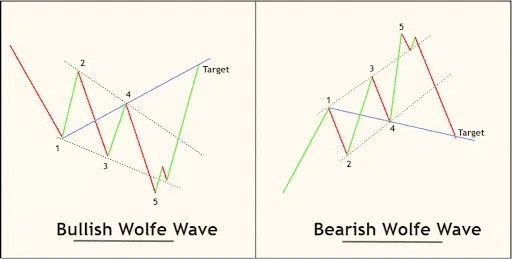

The trading strategy known as Wolf Waves, utilized by market analyst and experienced trader Linda Raschke, is based on a price pattern that can be applied to all currency pairs. The strategy is rooted in Elliott Wave trading and is focused on the fundamental issue of supply and demand imbalances in the market.

Notably, the Wolf Wave pattern can be observed on different TimeFrames, ranging from 5 minutes to W1, and has the unique ability to anticipate the precise “falling point” of the price, distinguishing it from other patterns.

If you find this strategy challenging to grasp, fear not! This article provides a helpful guide.

Table of Contents

1. Definition of Wolfe Wave indicator

Wolfe Wave indicator is a technical tool developed with the Pine Script programming language, designed to detect wave patterns on price charts.

It is conveniently available on TradingView, allowing users to utilize the indicator on their mobile devices as well.

To gain a deeper understanding of this Wolfe Wave pattern, we recommend reading this informative post beforehand.

2. How does the Wolfe Wave indicator work in trading?

The indicator operates by analyzing the relationship between waves, allowing it to swiftly identify potential trading opportunities on a price chart.

The creator of this indicator implemented a Fibonacci sequence between waves to determine chart patterns. Specifically, the relationship between waves 3 to 4 and waves 2 to 3 corresponds to the Fibonacci ratio of 127%, while waves 3 to 4 and waves 1 to 2 exhibit a Fibonacci ratio sequence of 68%.

Meeting the primary requirement of the Wolfe Wave pattern, which stipulates that wave 3-4 must be shorter than wave 1-2, necessitates the use of Fibonacci ratios, as employed by the indicator’s author.

3. How does the Wolfe wave indicator generate buy/sell signals?

A line peak constitutes the generated signal whenever a Wolfe Wave pattern appears on the chart.

A significant drawback of this indicator is that it fails to plot real-time wave lines on the candlestick chart, signaling only the formation of a pattern in a separate window through a line peak.

However, an advantage of using this indicator is that it obviates the need to constantly monitor the screen for wave patterns. Whenever the indicator signals an alert, traders can simply verify the pattern on the chart and execute an order accordingly.

3.1. Buy signal

A green line peak indicates an upcoming bullish trend reversal, corresponding to a Bullish Wolfe Wave pattern. The strength of this signal is directly proportional to the height of the green line.

3.2. Sell signal

On the other hand, a red line peak suggests a bearish Wolfe Wave pattern has formed on the chart, signaling an imminent bearish trend reversal. The validity of this sell signal corresponds to the height of the red line.

4. How to trade with the Wolfe Wave indicator?

While the traditional Wolfe Wave indicator can be helpful, solely relying on it may not optimize the winning ratio of your trading strategy. To increase the accuracy of trades, it is advisable to manually review each signal generated by the indicator.

For instance, when a sell signal appears, it is not recommended to immediately open a sell trade. Instead, traders should analyze the chart manually, using wave analysis to determine whether to execute the trade or skip it.

Adopting this approach should improve the winning ratio of the Wolfe Wave strategy. Although the initial indicator identifies potential trade setups, manually refining those setups can optimize the results.

Does this seem complicated?

No need to worry! Our latest Tradingview tool, the “Easy Wolfe Wave” indicator, automatically identifies Wolfe Wave patterns, which are known as one of the most popular high-probability reversal setups.

Utilize this automatic pattern detection tool to spot fascinating Wolfe Wave patterns on any market, including FX, stocks, indices, commodities, and futures.

Take advantage of this opportunity to improve your trading position NOW

5. The bottom line

Wave analysis can be challenging in highly volatile markets, such as forex trading. The Wolfe Wave indicator can aid in accurately identifying these setups and reduce the amount of time spent monitoring the screen. Moreover, it can significantly improve one’s psychology when trading.

To achieve optimal results, it is crucial to adequately backtest this indicator on a demo account before utilizing it in live trading.

In order to make the best decisions, it is important to equip yourself not only with fundamental knowledge but also with supportive tools that can serve as excellent guides.

What do you think? Please feel free to share your comments!

Find this article useful? Share this blog with your friends on social media!