Moving averages are essential for identifying market trends, but traditional indicators lag and create false signals. Discover how the Trend Focus indicator filters our noise, spots real trend direction, and helps you trade with precision.

1. What is the moving average?

The moving average is one of the most widely used tools in technical analysis. It smooths out price data over a specific period, helping traders identify the overall direction of the market, whether it’s trending upward, downward, or moving sideways.

But here’s the catch: while moving averages are great for clarity, they often lag behind real-time price action. By the time a crossover confirms a trend, you’ve already missed a big part of the move.

That’s why understanding how moving averages work and improving them is key to smarter trading.

2. How to calculate moving average?

There are several types of moving averages, but the two most common are:

2.1. Simple Moving Average (SMA):

The SMA calculates the average closing price over a specific number of periods. For example, a 20-day SMA adds up the last 20 closing prices and divides by 20.

2.2. Exponential Moving Average (EMA):

The EMA gives more weight to recent prices, making it more responsive to recent price changes. Traders often prefer the EMA for faster reaction to market movements.

Both SMAs and EMAs are valuable, but they come with trade-offs. SMAs are slow to react, while EMAs can overreact to short-term volatility.

So how do you strike the perfect balance between responsiveness and reliability?

3. Types of moving averages

In addition to the simple and exponential moving averages, traders also experiment with:

- Weighted Moving Average (WMA): focuses even more recent data

- Smoothed Moving Average: reduces volatility by averaging a broader data set

- Adaptive Moving Average (AMA): Changes speed based on market volatility.

However, even the most advanced moving average indicators can produce false signals in choppy markets. That’s why many traders seek an alternative, something that captures the trend accurately while cutting out the noise.

4. How to apply moving average to your trading strategy?

Moving average helps traders:

- Identify the trend direction

- Find entry and exit points

- Confirm support and resistance levels

- Spot potential reversals

A common method is using moving average crossovers, when a short-term average crosses above a long-term average, it signals a bullish trend. When it crosses below, it signals bearish momentum.

The problem? These signals often come too late. The market may have already shifted by the time the indicator reacts.

That’s where an advanced moving average indicator, one that’s faster, smarter, and adaptive, comes in.

5. Filter the trend direction from lag and noise with Trend Focus indicator

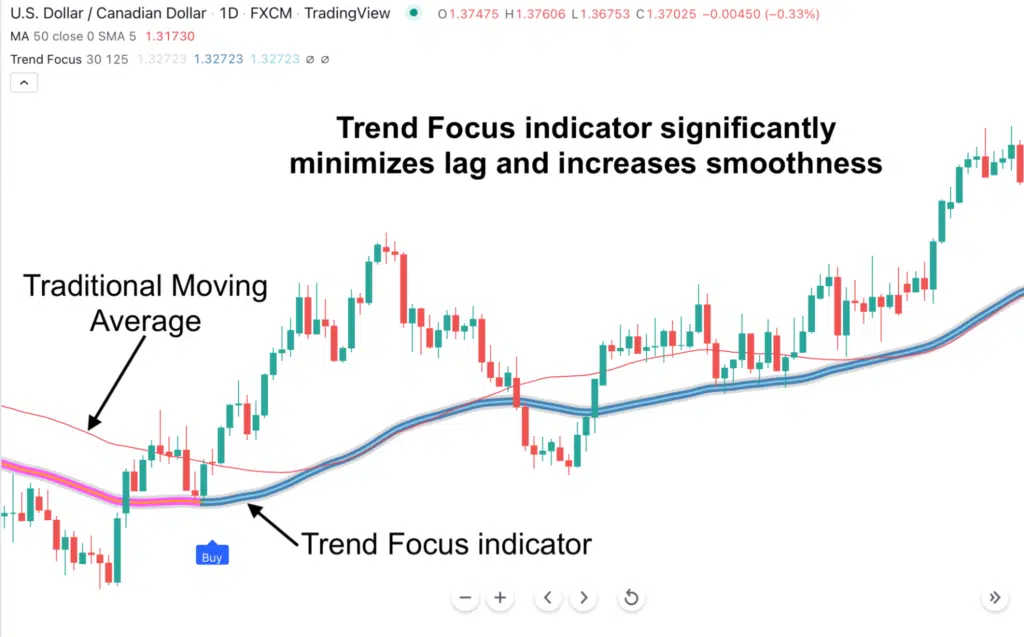

This is where the Trend Focus indicator for Tradingview steps in.

Trend Focus is built to overcome the biggest weakness of traditional moving averages, lag and noise.

By using a dynamic smoothing algorithm, Trend Focus reacts quickly to trend changes while filtering out meaningless price fluctuations. You’ll see only the real direction of the market, nothing more, nothing less.

With Trend Focus, you can:

- Identify trend direction early before the move accelerates

- Avoid false entries caused by short-term noise

- Trade confidently on any timeframe, from 5-minute to daily

- Confirm momentum strength with color-coded trend zones

Unlike the simple or exponential moving average, Trend Focus does not just follow price, it predicts it.

It helps you enter earlier, exit smarter, and stay aligned with the dominant market trend whether you’re scalping, day trading, or swing trading.

6. The bottom line:

The moving average remains a cornerstone of technical analysis, but traditional methods leave too much room for delay and confusion.

If you want to cut through the noise, eliminate lag, and see trend direction clearly, the Trend Focus indicator is your edge.

It’s everything traders love about moving averages, just faster, sharper, and smarter.