Table of Contents

Are you tired of falling for fake reversals and entering trades at the worst possible time? Does it feel like your stop-loss always gets hit right before the price moves exactly in your direction?

The biggest profits are made when you trade alongside the institutional players, not against them.

1. Why Is Order Block Trading So Hard?

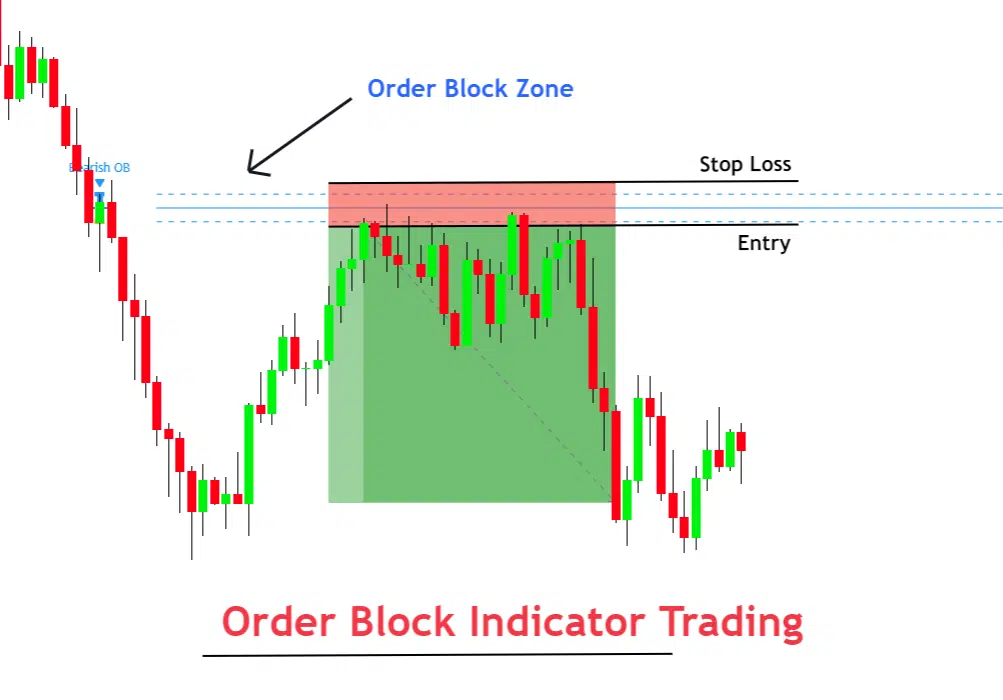

The concept of an Order Block is simple: it’s the specific candle where big money placed its massive orders, essentially marking a high-volume supply or demand zone.

If the concept is simple, why do so many traders fail with it?

The challenge lies in filtering false signals. In dynamic markets, countless candles could appear to be an order block, but they lack the necessary volume or structural confirmation. Trading these weak, unvalidated blocks is a fast track to getting caught in “the divergence trap” and having your stop-loss hit by the smart money.

The secret to winning is finding the genuine footprints of institutional activity, the high-probability zones where the market must react.

2. The Automated Smart Money Detection

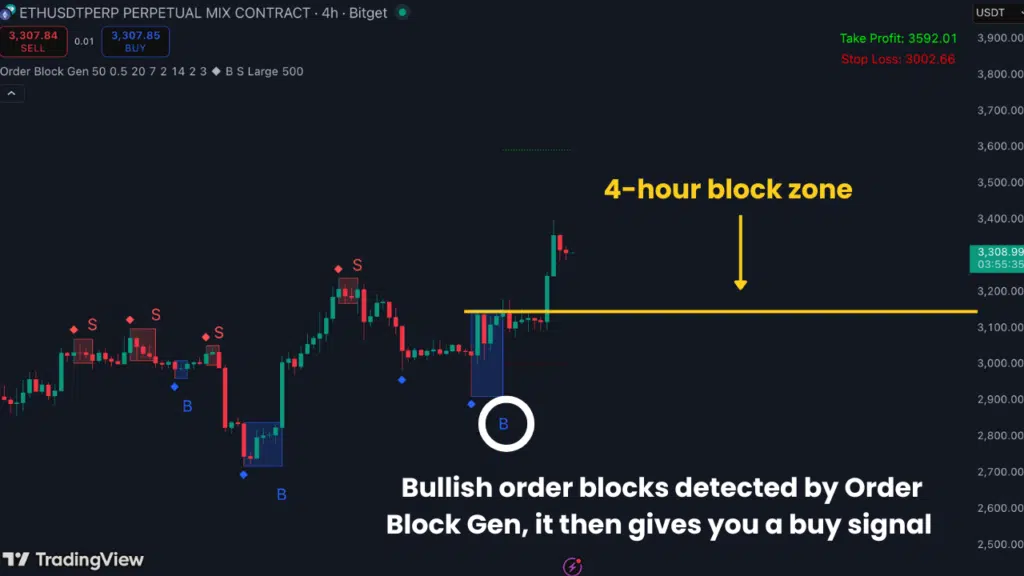

The Order Block Gen indicator was engineered to solve the problem of identification and confirmation. It goes beyond simple candle marking by employing a proprietary algorithm to detect and automatically highlight only the highest-quality, genuine bullish and bearish zones.

The core benefits include:

- Clearly marks valid bullish and bearish zones where the market is most likely to reverse.

- The indicator provides suggested Stop-Loss and Take-Profit placements, helping you secure trades with sound risk-to-reward ratios.

- By using intelligent filtering, it significantly reduces the noise and false signals that plague manual and traditional order block strategies.

3. The Pro Strategy: HTF Anchor, LTF Entry

To maximize profits, the Order Block Gen facilitates a powerful, multi-timeframe strategy that combines high-level conviction with surgical precision.

Step 1: Find the High Time Frame (HTF) Anchor

Start on a longer time frame (e.g., the 4-Hour chart). This gives you the “high-level view.” Look for a strong, recently validated order block. This 4-Hour zone is your anchor, the area where the market has shown a strong directional bias.

Step 2: Confirm the Turn on the Mid Time Frame

Zoom down to a middle time frame (e.g., the 1-Hour chart). As the price approaches your 4-Hour Anchor, watch for the Order Block Gen to draw a new block on the 1-Hour chart within the 4-Hour zone. This is a massive green light, confirming the higher time frame momentum is about to be respected.

Step 3: Execute the precise entry on the Low Time Frame

This is where you make the money. Drop to the 5-Minute chart. Wait for the price to hit the 4-Hour Anchor, and then for a 5-Minute block to form. The optimal entry is often a quick, tiny retest of that 5-Minute block before the massive move begins.

This surgical method allows for an incredibly tight stop-loss (low risk) and a massive profit target (high reward), often achieving 5x Risk-to-Reward trades easily.

4. Trade Exit Strategy: Using Opposite Blocks As Targets

A common failure point for traders is taking profits too early. The market moves from one high-volume area to the next. Therefore, your take profit target should be set at the next confirmed institutional zone.

If you are buying using a bullish order block, you should often hold that trade until the price hits the next higher time frame bearish order block. By using the opposite side’s high-probability zone as your target, you are aligning your profit-taking with the market’s next natural reaction point.

5. Step-by-Step Video Guide

Want to see this indicator in action? Watch the step-by-step video guide for the full details:

This video introduces the Order Block Gen indicator for TradingView, which helps traders find genuine “Order Blocks” or the footprints of institutional money. The video highlights the common challenge where retail traders’ stop-losses are often hit because they are trading in the wrong spots.

It explains that the indicator automatically highlights both bearish and bullish order blocks, eliminating guesswork and false signals. The main focus of the video is dedicated to a multi-timeframe strategy for using the tool.

6. The Bottom Line

Order block trading is arguably the most powerful way to trade, but it requires precision that the human eye often cannot sustain across multiple markets.

The Order Block Gen indicator is a game-changer that eliminates the guesswork. It gives you clear, high-probability entry points based on genuine institutional flow, setting you up to consistently capture trades with excellent risk-to-reward ratios every single day.

If you are serious about smart money concepts and capturing true market reversals, the Order Block Gen is the tool you need.