Table of Contents

The Trading Breakout Strategy has been specifically built to meet the demands of traders and assist them in entering the trending market as soon as feasible. In this post, you will learn about proven Trading Breakout Strategies and how to use them in your trade.

Let’s trade breakout with us!

1. What are trading breakouts?

Along the way when you’re trading or if you are in the trading journey long enough, you may sometimes hear the word “breakout”

I remember the first time I encountered this word, I was like:” whatttt?”

“Is this an acne madness or something else in trading?”. No, it’s just simply “trade breakout”

A trading breakout is different from the breakouts you (and me) may have experienced as a teenager. When price moves outside of a previous consolidation or trading range, this is known as a breakout. A breakout may also occur when a certain price level is broken, such as support and resistance levels, pivot points, Fibonacci levels, and so on.

The idea of breakout trades is to join the market just when the price makes a breakout and then ride the trade until volatility subsides.

2. Volatility is the keyword, forget the volume!

If you also trade stocks and futures, you may notice that there is no way for you to see the volume of trades made in the forex market. Volume is critical for making effective breakout trades in stock or futures markets, thus not having this data accessible in forex puts us at a disadvantage.

As a result of this disadvantage, we must depend not only on effective risk management but also on certain criteria in order to set ourselves up for a favorable prospective breakout. Volatility is deemed high when there is a substantial price shift in a short period of time. Volatility, on the other hand, is deemed low if there is very little fluctuation in a short period of time.

Although it may be tempting to enter the market while it is moving quicker than a racing bullet, you will often find yourself more worried and nervous, making poor judgments when your money enters and then exits.

This extreme volatility is what draws a lot of forex traders, but it is also what kills a lot of them.

The idea here is to take advantage of volatility.

Rather than following the herd and attempting to enter the market when it is very volatile, it is preferable to seek for currency pairings with relatively low volatility. This manner, you may position yourself and be ready for when there is a breakthrough and volatility skyrockets!

Yet, not all breakouts are certain to occur. After all, the market is just utilizing previous price movements to anticipate future price movements with certain instruments, since it is one of the most realistic methods to learn to trade financial markets, and then you observe price breaks below the support or resistance line, which provides breakout signals. Only to shatter and then rally back to its original position.

When this breakout strategy occurs, it is referred to as FALSE BREAKOUTS or FAKEOUTS.

3. False Breakouts – Trade breakout

Do you know what to notice when you trade breakouts? False breakout!

A false breakout is a price reversal, sometimes known as “market manipulation,” in which the price breaks below or above the zone and then rapidly and impulsively reverses. It happens in zones of resistance or support.

Regrettably, many inexperienced traders are frequent victims of this ‘trap.’ When the price breaks through a support or resistance zone, inexperienced traders believe it is a wonderful time to enter a trade.

“Well, this bearish candle indicates a continuance.” Others may think, “Opportunities come just once; let me seize them.” Only for them to put their stop losses and be instantly pulled out.

So, how can you use this to your advantage?

- Detect strong bullish/bearish candles at resistance/support levels, removing prior highs and lows.

- Strive for a powerful full-body reversal.

- Next, at the opening of the following candle, insert your short or lengthy entry.

4. Indications for Forex Breakout Strategy

When the market is not moving, trading breakouts are ineffective. It will also function when market circumstances are range-bound, requiring price action to be towards the top end of the market range. If the market circumstances are favorable, the following tactics and indicators might assist you in developing profitable trading strategies.

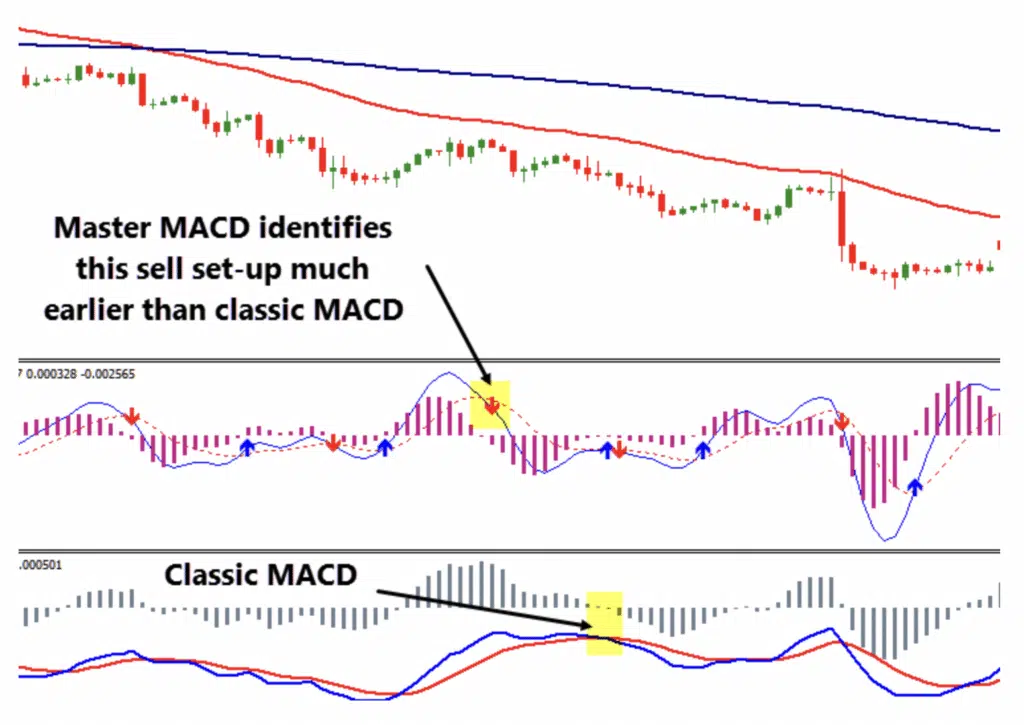

Moving Averages Convergence/Divergence (MACD) – Master MACD indicator for MT4

The MACD is one of the most often used Forex breakout strategy indicators. Although this signal seems basic and straightforward, it is also quite reliable.

Introducing: Master MACD indicator for MT4. The special thing about it is, this tool reacts faster to market changes.

That way, it lets you enter the trend with near-perfect timing. It helps you identify explosive breakout moves with greater accuracy. And it spots divergences and market reversals earlier than traditional indicators.

Think I’m exaggerating? Click here to view all details

Once you gave it, you can trade breakout like a pro.

5. The bottom line

Volatility is welcomed in breakout trading. When prices are changing swiftly, the volatility seen following a breakthrough is likely to elicit emotion. Following the techniques outlined in this article will assist you in developing a trading strategy and trade breakout like a master that, when implemented correctly, may provide excellent profits with reasonable risk.

If you’re looking for some knowledge-trading articles or an update on our newest indicators, you can find them here:

What do you think? Do you have other trading strategies to trade breakouts?

Comment below to share your idea!

Find this article useful? Share this blog with your friends on social media! Your friend may need to know how to trade breakouts!

Interesting? Find out more about Indicator Vault in other articles: Use QM Pattern and Divergence Solution to find high-probability trades