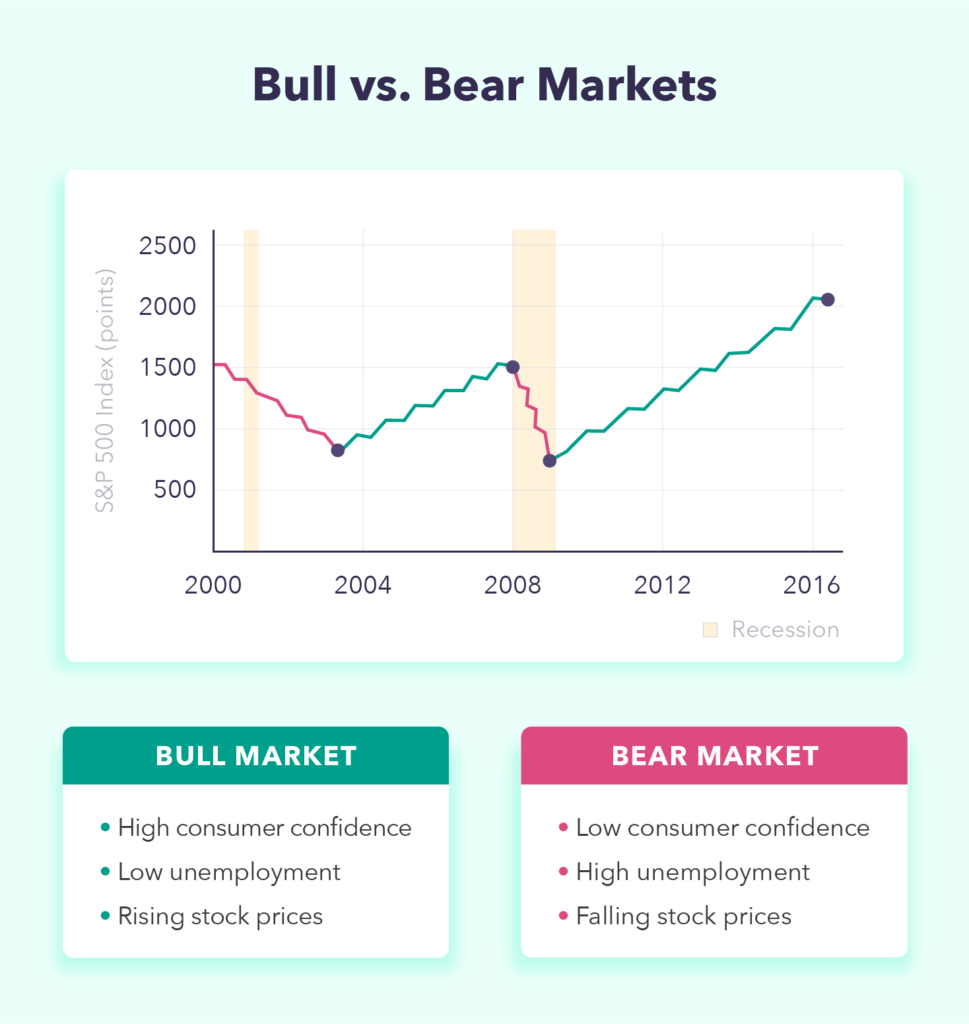

Bull market and bear market are both market types that are very common in the financial markets during an economic cycle. An economic upswing, low unemployment, and consumer optimism characterize a bull market. In contrast, a bear market is characterized by a slump in the economy, elevated unemployment, and decreased consumer expenditure.

You might not be hearing about someone’s most recent trip to the zoo if you overhear a chat involving bears and bulls. In actuality, they can be discussing bull and bear markets. After all, 55% of Americans are stock market investors. However, even if you have experience investing, you might be wondering what the distinction between a bull market and bear market is.

Continue reading this tutorial to gain a thorough grasp of the distinctions between bull market and bear market and how these trends impact investment activities.

Table of Contents

1. What Is a Bull Market?

A bull market is a time of economic growth and consumer confidence. During this time, the economy is thriving, and there are low unemployment rates. In a bullish market, you can expect stock prices to increase over 20 percent for an extended period. Because of this, investors are likely to buy and hold onto their stocks.

2. What Is a Bear Market?

The polar opposite of a bullish market, a bear market signifies a recession and elevated unemployment rates. Stock prices will drop by over 20% during a bear market and do so for a while. Many investors will sell their securities in order to obtain cash due to the falling stock prices.

3. Differences Between a Bull Market and Bear Market

As you might guess, there are some notable distinctions between bear and bull markets. However, it’s crucial to emphasize a few major differences in order to better grasp the economic factors that contribute to each one and what to watch out for to preserve your cash.

3.1. Investor Attitudes

Investor sentiments about bullish and bearish trading frequently shift based on the state of the market. Investors are typically upbeat and eager to take advantage of the rewards in a rising market. Investors will do this in the hopes of profiting from the rising trend in price by purchasing and holding onto their preferred securities.

In a down market, the situation is quite different. Investors are hesitant and unwilling to take the chance of losing their money instead. Investors will sell everything they can and withdraw from the market in favor of cash in order to prevent losing money.

3.2. Supply and Demand

The foundation of economics is supply and demand, so understanding how bull and bear markets affect them is important. For instance, there is a significant demand for stocks and other securities during a bull market. As a result, there is ultimately less stock available, which drives up the price even more.

We have created an incredible indicator, Supply Demand Pro for TradingView, to assist you in finding a fresh, straightforward method to uncover entry points.

The converse is typically true during a bear market. The supply grows as a result of numerous investors selling their equities, while the demand declines, lowering the stock price and raising investor anxiety.

Interesting?

3.3. Economic Activity

The final distinction between bullish and bearish markets is that bull markets are typically linked to healthy economies, whilst bear markets are linked to troubled economies. For instance, a bear market may prevent many businesses from recording a high net income because customers may be less inclined to spend money.

On the other hand, in a bull market, the majority of people will probably have more spare income for guilt-free spending, boosting their inclination to spend it. This conduct can promote corporate growth and hence support the economy.

4. What Investors Should Do in a Bull vs. Bear Market

What should you do in each market now that you are aware of the distinctions between a bear and a bull market? Follow along as we take a look at each one.

4.1. What To Do in a Bull Market

You can hear folks in a bull stock market advise you to benefit from the growing prices. The buy-and-hold approach is one strategy that is popular among investors. When using this method of investing, you’ll acquire stocks with the idea of holding them until their values rise.

This is easier said than done, though. It’s important to keep in mind that every investment has some risk. As a result, many investors can decide to choose low-risk investments to gradually grow their money.

4.2. What To Do in a Bear Market

Bear stock markets are riskier since it’s difficult to predict which companies will survive and turn a profit in the future and which ones will fail and take your money with them. When making short-term investments, it’s wise to find out which businesses have a decent chance of surviving and only think about making investments in them.

Additionally, keep in mind that investing in a volatile market is always risky. It’s preferable to avoid panic selling if you’re in it for the long run (like an index fund or retirement account). The likelihood that the economy will recover and your holdings will start to appreciate again is high, as demonstrated by the history of the stock market.

5. The Bottom Line

Here are some things to keep in mind regarding bull markets and bear markets before you begin investing:

- A bull market occurs when the value of equities increases, which benefits the economy and employment rates. They typically last a couple of years.

- When the economy becomes shaky, the stock market is in a bear market and unemployment may rise. Bear markets typically last a few months, although they may linger longer.

- Market performance is greatly influenced by investor sentiment. Bullish investors may raise stock values, while bearish investors may cause them to fall.

- Your individual risk tolerance will ultimately determine your investment approach. However, since the risk is significantly larger in a bear market, it is frequently a good idea to buy low and sell high during a bull market.

Whether you’re a seasoned investor or just beginning started, knowing the difference between a bull market and a bear market can be helpful knowledge to have when making financial decisions. Check read the articles 3 Popular Forex Trading Strategies To Trade More Profitably and Use QM Pattern and Divergence Solution to find high-probability trades

If you would like to keep up on the latest trading news and best deals, come by and connect with us: