Swing trading is undeniably getting more popular than other trading strategies. In this article, we’ll go over some of its fundamentals to see why it’s so popular, especially among part-time traders!

Table of Contents

1. Swing trading definition

1.1 What is swing trading?

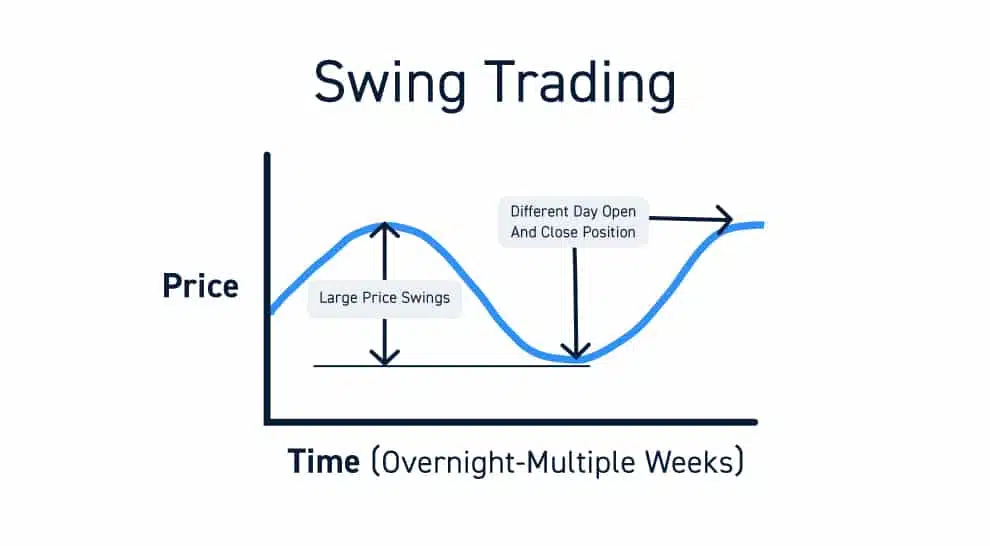

Swing trading is a basic style of trading where traders hold assets for an extended period of time, usually from a few days to a few weeks.

They will first observe how the market moves before identifying a future trend. And patiently hold the asset and wait until the goal is set out according to the initial analysis.

If you are familiar with trading styles, you will also realize that swing trading is somewhere between day trading and trend trading.

- Day trading: short-term trading strategy, usually with the least profit.

- Swing trading: a medium-term trading strategy that earns more than day trading but less than position trading.

- Position trading: a long-term trading strategy, the highest level of profit in the three types mentioned here

1.2 Advantages and disadvantages

As with any other type of trading, swing trading also has certain advantages and disadvantages. Let’s take a look at some of the most common ones.

Advantages:

- There is no need to devote too much time to day trading.

- Much of it can be based on technical analysis, which simplifies the trading process.

- If you follow the strategy consistently, you will make a lot of money.

- Constant flexibility in capital management.

Disadvantages:

- You will face additional risks when trading is open overnight, even on weekends.

- The market may quickly reverse, resulting in big losses.

- Did not take advantage of the potential to apply leverage in day trading.

2. Who is swing trading suitable for?

Those who trade in swing are called swing traders.

This type of trading is suitable for people with full-time jobs. Due to the nature of their work, they cannot spend all day monitoring the progress on the chart as well as continuously placing orders in short timeframes.

Swing traders, on the other hand, only need to keep up with global economic news on a regular basis and spend a few hours each night researching the market.

2.1 Should I choose swing trading?

To answer the question, “Should I choose swing trading?,” you need to understand what it is and think about who you are.

Traders should have the following characteristics:

- You must be extremely patient in waiting (for more than a day) for the best moment to place an order.

- Remain calm during market volatility and trust your own analysis and strategies.

- Don’t be afraid to face big capital losses.

- Able to spend 1-2 hours per day updating global economic news and forecasting price trends in the near future.

2.2 Is it for beginners?

A few things to keep in mind if you are a newbie and wish to try out this trading strategy.

- H4 and D1 are recommended times. Because these are the long periods that are appropriate for the characteristics of this type. Simultaneously, observing the trend of the full day will provide higher precision.

- Swing traders can profit from almost any asset. But we highly recommend a few properties that assets should have, including: liquidity and volatility. Choosing the right stocks in an active market will improve your chances of making a profit.

- You should also learn more about charting software and conduct a technical analysis to guarantee you have a good knowledge basis.

- Finally, to start trading with this form, you are required to have a certain amount of capital in advance.

3. What Are Some Indicators Used by Swing Traders?

Some typical tools commonly used by swing traders include: moving averages, momentum indicators, etc.

In this section, we would like to introduce to you some indicators for swing trading that our team has developed with the desire to improve the customer experience.

3.1 Swing Force for TradingView

Not just for swing traders, this Swing Force indicator also works equally well for day traders, and scalpers.

Take a look list of some useful features:

- Locates market’s turning points

- Finds new market trends

- Detects explosive breakouts

3.2 Harmonic Pattern Pro for TradingView

Identifying harmonic patterns will assist swing trades in maximizing profits in a short period of time.

This pro indicator, which is made out of a secret algorithm, can do the following for you:

- It detects all 6 popular harmonic patterns.

- Displays all historical patterns as well as newly formed patterns…

- Gives you alerts as soon as a valid pattern forms…

Interesting?

4. The bottom line

Swing trading is an interesting strategy that is worth experiencing on your trading path. But remember, theory alone is not enough. I purpose that you practice trading using a demo account before trading in real time with real money.

I hope this article has provided you with really useful knowledge to contribute to your success on your path to becoming a good swing trader!

If you’re looking for some knowledge-trading articles or an update on our newest indicators, you can find them here:

What do you think? Do you have any tips to become a swing trading master?

Comment below to share your idea!

Find this article useful? Share this blog with your friends on social media!