If you’re stuck with unreliable manual pattern recognition, Candlestick Pattern Pro helps you automatically detect high-probability candlestick setups like Engulfing, Hammer, and Morning Star before major market turns.

Table of Contents

1. The Power (and Problem) of Reversal Candlestick Patterns

Reversal candlestick patterns are some of the most powerful tools in technical analysis. These formations signal when a current trend is losing momentum and about to reverse direction, allowing traders to catch major market moves right at the turning point.

When identified correctly, reversal patterns like the Bullish Engulfing, Morning Star, Hammer, and Evening Star can help you:

- Exit losing positions before they get worse

- Enter new positions at optimal prices

- Catch the beginning of major trend changes

- Improve your risk-reward ratios dramatically

But here’s the brutal truth that most trading books won’t tell you…

While reversal candlestick patterns are incredibly powerful in theory, most traders struggle to use them effectively in real-world trading. And it’s not because the patterns don’t work – it’s because by the time you spot them in real time, the move has already happened.

- Physical & Mental Limitations: You can’t watch 10 charts on 3 timeframes (30 charts total). After hours of staring at screens, your brain starts seeing patterns that aren’t there – or missing real ones. In volatile markets, patterns form within minutes.

- Subjective Interpretation: Is that really a Hammer or just a long wick? A Piercing pattern or strong bullish candle? This uncertainty leads to hesitation, and hesitation kills profits.

The reality is that reversal patterns work brilliantly… if you can actually spot them when they matter.

So what’s the solution?

2. The Solution: Automated Detection with Candlestick Pattern Pro

The solution isn’t to try harder or add more monitors to your trading desk. The solution is to stop relying on manual reversal candlestick pattern recognition entirely.

Think about it: Why should you manually scan charts for patterns when technology can do it faster, more accurately, and across unlimited charts simultaneously?

This is exactly what Candlestick Pattern Pro for TradingView was designed to solve.

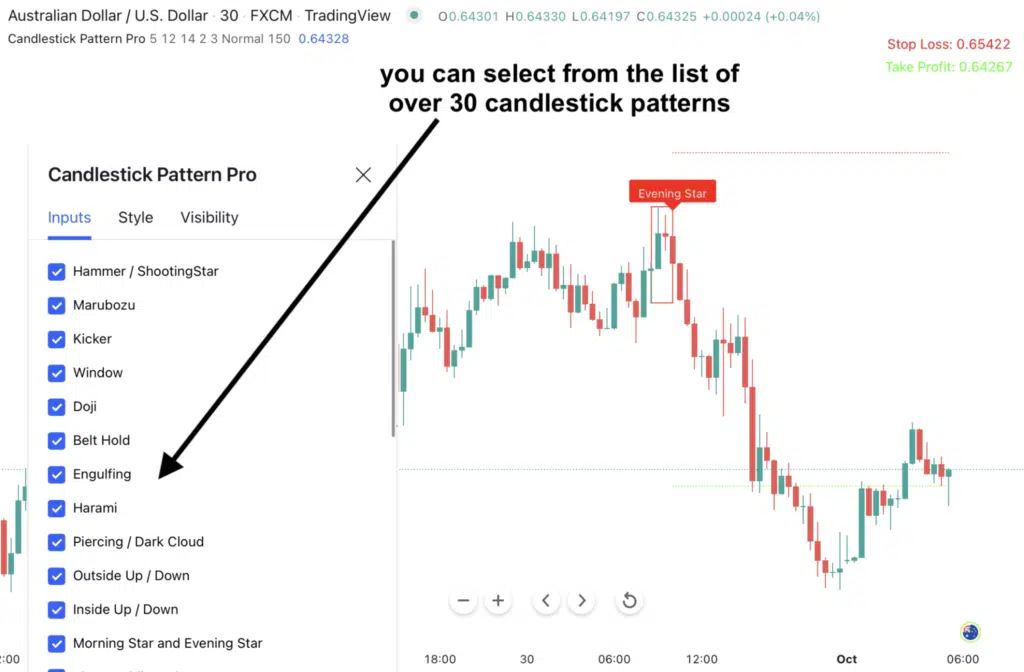

Instead of manually hunting for reversal patterns across multiple charts and timeframes, Candlestick Pattern Pro automatically detects over 30 candlestick patterns in real time, including all the major reversal, continuation, and trend exhaustion patterns that traders rely on.

Here’s what makes it a game-changer:

✅ Detects 30+ Patterns Automatically

The indicator scans for reversal candlestick patterns, continuation patterns, and even exhaustion patterns. You don’t need to memorize dozens of pattern rules. The indicator knows them all.

✅ Real-Time Pattern Identification

This is critical: Candlestick Pattern Pro identifies patterns as they complete. Every new candle counts, so you won’t miss any potential candlestick patterns.

✅ Visual, Audio, Email, and Push Alerts

The moment a reversal pattern forms, you get notified. Pop-up alerts on your TradingView screen, email alerts, or push notifications. You can customize exactly which patterns trigger alerts and how you want to be notified.

✅ Clear Chart Plotting with Labels

Every detected pattern is clearly plotted on your chart with easy-to-read labels. No more squinting at candles trying to figure out if that’s really a Hammer or just a long-wicked candle.

3. How the Indicator Detects Patterns Automatically

Candlestick Pattern Pro continuously scans price action across all your selected charts, identifying reversal candlestick patterns by analyzing each completed candle with specific criteria like candle body size, wick length ratios, and positioning relative to previous candles.

The indicator can detect multiple pattern types simultaneously, so if both a Hammer and a Bullish Engulfing pattern form in the same area, you’ll see both for higher-conviction setups.

And that solves your biggest reversal trading challenges:

Save Hours of Screen Time

Candlestick Pattern Pro scans your chart automatically, 24/7, for potential candlestick patterns. You review the setup in 30 seconds, do your analysis, and make your trading decision. You’ve just cut your chart time by 80% while actually catching MORE opportunities.

Dramatically Increase Pattern Detection Accuracy

Candlestick patterns are mathematical, so you want the math to do the job, not human bias. Candlestick Pattern Pro removes second-guessing or any “look quite right” subjective opinion from the equation.

The indicator applies the same objective criteria every single time. So you won’t miss a pattern due to human errors or complexity.

4. How to Trade with Reversal Candlestick Patterns: Your Actionable Trading Strategy

Now that you understand what reversal patterns are and how the indicator works, let’s get practical. Here’s your step-by-step guide to trading with Candlestick Pattern Pro.

Step 1: Set Up Your Alerts (One-Time Setup)

First, configure Candlestick Pattern Pro to spot all reversal candlestick patterns (Engulfing, Hammer, Morning/Evening Star, etc.). You can disable other types of patterns to have a clearer view.

Important: Don’t jump into a trade immediately just yet – your analysis determines whether you actually take the trade. Take the next step for the right strategy.

Step 2: Identify High-Probability Setups (The Secret Sauce)

Key Zones: Patterns at support/resistance levels, psychological round numbers (1.2000, 1.5000), major MAs (50/200 EMA), Fibonacci levels (38.2%, 50%, 61.8%), or previous swing points carry more weight.

Trend Exhaustion: Look for exhaustion patterns, extended moves without pullbacks, RSI divergence, declining volume, or smaller candles in trend direction.

Multi-Timeframe Alignment: Check higher timeframes before trading lower timeframe patterns. Is the larger trend supportive? Is price at a logical reversal zone?

Golden Rule: Trade reversal patterns on lower timeframes that align with higher timeframe structure.

- You get an alert for a Bullish Engulfing reversal candlestick pattern on the 15-minute chart.

- Before trading it, check the 1-hour and 4-hour charts

- Is the larger timeframe trend supportive? Is price at a logical reversal zone on the higher timeframe?

Step 3: Plan Your Trade (Risk Management Is Everything)

Entry: Two Approaches

Aggressive Entry: Enter immediately when the pattern completes (at the close of the pattern candle). This gives you the best price but slightly higher risk of false signals.

Conservative Entry: Wait for the next candle to confirm the reversal direction. If the pattern was a Bullish Engulfing, wait for the next candle to open and move higher before entering. This provides additional confirmation but you get a slightly worse entry price.

Stop Loss: Protect Your Capital

Your stop loss should be placed just beyond the pattern formation:

- For bullish reversal patterns: Place your stop loss 5-10 pips below the lowest point of the pattern

- For bearish reversal patterns: Place your stop loss 5-10 pips above the highest point of the pattern

Take Profit: Lock in Gains

Target 2:1 or 3:1 minimum risk-reward, previous swing highs/lows, or key technical levels (Fibonacci extensions, psychological numbers). Consider scaling out: take 50% at 1:2 R/R, let the rest run to 1:3+ with a trailing stop.

Step 4: Combine Multiple Patterns for Higher Conviction

One of the most powerful features of Candlestick Pattern Pro is that it shows you ALL patterns simultaneously. When multiple patterns align, your probability of success increases dramatically.

4. How to Trade with Reversal Candlestick Patterns: Your Actionable Trading Strategy

Reversal candlestick patterns are among the most reliable technical signals for identifying trend changes – but only if you can actually spot them when they matter.

This is why serious traders use automation.

Candlestick Pattern Pro eliminates the burden of manual detection recognition. It scans your charts 24/7, detects over 30 patterns with perfect consistency, and sends you instant alerts the moment a high-probability setup appears.

Start catching those high-probability trades that you used to miss now.