Forex is continually changing, therefore traders must have a well-thought-out plan in place if the price does not move as expected. One of the important factors you should consider including in this plan is a stop loss order. Stop-loss orders, when utilized effectively, can help you maintain control over trade objectives. Don’t overlook this tool; scroll below for further knowledge.

Table of Contents

1. What is a stop loss order?

One of the three most common orders in the financial market is the stop order (others one is market order and limit order). It is used to acquire or sell assets when the price exceeds a certain position.

There are several types of stop orders that traders can use to manage their trades and minimize possible losses. And stop loss order is one of the most common types.

All buy and sell orders should include stop loss orders. It will assist you in “stopping loss,” as the names suggest. That is, in a negative situation, you will only suffer a loss to the extent that you mentally prepared before placing the transaction. In other words, a stop loss will keep your account from losing any additional money.

This is a very significant order, especially if you don’t have the capacity to monitor the market move over time.

For instance, suppose you own the USD/EUR pair and expect to sell it at 1.1440. In addition to placing a sell order, you also need to place a stop-loss order at a time that is different from the moment you intend to submit the order. For example, if the gap is 60 pips, the stop loss will be set at 1.1500.

When the price moves against your forecast and reaches 1.1500, the stop-loss order will do its job, which is to close the position as soon as possible in order to limit the loss.

2. Two types of stop loss order

Stop loss orders are classified into two types:

2.1 Stop loss order to sell

- A trader’s order to sell a currency pair when it hits a certain price.

- This order is typically placed below the current market price.

- Its purpose is to limit traders’ losses when the price moves against them.

- For example, suppose you sell the EUR/USD pair at 1.2000 and would like to limit your risk of a loss if the price goes down. You should now place a sell stop loss order at 1.1950. When the EUR/USD price drops to 1.1950, the order will be automatically activated, and the position will be closed with the predicted loss.

2.2 Stop loss order to buy

- When a currency pair reaches a given price, traders will place this order to buy it

- This type of order is usually placed at a price greater than the current market price.

- Its purpose is to limit losses when the price goes in the opposite direction of the trader’s position.

- For example, suppose you buy the EUR/USD pair at 1.2000 and would like to limit your risk of a loss if the price may rise unexpectedly. You should now place a stop loss order to buy at 1.2050. When the price reaches this level, the order will automatically activated and the position will be closed with the predicted loss.

3. Benefits and Drawbacks

Stop-loss orders have various benefits for traders, but there are also drawbacks to consider. Here are some of the primary benefits and drawbacks of using a stop-loss order:

3.1 Benefits

The most attractive feature of a stop-loss order is risk management. This enables traders to identify the maximum loss they are willing to accept. It also assists in the prevention of huge losses that could wipe out their trading accounts.

This type of order is for you if you are an emotional person. That will prevent you from making emotional decisions. You will no longer be influenced by emotions that cause you to hold out hope that the price will return as predicted, resulting in a big financial loss.

One of the numerous issues that traders encounter is being dominated by emotions. You can see more: Overcoming The Top 5 Challenges Every Trader

Stop loss orders, in my opinion, are ideal for people who enjoy to move and desire to have more relaxation time, such as during the vacation season. I mean, you don’t have to stare at a computer screen every day, or even hourly, to monitor the chart.

I’m not suggesting full-time traders shouldn’t use it. As previously said, it is recommended in all trades and for all traders.

3.2 Drawbacks

Because of the short-term volatility of the financial markets, a stop order may be triggered at an unsuitable period. When the price fluctuates, it immediately reverses direction and continues in the way you prefer. When the stop loss order is activated, you will miss out on a fantastic profit chance.

If the market moves too quickly, the price is below (or above) the price of the stop loss order, making it impossible to execute the stop loss order at the intended price. Even if the trade price is far from your stop loss, the currency pair will be sold (or bought) at the next available price.

Because of the above limitations, you should be extra careful in calculating a reasonable stop loss percentage. This allows the asset to fluctuate on a daily basis, eliminating the need for unnecessary stop loss execution.

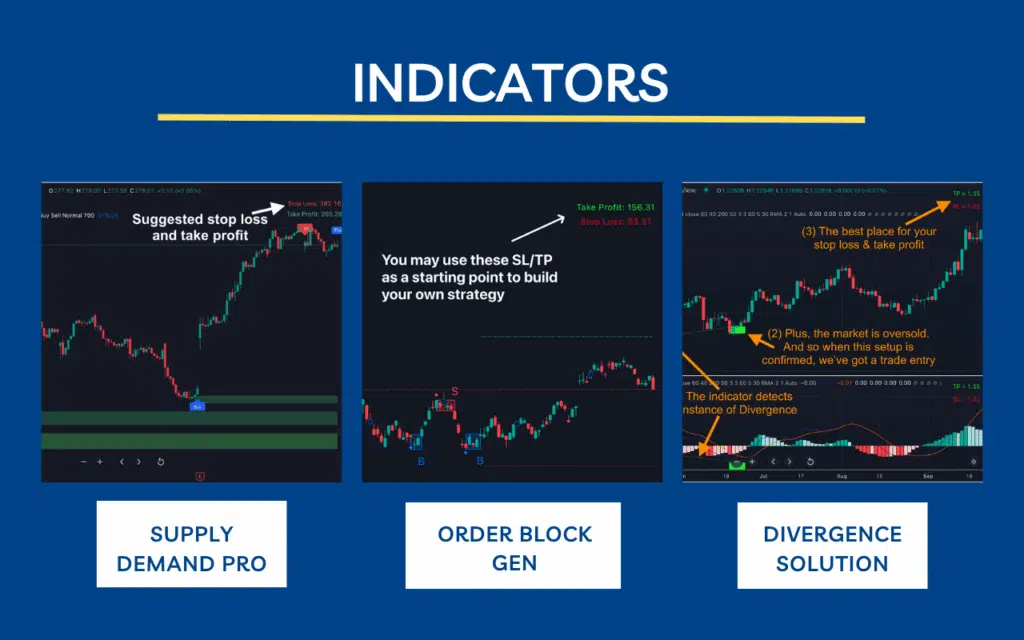

Don’t be concerned if you can’t decide where to place a stop loss. Recognizing the significance of placing a stop loss order, the most of our indicators focus on this factor. Here are some common indicators I’d like to share with you:

These indicators will show you the best place to place your stop loss and take profit. In other words, they give you everything on a silver platter: High-probability trade entry, stop loss, take profit,…

4. The bottom line

Remember that no matter what method you use, it will only work if you keep to it. As a result, if you are a buy-and-hold investor, your stop-loss orders are nearly useless.

In a nutshell, a stop loss order is a straightforward trading instrument that, assuming it is executed in the appropriate manner, has the potential to bring about a wide range of advantageous scenarios. This tool can be useful for any trading strategy, whether your goal is to take a profit or to limit your losses.

If you’re looking for some knowledge-trading articles or an update on our newest indicators, you can find them here:

What do you think? Do you have any suggestions for using a stop loss order?

Comment below to share your idea!

Find this article useful? Share this blog with your friends on social media!