Table of Contents

1. Introduction

It’s one thing to know trending conditions are the most favorable for trading; it’s another thing to identify them. Price analysts have invented various means, including indicator-based ideas – seemingly the most popular today.

Stick around to learn four of the most useful trend-following indicators, from MACD to Smooth Trend Finder.

2. Moving Averages

The Moving Average (MA) is hands down the most popular trend-following indicator available. It represents the average of some values with a fixed subset as a smooth line.

As more data becomes available, the MA makes recalculations to ensure it always moves with price. Hence, the name “Moving” Average.

Using The Moving Average Confirm Price Trends

Alone, Moving Averages look like price data from regular line charts. They seem shallow, without much significance to newbie technical analysts.

On the contrary, this tool is highly effective in trend identification.

The market price is in an uptrend, downtrend, or sideway trend, depending on its position relative to the MA.

Traders consider it bullish when the price is consistently above the indicator and bearish when it’s been consistently below. There are also ranging conditions when they frequently cross each other.

The timeframe, instrument, and MA’s period and type are also highly influential. Therefore, back- and forward-test your theories extensively before application in live accounts.

3. Moving Average Convergence Divergence (MACD)

Despite being significantly more complex than the Moving Average, the MACD can be highly useful for trend-following.

Classical ones consist of the following parts:

- Two Exponential Moving Averages of different periods

- A MACD Line formed from the subtraction of the EMAs

- A Signal Line calculated from the MACD Line

- A MACD histogram

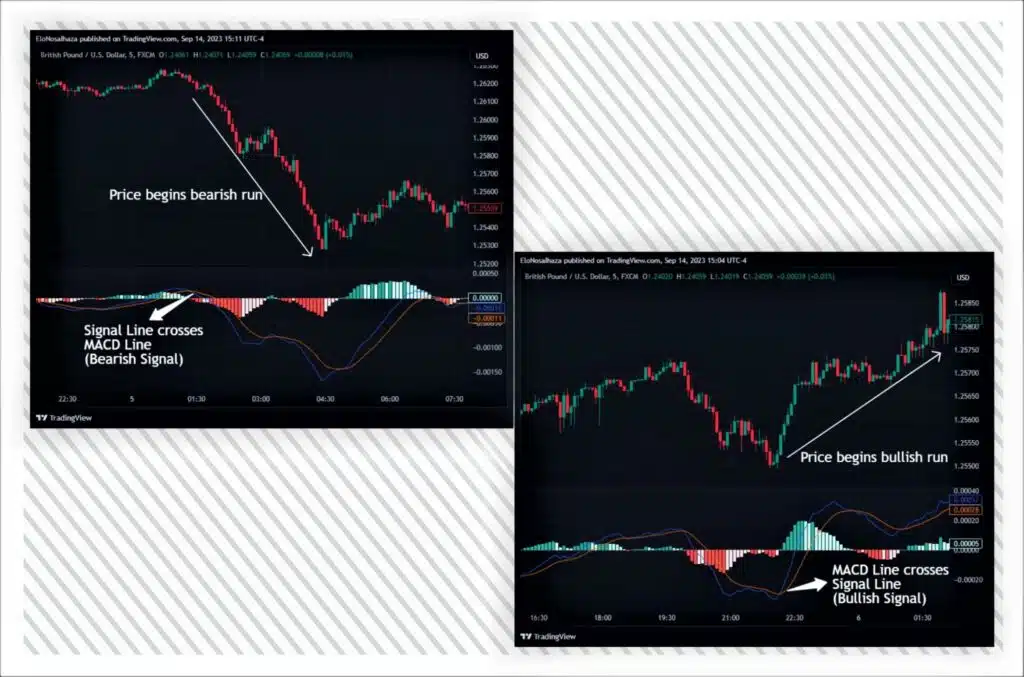

Trend-Following With the MACD

Gerald Appel initially designed the MACD (in the 70s) for trend assessment, and the theories still prove practical today.

The classical and generally accepted way to confirm a trend is the cross of the MACD Line and the Signal Line. The former is a “faster” Moving Average than the latter.

Conditions are bullish when the MACD Line remains above the Signal Line and bearish when below.

The probability increases when the histogram bars are positive and negative for uptrends and downtrends, respectively.

4. Supertrend

The Supertrend has also become essential for technical analysts seeking trend confirmations, thanks to two fundamental entities – The Average True Range (ATR) and a multiplier.

Ideally, the ATR helps measure volatility over a certain period by analyzing price highs and lows. However, the multiplier (usually between 1 and 3) tweaks the indicator’s sensitivity.

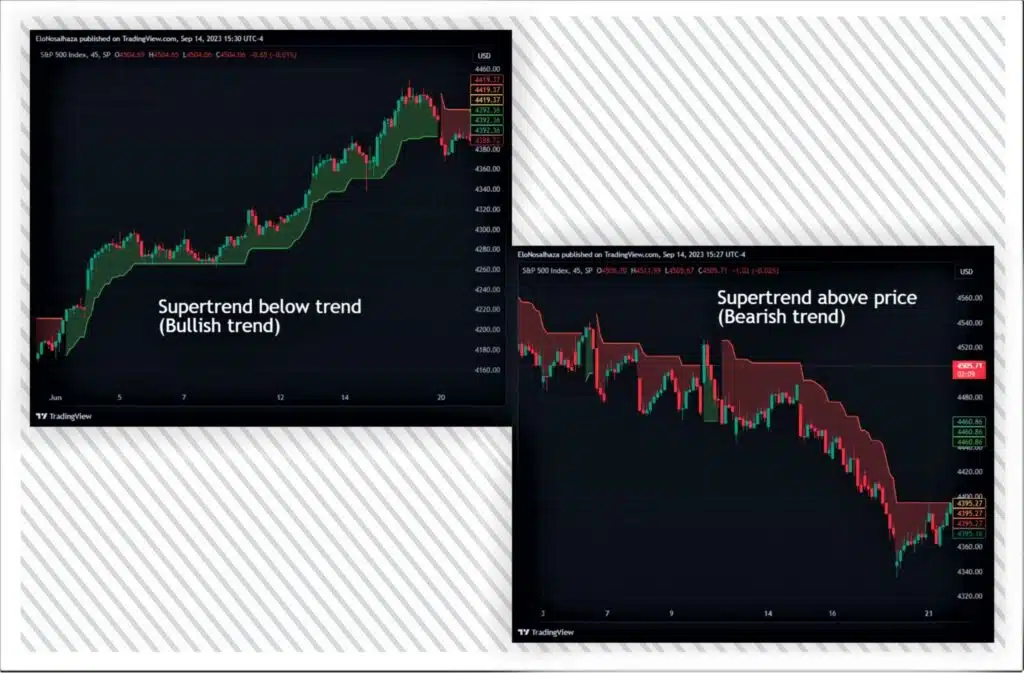

Applying the Supertrend for Trend Assessment

The Supertrend works like the Moving Average for identifying trends.

Advocates believe the price is in a healthy uptrend whenever the Supertrend line is below. Conversely, they become bearish-biased when the indicator moves above.

Below is an example of both scenarios:

Note that the Supetrend’s probability drops whenever the price isn’t clearly trending.

Other traders get more precise with it for entry and exit signals, but its trend-following function is the most promoted use.

5. Smooth Trend Finder

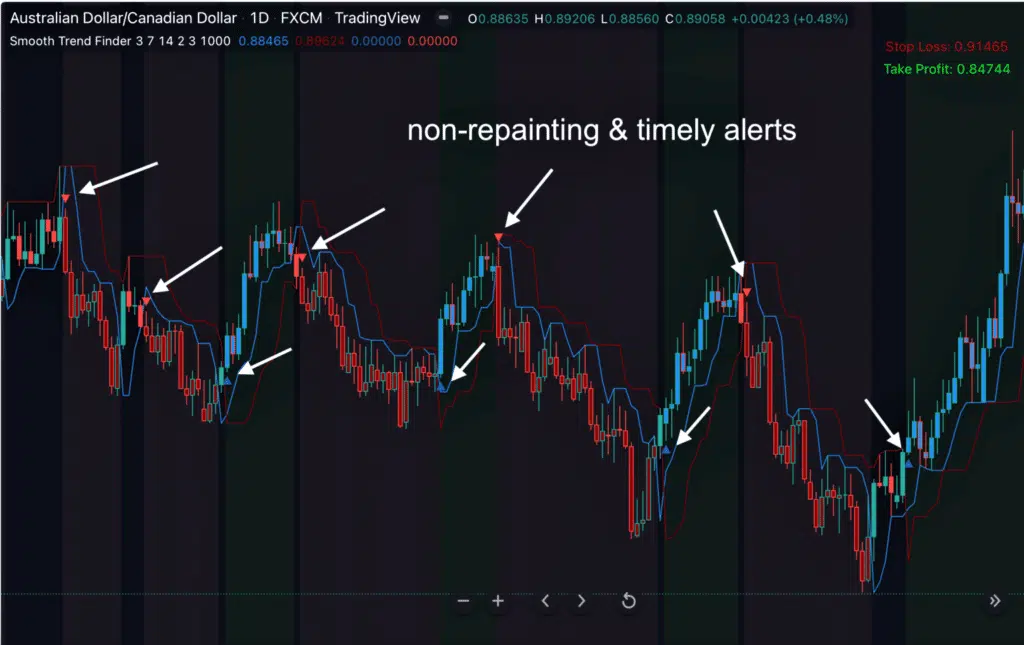

The lesser-known Smooth Trend Finder is one of the most recommended for trend spotting and following.

Currently available for TradingView, this indicator focuses on the latest close price relative to previous highs and lows. The evaluation doesn’t only share the underlying movement but also signals upcoming reversals.

Benefits of the Smooth Trend Finder

The Smooth Trend Finder comprises two simple but functional lines and switching chart background colors.

It may not seem like much from a superficial perspective. However, studies into price data prove it’s genuinely one in a million.

Here are a few of several benefits users enjoy:

- Discovery of new movement (reversals) far quicker than Moving Averages, MACD, or Supertrend

- Learning when the market is ranging with utmost certainty

- Faster response to price movements due to the tool’s high sensitivity

- Abstinence from false signals, thanks to Indicator Vault’s Triple Confirmation algorithm

Click here for an exclusive plan to use it ASAP.

6. Final Thoughts

Every ambitious trader dreams of engaging markets with the strongest tendency and avoiding ranging conditions. Thankfully, indicators like the MA, MACD, Supertrend, and Smooth Trend Finder reveal them.

The Smooth Trend Finder is arguably the most impressive because it predicts potential trend changes, unlike others that lag.

There are several trading opportunities to employ these indicators. Thus, share this article to help friends and aspiring traders on social media.

The Comment Section is also open to questions, contributions, and trading results regarding market movement.