Divergences theory has swiftly become one of the most trusted for reversal trading. Dive into this article to learn its inner workings, triggers, and types.

Table of Contents

1. Introduction

The divergence theory has swiftly become one of the most trusted for reversal trading. Market participants, accomplished and novice, find ways to incorporate it into potentially fruitful strategies.

Thus, this article dives into its inner workings, including the triggers and types for improved insights. Readers will also gain exclusive access to a top-tier indicator predicated on the concept.

2. Overview of Trend Reversals with Divergence

Divergence entails any notable inconsistency between two or more market entities that are closely related. Such entities include assets and indicators in different combinations.

In related pairs, the formation of a higher/lower swing high or low at a particular period should appear on both charts. When this fails, the phenomenon is known as a divergence.

Extensive technical studies reveal that divergences precede significant trend reversals. These can be bullish or bearish across various timeframes, but like every trading strategy, such forecasts can also be imperfect.

2.1. Basis for Divergence in Financial Markets

As discussed, divergence discovery is from comprehensive poring over charts and past results. There is little fundamental backing behind the belief.

Hence, inference from similar studies discloses the following as possible reasons behind the event:

2.1.1. Trend Weakening

Divergences occur when a bullish/bearish trend is approaching its peak/trough. One of the entities loses its momentum faster than the other.

Hence, reversal trading proponents anticipate an opportunity sooner or later.

2.1.2. Sentiment Change

Shifts in investor sentiment can also manifest as divergences in the markets.

For instance, a bullish divergence may occur when more buyers engage in a market despite a price decline and vice-versa.

2.1.3. Lagging Indicators

Particular technical indicators are designed or can be adjusted to delay reactions to price movements. When significant enough, it yields a divergence that can also be exploited.

2.1.4. Market Anomalies & Manipulations

Large financial institutions, as prime market movers, can deliberately instigate manipulations that could cause divergences. Such scenarios may deceive ignorant traders in the process.

2.1.5. Increased/Reduced Volatility

As divergences depend on swing highs and lows, volatility changes play a huge role in their formation. Periods of increased fluctuations will generate more potential opportunities, which may sometimes be unfavorable.

3. Classification of Divergences For Reversal Trading

The divergence theory has also enjoyed technical analysis’s continuous evolution. Several tweaks help users make the most from reversal trading.

However, below are the two most popular ways it can be classified, extensively discussed in this article:

- Reversal Direction

- Entity Type

3.1. Reversal Direction

The most popular classification of divergences reveals the type of reversal imminent – bullish or bearish.

3.1.1. Bullish Divergence

Bullish divergence refers to a reversal from a bearish to a bullish trend. Swing lows from each entity are responsible for such developments.

3.1.2. Bearish Divergence

Conversely, bearish divergences signal potential reversals from an uptrend to a downtrend.

The rising price forms higher/lower swing highs in one entity than the other.

3.2. Entity Type

Based on the related entities used for divergence, traders can also classify it in the following ways:

3.2.1. Price-Indicator Divergence

Price-indicator divergence is the most popular and usually discussed whenever ‘divergence’ is used. It involves any interested market’s price and a technical indicator, such as the MACD, RSI, or Stochastics tracking it.

Bullish and bearish divergences occur when there is a discrepancy in highs or lows.

3.2.2. Price-Price Divergence

True to its name, price-price divergence involves two closely related assets. Such relationships may exist within or outside one financial market.

4. Essential Divergence Trading Rules To Remember

Like most trading disciplines, analysis with divergence theories must follow particular guidelines for optimal results. Below are a few such:

4.1. The Relationship Between Entities Must Be Unquestionable

The closeness between the markets and indicators involved is the pillar of divergence. Thus, it must be obvious & indisputable in any pairing.

A famous example is the S&P 500 Index and Nasdaq-100. Similarly, EUR/USD and GBP/USD pairs show such relationships in the Forex market.

4.2. The Timeframes On Each Entity's Chart Should Be Similar

During comparisons (especially in price–price divergences), traders must always utilize similar timeframes on both charts.

For example, a scalper’s study between two closely related currency pairs in one session must be in M1 charts or M5 charts, not both.

It ensures maximum correlation between the entities for peak analysis and forecast.

4.3. The Compared Swing Highs/Lows Must Be Strictly Related

Divergence analysts should only consider the swing highs and lows formed in the same period.

For instance, traders can’t utilize a high/low that develops in one entity hours after manifesting in the other for divergence comparisons. Instead, the time difference, if any, between the formations in both should be closer to be considered.

4.4. Seek Confirmation From Other Parameters

For the most experienced traders, divergence is only a part of a more detailed trading strategy. Such plans may involve technical indicators, candlesticks analysis, chart pattern analysis, etc. Newbies can also copy this approach and seek more confirmations from independent parameters for improved forecasts.

5. Surmounting Every Reversal Trading Setback With the Divergence Solution

Although divergence trading is undoubtedly one of the most straightforward strategies for reversals, it is by no means flawless for many reasons.

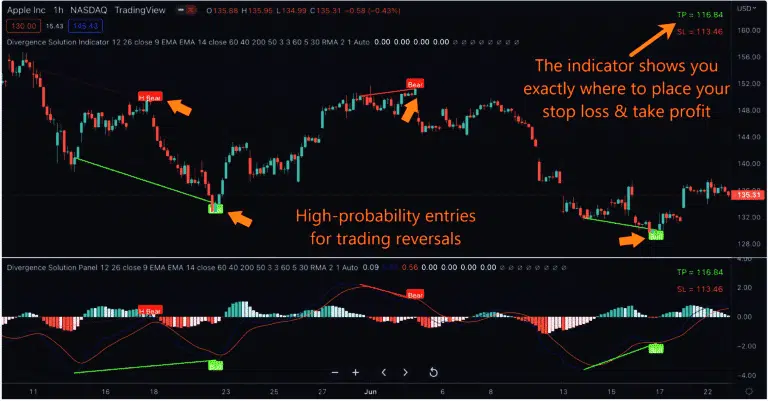

Indicator Vault’s Divergence Solution for TradingView has become a long-awaited panacea to most potential setbacks. Its ‘Triple Confirmation’ algorithm reveals the highest probability reversal opportunities from divergences.

In short, users get to enjoy the following benefits:

- Awareness of the quickest and most reliable trend reversal signals

- Stress-free analysis and trading owing to the indicator’s complete automation

- Knowledge of the most favorable risk management strategies at every opportunity

- Ability to test multiple markets, from Forex to Stocks and Indices

- Assurance of exploiting every opportunity, thanks to the prompt alerts within and outside TradingView

Doubt these? Click here now and brace yourself to be amazed by the results!

6. Conclusion

Reversal trading with the divergence can be fulfilling. The ease of spotting and executing it is almost unmatched.

However, the imperfection of its forecasts makes Divergence Solution for TradingView the most recommended method to approach divergences. It is completely automated, providing only the best opportunities from a ‘Triple Confirmation’ algorithm.

Please share this article among friends and trading enthusiasts for increased insights into reversal trading with divergence. Also, leave a comment below for educative discussions from experts.