Table of Contents

Proper risk and money management is the bedrock of successful trading. Without it, you are simply gambling. The two most critical tools for implementing a systematic risk framework are Stop-Loss (SL) and Take-Profit (TP) orders.

These seemingly simple commands are essential for fulfilling every financial goal, from limiting catastrophic losses to semi-automatically securing gains.

This guide clarifies the function and crucial benefits of SL and TP orders and provides practical examples for every trader, regardless of market or strategy.

1. Stop-Loss and Take-Profit Defined

1.1 What is a Stop-Loss Order (SL)?

A Stop-Loss order is a pre-set instruction given to your broker to automatically close an open position when the market moves unfavorably and hits a specific, defined price (the stop price).

- Function: Its sole purpose is to prevent further losses and restrict your risk exposure on a single trade to a manageable amount.

- Mechanism: When the market price touches your stop price, the order instantly converts into a market order, closing the position as quickly as possible.

1.2 What is a Take-Profit Order (TP)?

A Take-Profit order is a pre-set instruction given to your broker to automatically close an open position when the market moves favorably and hits a specific, desired price (the target price).

- Function: It ensures profits are secured before a market reversal can erase them. It locks in your reward once your trade idea is validated.

- Mechanism: When the price touches the pre-determined target, the order converts to a market order, closing the position to realize the gain.

The Power of Both: Most professional trades involve setting both an SL and a TP simultaneously. This defines your maximum risk and maximum reward before market emotions can interfere

2. Four Crucial Benefits for Consistent Trading

Trading experts rely on SL and TP orders because they solve the most common problems faced by both rookie and veteran traders.

2.1. Superior Risk Management & Position Sizing

Stop-Loss orders are the foundation of position sizing. By setting an SL, you define the maximum amount you are willing to lose.

This allows you to precisely calculate your position size (the number of shares or contract size) so that a loss only equals 1% to 2% of your total trading capital. Without an SL, your risk is undefined and unlimited.

2.2. Reduced Psychological Demand

The automated nature of SL/TP orders removes the two biggest enemies of a trader: greed and fear.

- Fear: An SL handles the fear of a small loss turning into a catastrophic one.

- Greed: A TP handles the greed that tempts you to hold onto a winner until it reverses.

Once the order is set, you worry less about monitoring every tick, significantly reducing psychological fatigue.

2.3. Automated Trading & Plan Adherence

These orders make automated trading possible. Once set on your platform, they execute seamlessly without your intervention.

This mechanical closure forces you to adhere to your trading plan if your strategy dictates a $500 risk limit and a $1,000 target, the orders enforce that discipline, regardless of sudden volatility.

2.4. Defining Your Risk-Reward Ratio

Before every trade, SL and TP orders allow you to define your Risk-Reward (RR) Ratio. For example, placing a Stop-Loss 50 points away and a Take-Profit 150 points away gives you a 1:3 RR ratio.

Focusing on trades with an RR of 1:2 or higher is fundamental to long-term profitability, even if you only win 40% of the time.

3. Practical Scenarios: SL/TP in Real Markets

The placement of your SL and TP is highly dependent on your trading style, the asset, and the time frame.

Scenario A: Day Trading the NASDAQ 100 Futures (NQ)

- Time Frame: 15-Minute Chart (M15)

- Trade Setup: You identify a breakout above a key resistance level at 24,400. You go long (buy).

- Stop-Loss (SL) Placement: Place the SL immediately below the confirmed support level (the previous resistance that just broke), perhaps at 24,112.

- Rationale: If the price falls back below that old resistance, the breakout is considered a false signal, and you must exit quickly.

- Take-Profit (TP) Placement: Look for the next major high-volume node or a previously untouched resistance level, such as 25,113.

Result: This trade risks 50 points to gain 150 points (a 1:3 Risk-Reward Ratio).

Scenario B: Swing Trading EUR/USD Forex Pair

- Time Frame: Daily Chart (D1)

- Trade Setup: You spot a strong bullish trend on EUR/USD and buy when the price pulls back to the 50-period Moving Average (MA).

- Stop-Loss Placement: Place the SL comfortably below the 50 MA and below the previous major swing low. If the price closes below the swing low, the entire trend structure is invalidated.

- Rationale: This prevents your account from absorbing losses if the overall uptrend fails and a major reversal begins.

- Take-Profit Placement: Target the nearest major structural resistance, such as the high from three months ago, or a specific price suggesting market exhaustion.

Result: This is a multi-day or multi-week trade where your risk might be 150 pips to gain 300-450 pips.

4. What Happens Without SL and TP?

Ignoring Stop-Loss and Take-Profit orders is the single fastest way to derail a trading career. These aren’t optional settings; they are mandatory safety protocols

4.1 Without a Stop-Loss

When you enter a trade without a predetermined exit point for loss, you expose your account to the dreaded black swan event.

- Catastrophic Loss: A sudden, unexpected news event or market flash crash can erase months of gains—or your entire account—in minutes, often while you are away from the screen.

- Emotional Holding: You are forced to “hope” the market reverses. This often leads to doubling down on a losing position (known as “averaging down”) or holding a bad trade until the loss becomes too painful to bear, gutting your capital.

Warped Position Sizing: Without knowing your maximum risk, you cannot accurately size your position. This forces you to over-leverage, multiplying your potential losses.

4.2 Without a Take-Profit

While less destructive than trading without an SL, neglecting the TP still leads to massive profit erosion.

- Profit Reversal: Your trade hits a significant profit target, but your greed prevents you from clicking the exit button. The market reverses, and you watch a winning trade turn into a small profit, break-even, or even a loss.

- Increased Psychological Stress: You are tethered to the screen, constantly battling the urge to exit versus the desire for “just a little more.”

This psychological toll leads to fatigue and poor decision-making on the next trade.

5. Securing Every Profit with The Top Bottom Reversal Tool

Every trader’s dream is to record consistency in profits and gradual equity growth. In most cases, it means one’s interested markets will trigger more take profits than stop losses.

One of the most reliable trading tools to reveal opportunities that ensure this is the Top Bottom Reversal for TradingView.

The groundbreaking indicator combines the power of the Relative Strength Index (RSI), Bollinger Bands, and candlestick patterns to give every user absolute control of the markets.

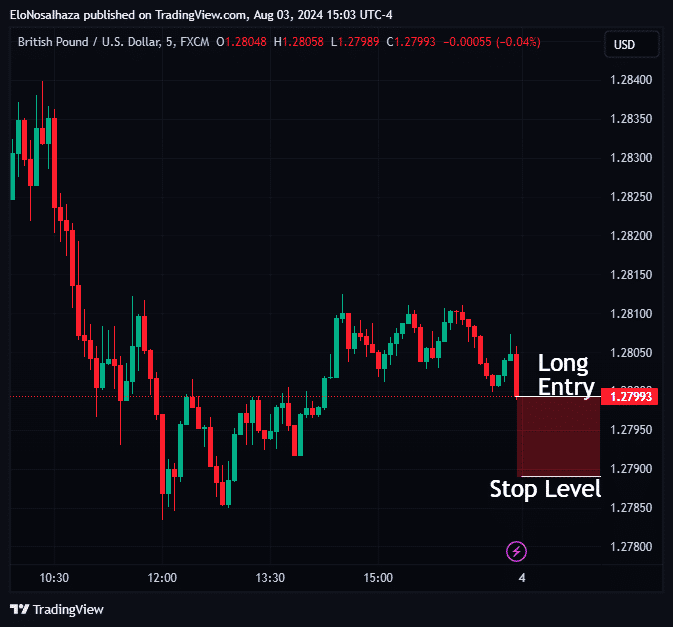

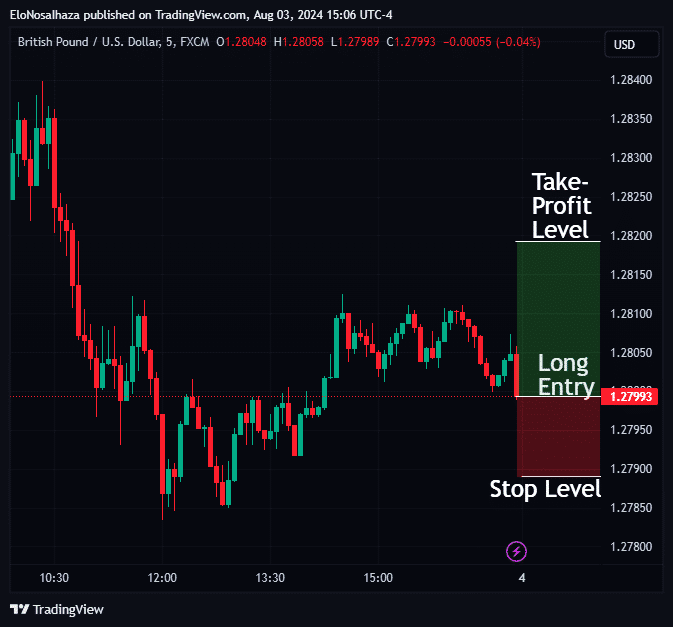

Below is a screenshot of the tool in action:

Succinctly, each user boasts the following benefits from its application:

- Quickest awareness of tops and bottoms in the market to ride every trend from start to finish

- Ability to trade on any desired timeframe

- Freedom to explore multiple securities in any market, from stocks to indices, and Forex

- Assurance of exploiting every opportunity due to the prompt alert system from within and outside TradingView

Want to be a part of the exclusive group harnessing this power? Click here and watch your account grow today!