There are numerous trading styles available on the market for traders to apply and select the best ones. But before embarking on any kind of experience, you need to learn about it first. This article will summarize the most basic information about scalping – one of the most popular trading styles.

Table of Contents

1. What is Scalping? What is Scalper?

Scalping is a trading strategy that profits from small price changes in short time frames.

Scalpers are traders who use scalping to make money in the market.

Instead of buying and holding positions for a long time, scalpers will place an order within 30 seconds to profit from small market movements. Then, they will repeat this action many times in a day and small amounts (from every order) will generate a large gain.

For this type of trading, traders need to have good discipline to come up with a strict exit strategy. If you are just absorbed in making more profit, you will easily receive a loss many times larger than the small gains the trader worked to obtain. In addition, scalper traders need to spend time every day analyzing the market, so this style is not for part-time traders.

Scalp trading is very simple to understand. There are two ways for traders to profit from scalping:

- They buy low and sell at a higher price

- They sell at a high price and then buy at a lower price

Traders can easily find opportunities in the market in both directions, whether bullish or bearish.

One important thing you need to keep in mind is the liquidity of the asset. Due to the short-term nature of trading, the liquidity will make sure that you get a fair price when you enter and exit an order.

2. Pros and cons

2.1 Pros of scalp trading

There are some outstanding advantages to scalping that make many people believe in adopting it.

First, traders do not need to know too much information about the asset in question. They trade for a very short period of time, so they just focus a lot on technical analysis. Therefore, it is not necessary to follow the basic fundamentals as well as determine the general trend of the price for the day.

Second, the risk of trading is low. Because it happens in a short time, it is less likely to encounter reversal trends (trends that occur when subjected to many external influences such as news, speeches or important meetings).

Third, you will have a lot of trading opportunities in a day. Whether the market is trending or moving sideways, scalping can be used to make profits. The number of scalping transactions can reach several dozen in a day.

2.2 Cons of scalp trading

Despite the fact that it has some good things going for it, it also has some bad things.

The biggest downside of scalping is the high transaction costs. Making profits in a short time requires scalpers to enter orders in large volumes. And a large volume of orders will come with an entry cost as well as a large commission cost. This is also the reason that some traders do not choose this way of trading.

Along with many trading opportunities, traders have to trade off high levels of concentration and spend a lot of time every day.

3. Types of scalping strategies

You have three options for scalping.

3.1 Trading at high volumes

Traders will buy a large number of assets to trade profitably on even small price movements. Of course, the chosen asset will be quite liquid. Because only then will it be possible to meet the requirements of a one-time purchase or sale of up to 3000 units.

3.2 Breakout trading

This can be seen as the traditional type of scalping that is closest to scalpers. Scalping trades are all about finding breakouts and driving the market until the first exit signal is formed. Right now, the trader’s system will close the position with a risk/reward ratio of 1:1.

3.3 Trading the spread

It is also known by another name as market making. In this way, traders have to execute both sell and buy orders for a particular asset at the same time.

It normally takes place in a stable market with little price fluctuation. Furthermore, this is regarded as the most challenging sort of scalping, as traders must fight with market makers for sufficient assets to execute both buy and sell orders.

4. What you need to know before scalping

The scalping strategy is quite simple, but you need some mental discipline before officially starting. Here are some tips I suggest you follow to have the best experience with this style of trading:

- Choosing currency pairs with high liquidity and high volatility in a short time will maximize the opportunity to profit.

- The Internet connection must be good because transactions require speed and accuracy. Let’s say that because of a small technical error, you have missed a good opportunity to lock in a higher profit. This incident can easily affect your trading results for the day.

- Stop loss should always be set to make sure you don’t lose too much compared to the original strategy. Simultaneously, it is always necessary to set a take profit and stop loss, particularly for a type of trading that requires a high level of discipline, such as scalping.

- Choose the most active market times of the day for more trading opportunities.

- If you are a beginner, you should focus on one pair first. You’ll have a better chance of being successful.

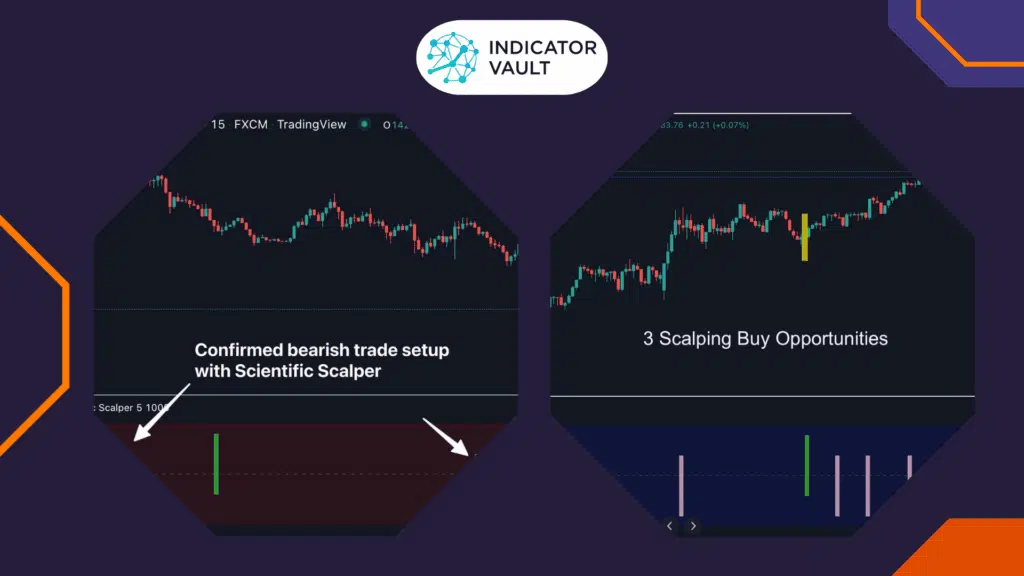

In addition, to make scalp trading easier and still profitable, you should consider using a powerful indicator. Scientific Scalper for TradingView by Indicator Vault comes highly recommended from my experience.

With this indicator, I have reduced the number of difficult steps in applying scalping to my trading strategies. It helped me:

- Improves my technical analysis skills significantly

- Timely alerts as soon as it detects that the market is overbought or oversold

- Works with and complements my existing trading strategy for maximizing the chance of winning

- And the most important: The “Scientific Scalper” indicator doesn’t repaint… ever!

I hope you enjoy this fantastic indication and can use it to maximize your profits in trading.

5. The bottom line

If you are a day trader, you can’t afford to ignore scalping.Hopefully, through the above article, you have understood the concept, advantages, and disadvantages, as well as the basic rules when using scalping.

Scalping is a key trading method for many traders. However, before using it, beginners should carefully consider whether their personality fits the nature of this type of trade or not!

If you’re looking for some knowledge-trading articles or an update on our newest indicators, you can find them here:

What do you think? Do you have any suggestions for using scalping strategies?

Comment below to share your idea!

Find this article useful? Share this blog with your friends on social media!