Table of Contents

1. Understanding unusual volume in trading

1.1 What is an unusual volume?

In trading, unusual volume refers to a significant spike in a number of shares or contracts traded compared to the asset’s average daily volume. This isn’t just a random fluctuation. It often signals that something important is happening behind the scenes, such as news about to break, institutional orders being placed, or a major shift in supply and demand.

1.2 Why unusual volume matters?

Volume shows how much activity is happening in the market. When trading activity suddenly jumps, it means more buyers and sellers are active, and that can push prices up or down quickly. For traders, spotting unusual volume early can help them enter a move at the right time instead of jumping in when it’s almost over.

Big traders, like institutions, see volume closely because it shows how strong the interest is. If the price breaks the key levels without much volume, the move might not last. But if it breaks with high volume, it’s more likely to be a strong and real move.

2. Strategies for trading with unusual volume

2.1 Popular approaches used by traders

There are several ways traders use volume surge in their strategies:

- Breakout confirmation: When the price breaks resistance or support with a spike in volume, it signals strength behind the move.

- Reversal spotting: Sudden surges in volume during continuing trend can mark exhaustion and the start of the trend.

- Momentum trading: Riding the wave of buying or selling pressure right after abnormal volume is detected.

2.2 The problem with tracking unusual volume alone

While unusual volume is a powerful signal, relying on it alone can lead to mistakes. Not every spike leads to a profitable trade. Sometimes it is driven by short-term noise, low-float stocks, or algorithm activity that doesn’t result in sustainable moves.

Another challenge is timing. You might see high trading volume and jump in it too early, only to get caught in a pullback. Or you might hesitate, and by the time you act, the move is already over. That’s why heavy volume works best when paired with a deeper understanding of price behavior and market structure.

3. How Justified Price Zone leverages unusual volume

This is where the Justified Price Zone indicator changes the game.

It doesn’t just track unusual volume, it integrates it into a complete, data-driven algorithm that identifies where price should be trading based on institutional behavior, supply demand imbalances, and market structure shifts.

Here’s how it works:

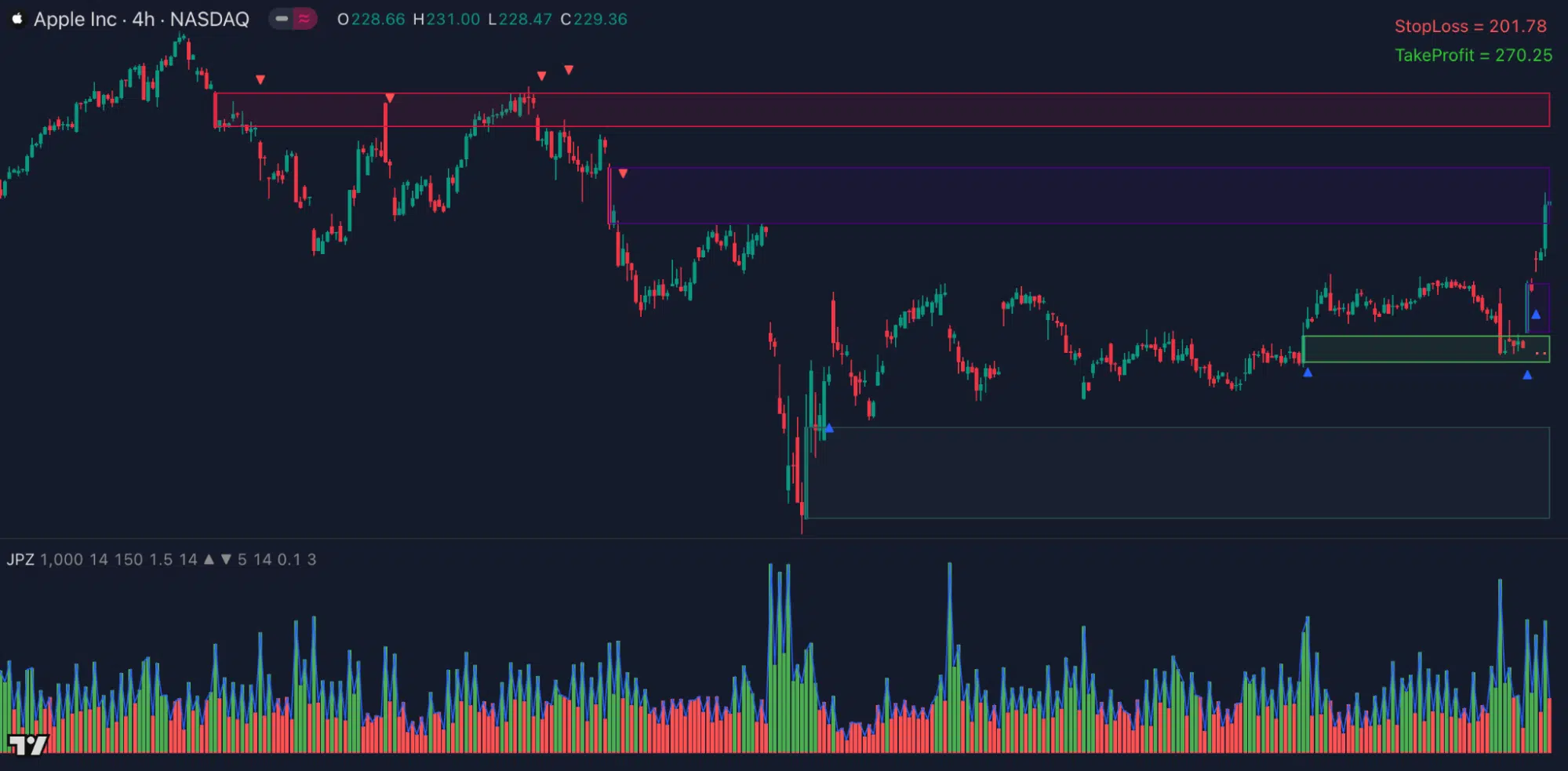

- Step 1: It verifies volume by detecting spikes that exceed 150% of normalized activity and identifying consecutive high-volume candles. This helps confirm whether institutional traders are likely involved, adding weight to the signal.

- Step 2: It focuses on volatility confirmation. The algo measures abnormal price movements, automatically filters out market noise, and validates whether a zone has real strength behind it.

- Step 3: It conducts zone strength analysis. Each zone is classified by its level of importance, updated automatically as market conditions change, and clearly displayed so traders know exactly which areas deserve their attention.

4. See the market like the pros

With Justified Price Zone, you can see the same market footprints that pros use. Instead of second-guessing every move, you’ll have clear zones that reveal when a trade is worth taking and when to stay out.

When abnormal volume surges, you won’t just wonder what’s going on, you’ll know whether it’s part of a strong move backed by real market pressure or just noise that will fade away.

It’s time to stop trading blind and start trading with the precision of a seasoned pro. Unusual volume is your signal that something’s happening – Justified Price Zone is the tool that tells you exactly what to do about it.

Get Justified Price Zone now and experience trading with clarity, timing, and confidence.