As a trader, I’m sure that you’ve undoubtedly heard the saying “trade with the trend”. Many, even experts, claim that the trend is your ally when trend trading. To this point, it might sound easy to win, ‘cause all you should do is being friend with the trend and trade with it. Till the market’s volatility hits you hard, you’ll know that it’s never an easy game.

To follow that proverbial advice to win trend trading, first, you need to identify the trend and predict when it will end. Accepting that the trend might cease is also a piece of important advice since all markets are volatile.

Before we start to go deeper, it’s better for you to rightfully know about trend trading.

Table of Contents

1. What is a trend?

A trend is when the price is going generally in one direction. Trends are classified into three categories, including: Uptrend, Downtrend, and Sideways trend.

An uptrend occurs when a market price is rising. It is indicated by higher swing lows and higher swing highs. On the contrary, a downtrend is indicated by lower swing lows and lower swing highs. These price patterns represent the downfall of the market price.

The sideways trend develops when the market is stagnant, meaning that the price neither reaches higher price points nor lower ones. Many expert trend traders ignore this sideways trend while trading trends. However, scalpers can make short-term market trades to profit on a sideways trend.

2. And what is trend trading?

Trend trading is one of the most popular types of trading. It aims to profit by analyzing an asset’s momentum in a specific direction aka the ongoing trend.

It is predicated on the idea that markets are somewhat predictable, thus a trader will be able to predict what could occur in the future by examining previous trends and price movements. You can examine and take advantage of these predictions.

Although trend trading is typically considered a mid to long-term trading strategy, depending on how long the trend persists, it may theoretically apply to any timeframe.

When it comes to long-term investments, the long-term timeframe dominates the shorter timeframes. However, the shorter time frame could be more valuable for intraday trading.

3. Types of Trend trading

Trend trading can be subdivided into three categories of trading strategies: intra-day, swing, and position trades. Traders that favor a position trading or swing trading approach are more likely to use it.

Day traders closely watch intraday price changes and time their trades to take advantage of short-term price fluctuations. Swing traders will see a trend and ride it from beginning to end, whereas position traders will maintain a trade for the duration of the current trend while ignoring daily changes.

4. How to trade with a trend?

Trend trading strategies presume that a security will keep moving in the same way as the ongoing trend. You can enter a long position if the underlying trend is upward. Similar to this, if the market is downtrending, you can choose to enter a short position to profit from the trend.

Such strategies usually come with a take-profit or stop-loss option to protect your asset against significant losses in the event of a trend reversal.

There are several ways traders have developed to pinpoint primary trends. To specify the current trend, you can observe price action or use technical tools such as indicators. Both methods require traders to have certain technical analysis knowledge and time to master the skill.

4.1. Price action

Price action traders pay attention to price changes on a chart. On an uptrend, you would want to see it surpass recent highs, and when it falls, it should hold above previous swing lows. This demonstrates that even if the price is fluctuating up and down, it is still moving upward. The same concept is applied to downtrends.

Once the price movement doesn’t happen as expected and the current trend is in doubt or over, at which point you will lose interest in maintaining your last positions and look for a way to exit.

4.2. Indicators

Using technical tools or indicators is a more common trend trading strategy. There are some basic and well-liked trend trading indicators: Moving averages and Relative strength index (RSI).

4.3. Moving Averages

A moving average (MA) indicator determines an asset’s average price over a certain period of time. This results in a smoothing of the price data and the generation of a single line that may be used by traders to spot patterns.

In these techniques, a position is placed when a short-term moving average crosses above a longer-term moving average or when a short-term moving average falls below a longer-term moving average. As an alternative, some traders may enter a long position when the price is above the moving average or a short position when the price is below the average.

4.4. Relative strength index (RSI)

A trader can wait for the RSI to go below 30 before pushing upward. This indicates that although the price initially declined, the general uptrend still persists, and you can enter a long position.

When the RSI climbs over 70 or 80 and then drops back below the chosen level, you may choose to exit their position.

5. A better tool for a better trend trading

Since the two strategies above are hard to follow, you might feel overwhelmed by the amount of information you have to analyze. For even skilled traders, all that technical analysis still stresses you out to spot a good setup. There are also many “hidden” setups that you may overlook, and that’s a big loss.

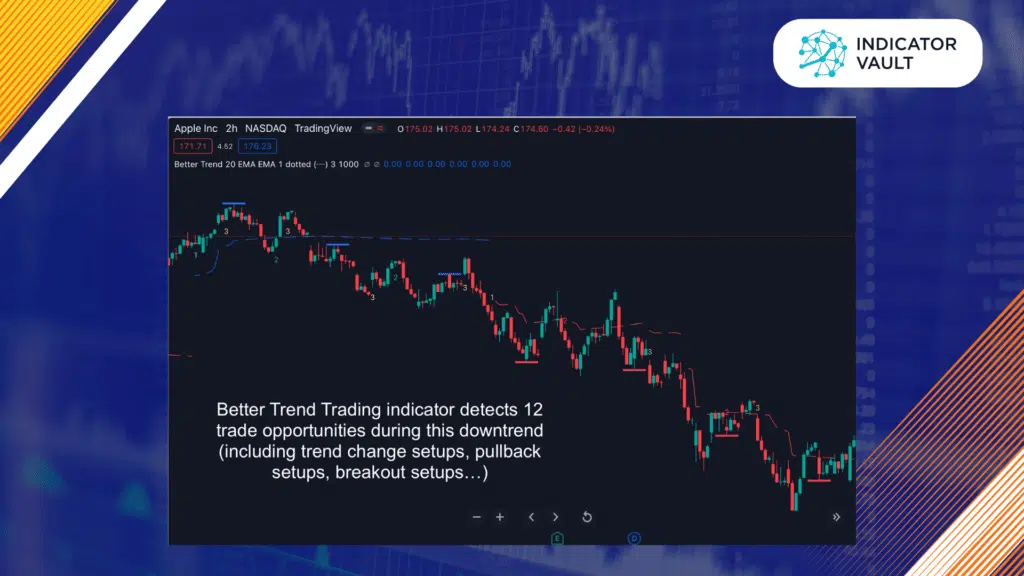

Let me introduce to you a more powerful indicator: Better Trend Trading by Indicator Vault. With Indicator Vault’s proprietary algorithm, this TradingView indicator can:

- Determine the overall trends of the market, and all the Pullbacks and Breakouts that happen during these trends.

- Provide you with up to 3 times more trades during a certain established trend.

- Work on any market and instrument.

No need to observe, no need to analyze, and no need to spot a setup, this indicator will do all the hard work for you. Now you can rest yourself and start trading with the high-probability setups provided.

6. Conclusion

Even the most successful trading method won’t result in long-term financial success if you don’t prepare properly. With the support from the mentioned indicators, especially Better Trend Trading, you can find yourself the right setups to trade with the trend.

Better Trend Trading can be extremely beneficial to you. By utilizing simple, high-probability trading chances that nobody else can identify, you might maximize your profits from these spotted setups.

Also, follow us for all the promotions and other useful topics:

- Facebook: www.facebook.com/indicatorvault

- Instagram: www.instagram.com/indicator.vault

- Youtube: www.youtube.com/c/IndicatorVault