Table of Contents

Trading reversals may be one of the most challenging techniques, but there are a few impressive strategies you can try today for the highest success rate!

Reversal trading is arguably the most challenging and nerve-racking technique in the financial markets. Traders go against the norm of sticking with the underlying trend to pick potential tops and bottoms.

Fortunately, this article discusses the three best ways to hop on the train and win big moves. You’ll also receive exclusive trading systems to skyrocket your results ASAP.

1. Catching Trend Reversals with Divergences

Divergence theories are some of the best products of thorough inter- and intra-market analysis.

They are basically periods when closely related markets (or a market & indicator) display inconsistencies, signifying potential reversals.

For example, in a direct relationship, a higher/lower swing high/low formed in one should also be present in the other. If not, it is known as a divergence, as seen below:

Based on the components of the pairs, technical analysts categorize divergences into two:

1.1 Price-Indicator Divergence

This type of divergence is significantly more popular than the other.

It involves looking for inconsistencies between the market chart of your interest and a momentum/oscillator indicator. Stochastics, Relative Strength Index (RSI), and MACD are popular options.

Here is a price-indicator divergence example:

1.2 Price-Price Divergence

Price-price divergence, as the name implies, involves two price charts. It could be within the same market (or not), but the pair must have a crystal clear relationship.

For example, traders are fond of the connection between the GBP/USD and EUR/USD pairs in the Foreign Exchange market. When one forms a swing high/low, the other usually does.

However, when it doesn’t, proponents seek reversals sooner or later.

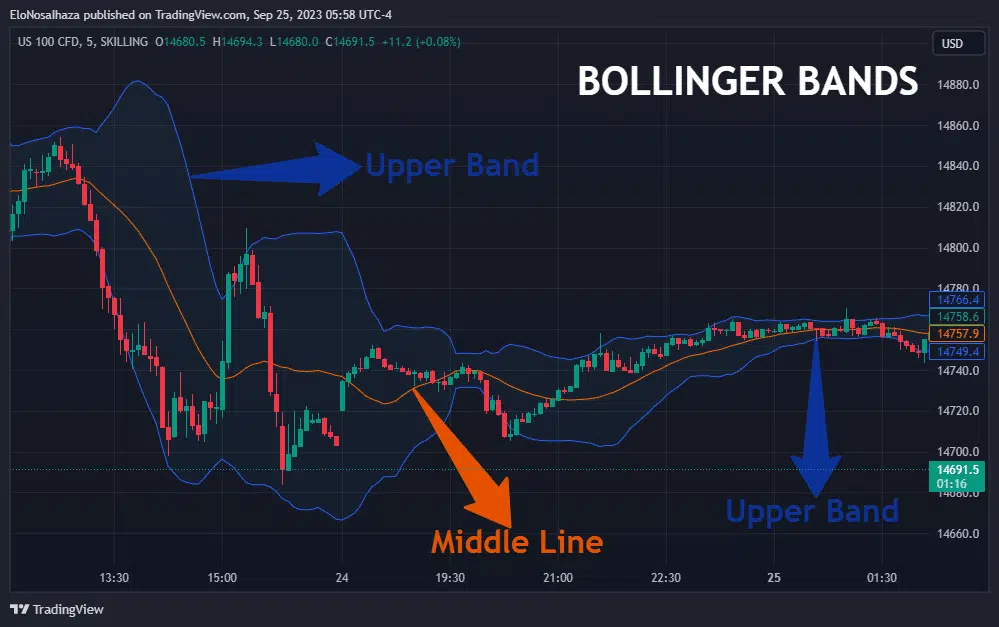

The relatively complex indicator comprises three parts:

- Middle Line: It is usually a 20-period Moving Average, but many platforms allow traders to adjust it to their taste.

- Upper Band: The Upper Band results from the addition of some standard deviations to the Middle Line.

- Lower Band: The line forms from the subtraction of some standard deviations from the Middle Line.

Here’s how they appear:

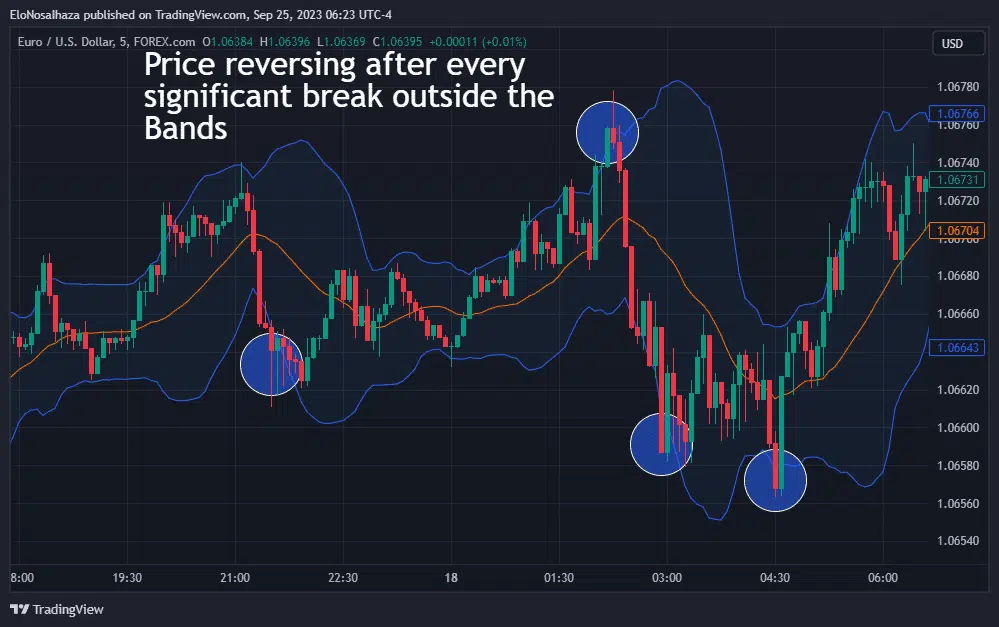

How does the indicator help in reversal trading? – Through overbought and oversold conditions.

Generally, a downtrend/bearish reversal is imminent when an instrument is overbought. When it is oversold, traders anticipate an uptrend/bullish reversal.

As discussed in The Economic Times, there are several factors to consider when using Bollinger Bands to determine overbought and oversold scenarios. However, a popular rule of thumb is to wait for the price (candlesticks) to break above or below the bands.

It is overbought when it breaks above the Upper Band and oversold when it moves below the Lower Band.

2. Momentum Indicators & Price Reversals

Momentum indicators, from the Relative Strength Index to Stochastics, are also practical for trading reversals. Below are various ways to exploit them:

2.1 Relative Strength Index (RSI)

The Relative Strength Index (RSI) has many uses, including evaluating the strength of a trend, which helps to trade in sync with the markets. For reversals, technical analysts use overbought and oversold ideas.

The indicator is overbought when it goes above 70, and you can expect a bearish reversal. Conversely, it is oversold below 30, hinting at an imminent bullish reversal.

2.2 Moving Average Convergence Divergence (MACD)

Bullish and bearish reversal forecasts with the MACD are also straightforward.

Most traders expect a bearish reversal if the MACD Line crosses the Signal Line from above (and starts trending downwards) and a bullish reversal if the latter moves above the former.

2.3 Stochastic Oscillator

There are multiple ways to use the Stochastic Oscillator for trend reversals. However, like the RSI, most users prefer using overbought and oversold theories.

With this tool, 80 and 20 are the oversold and overbought levels.

3. The Most Recommended Alternatives for Reversal Trading

Indeed, most reversal trading strategies demand immense time and effort. There’s no room for technical errors, delays, or emotions. Hence, it can be (too) challenging, especially for first-timers.

Indicator Vault, aware of these stumbling blocks, built excellent alternatives to capitalize on prices’ back-and-forth moves at the earliest.

Divergence Solution for TradingView presents the most promising divergences on a silver platter in two steps. The first involves scanning for potential setups before using a triple-confirmation algorithm to estimate the best by probability.

Concisely, here are the benefits users already enjoy:

- Exposure to the highest-probability setups without lifting a finger

- Understanding of the best risk management moves for open positions, including stop loss and take profit levels

- Ability to subscribe to any trading discipline in any timeframe

- Ease of customizing various kinds of alerts, from pop-ups to emails

You, too, can try it here today!

On the other hand, MACD Bollinger Pro for TradingView is all you need if you prefer a Bollinger-style strategy. True to its name, it combines the power of two reputable indicators – MACD and Bollinger Bands to provide the best signals that grow accounts.

Application of the MACD Bollinger Pro for TradingView

Below are a few of several advantages and perks it has over the regular Bollinger Bands:

- Assurance of the strength or weakness of the current trend

- Accurate price forecasts much earlier

- Eagle-eye view over several markets with a multi-timeframe dashboard

- Flexible notifications from within and outside the platform to ensure you never miss an opportunity

Finally, those most accustomed to momentum indicators have an incredible option in the Natural Momentum Indicator designed for TradingView.

Its thorough algorithms result in long-term profitability due to the following reasons:

- Ability to enter reversals earliest until the last pip

- Ease of assessing market strength in real time to understand the best and least favorable periods

- Understanding momentum changes quicker due to carefully curated color codes

- Real-time alerts through several mediums to guarantee your participation in big moves

4. Conclusion

Trading reversals is easier said than done. Any mistake and a security’s price can keep moving against you until it hits a stop loss and margin level.

Regardless, several strategies discussed in this article, such as divergence and momentum trading, will give you a solid edge.

Indicator Vault has several alternatives, including the MACD Bollinger Pro, that also ensure your success.

Please share your opinions, questions, or results in the Comment Section, and remember to promote this article with friends and colleagues on social media.