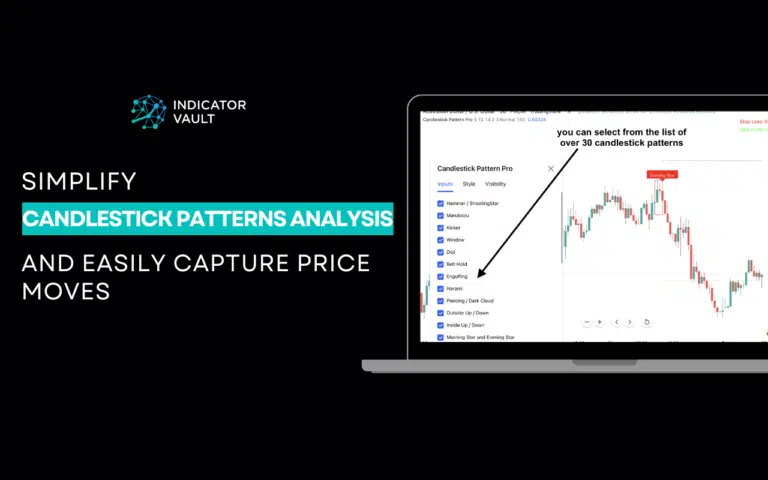

Video guide: Candlestick Pattern Pro for TradingView 2.0

Have you ever looked at a trading chart, knowing candlestick patterns hold powerful clues, but felt overwhelmed trying to spot them in real-time? You’re not alone. Manually identifying dozens of complex patterns, often in fast-moving markets, can be incredibly difficult and time-consuming. You end up missing key entries or getting faked out by unreliable signals….