Learn how to use moving averages in trading with this simple guide for beginners. Understand the difference between SMA, EMA, and WMA to spot trends and get better signals.

Table of Contents

1. Introduction to Moving average

Ever look at a trading chart and see those lines snaking through the candles?

That’s a moving average, and it’s one of the most useful tools a trader can use. This guide will show you exactly what it is, what it does, and how you can use it to get better at trading.

2. What a Moving Average Actually Is

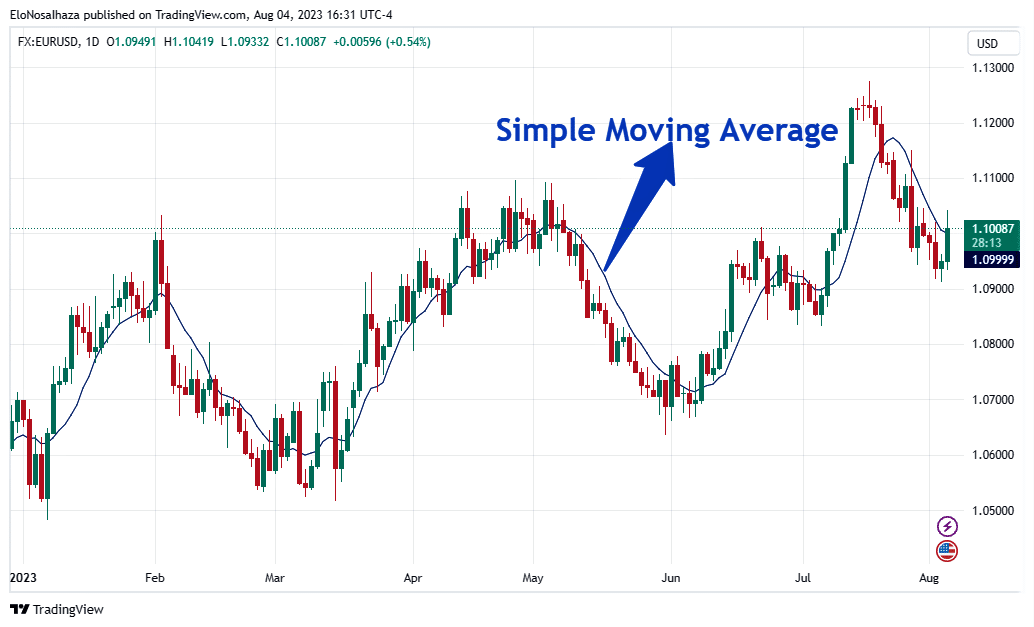

Think of a moving average as a way to smooth out a bumpy road. On a price chart, prices can jump up and down all the time. A moving average takes the average price over a certain time period, like the last 20 days, and draws a single, smooth line.

This line helps you see the real direction of the market by ignoring all the daily ups and downs.

When the price is above the moving average line, the market is generally moving up. When the price is below it, the market is likely moving down. See? It’s that simple.

3. The Three Main Kinds of Moving Averages

Not all moving averages are the same. They each work a little differently, and knowing this helps you pick the right one.

- Simple Moving Average (SMA): This is the most basic one. It just takes a simple average of all the prices in its period. It’s great for seeing long-term trends because it’s very smooth, but it can be slow to react to new changes.

- Exponential Moving Average (EMA): The EMA is much faster. It gives more importance to the newest prices, so it reacts faster to a change in the market. This is why day traders often use it for quicker signals.

- Weighted Moving Average (WMA): The WMA is similar to the EMA because it also focuses more on recent prices. It’s not as common, but some traders like its unique way of calculating the average.

For most people, especially if you’re new to this, the EMA is a great choice because it’s a good mix of fast and smooth.

4. How to Use Moving Averages in Your Trading

You can use moving averages on their own to find powerful signals.

Step 1: Spotting Trends

This is the main job of a moving average.

- If the price stays above a moving average for a long time, the trend is up.

- If the price stays below it, the trend is down.

Step 2: Finding Support and Resistance

A moving average can act like a floor or ceiling for the price.

- In an uptrend, traders often watch the price “bounce” off the moving average line and keep going up. This is a support level.

Step 3: Finding Buy and Sell Signals

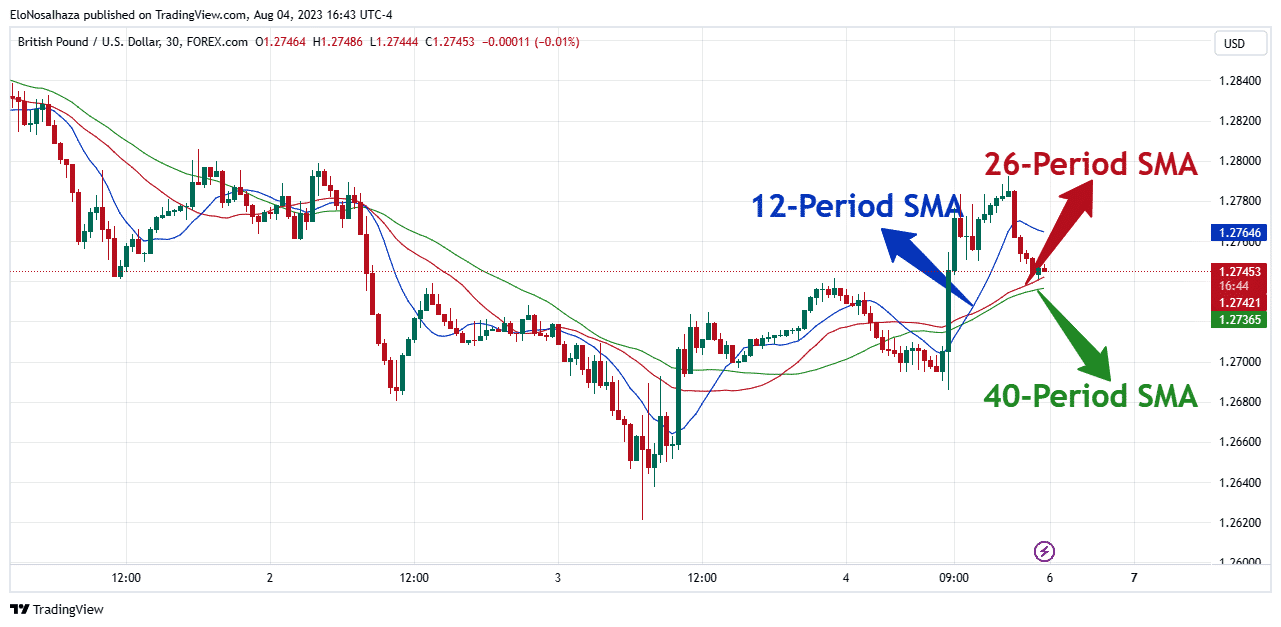

Many traders use two moving averages to find signals. For example, a 20-period EMA and a 50-period EMA.

- You can look to buy when the faster EMA crosses over the slower one.

- You can look to sell when the faster EMA crosses below the slower one.

5. The Next Step for Moving Averages

Moving averages are so foundational that they’re a key part of other famous indicators you’ve probably heard of, like the MACD, Bollinger Bands, and the Ichimoku Cloud. They’ve been a starting point for countless trading innovations.

We’ve taken that same foundational idea and built something even more powerful: the Dynamic Bands Indicator.

It’s a next-generation tool that combines a dynamic moving average with the Average True Range (ATR). It’s engineered to:

- Predict bullish or bearish breakouts with stunning accuracy.

- Cut through “false signals” (whipsaws) that often trap traders.

- Give you instant alerts so you never miss a perfect entry.

The moving average is a foundational tool, but we believe our Dynamic Bands Indicator is one of its most impressive evolutions yet.

Click here to see Dynamic Bands Indicator in action

It’s what happens when you take a simple idea and build something truly powerful for today’s markets.