retracement.

2.2 Similarities Between the Regular Pullback and the Two-Legged Pullback

Despite the considerable differences, the regular and the two-legged pullback strategies have several features in common.

Below are the most noticeable of such:

Presence of an Existing Trend

As discussed, the primary criterion for both pullback strategies is confirming a trending market. It is only then traders can consider such moves a retracement/drawback, which is temporary.

If not, what an inexperienced trader sees as a pullback may be a trending run in the opposite direction.

Pullback traders use various techniques to confirm a bullish or bearish trend, from indicators to price action theories.

Retracement to a Reference Point

Every retracement in both pullback types is typically to a reference chart point, which could be:

- A moving average

- Trendline support or resistance level

- Fibonacci retracement level

- Divergence level

- PD array

Awareness of this helps traders to make precise decisions, ultimately improving performance overall.

Entry Strategies

The regular and the double-legged pullback strategies are for trade entries. The aim is to ride an underlying trend asap by capitalizing on this ‘correction’ move.

A regular drawback trader will look to open new positions immediately after one retracement, while a two-legged one will wait for the second pullback before doing the same.

3. Doubling Down Pullback Trading With Unbeatable Market Aides

In retrospect, pullback trading strategies may seem straightforward and unchallenging to novices. Anyone can easily open a position after confirming a drawback based on the underlying trend.

However, the conditions are much different in a live market. Uncertainties, inexperience, and impatience are a few plaguing factors.

Hence, every pullback trader needs the highly recommended Pullback Factor for TradingView.

The indicator is designed to reveal the beginning of a new trend earliest utilizing the regular pullback theory.

Here are a few benefits every user enjoys from its application:

- Opportunity for the fastest trade entry, increasing the chance to ride an entire trend

- Freedom to explore any market, from indices to stocks, and Forex

- Ability to trade in any timeframe desired

- Confidence in exploiting every opportunity, owing to the prompt alert system

Want to be part of this? Click here to install the indicator in no time!

Fortunately, traders who prefer the two-legged strategy can also opt for the Two-legged Pullback Indicator by Indicator Vault.

It works like the regular one by providing precise entry points in trending markets. However, its algorithm is based on the two-legged theory.

Below are some of the many perks it offers:

- Potential to capitalize on any double-legged pullback opportunity

- Ability to minimize trade entry risks

- Freedom to explore scalping, swing trading, or any other discipline

- Increased assurance of partaking in most opportunities due to its reliable alert system

Too good to be true? Click here to confirm more benefits to boost your trading account today!

4. Conclusion

The regular and the two-legged pullback are similar, highly reliable strategies for trade entries. Their working depends on markets’ tendency to retrace while trending (especially at the outset).

The primary difference is that the regular strategy needs a single drawback to signal an entry while the two-legged one needs two.

In that regard, two of the best trading systems to apply for these entries are the Pullback Factor for TradingView and the Two-legged Pullback Indicator.

Please share this post on social media and remember to leave feedback below for engaging discussions.