Distinct price action, volume, and momentum strategies have shaken the technical trading world from day one. However, owing to the fast-paced evolution of the field today, how well can they work in combinations for deeper analysis?

This article reveals the role of these theories in a unified strategy and how experts possibly employ them for better results. It also includes an exclusive indicator tailor-made for traders seeking higher market precision.

Table of Contents

1. Purpose of Price Action, Volume, and Momentum Theories in A Technical Trading Strategy

There’s no questioning price action, volume, or momentum principles’ stance in technical analysis. Traders of all experience levels prove their worth day in and out.

Fortunately, their fundamentals remain the same even in hybrid strategies aimed at improved forecasts.

Price action techniques always involve studying an instrument’s movement over a specified duration. Most evaluations depend solely on the charts and how prices move.

In volume analysis, the total number of shares or contracts traded in a particular period signals favorable or unfavorable market conditions.

Finally, momentum trading simply entails engaging an asset based on a prevailing trend. Subscribers are hopeful it will continue (whether bullish or bearish) after grabbing an opportunity.

Below are insights into each discipline in a combined strategy:

1.1 Popular Price Action Techniques

A meticulous study of price movements to uncover the next most favorable market opportunity is called price action trading.

Technical analysts typically employ its theories for a short-term perspective, but many also confirm its efficiency for long-term assessments.

Below are two primary branches to explore in this technique:

1.1.1 Candlestick Pattern Reading

One of the most widely embraced chart styles today represents securities in the form of “candlesticks” or Open-High-Low-Close (OHLC) bars.

In such charts, price action traders assert forecasts from the formation of distinct shapes on individual candlesticks.

Thus, candlestick patterns can provide excellent entry and exit signals in a combined strategy.

For example, a bullish engulfing pattern formed after prolonged consolidation generally signifies an imminent bullish run.

1.1.2 Chart Pattern Analysis

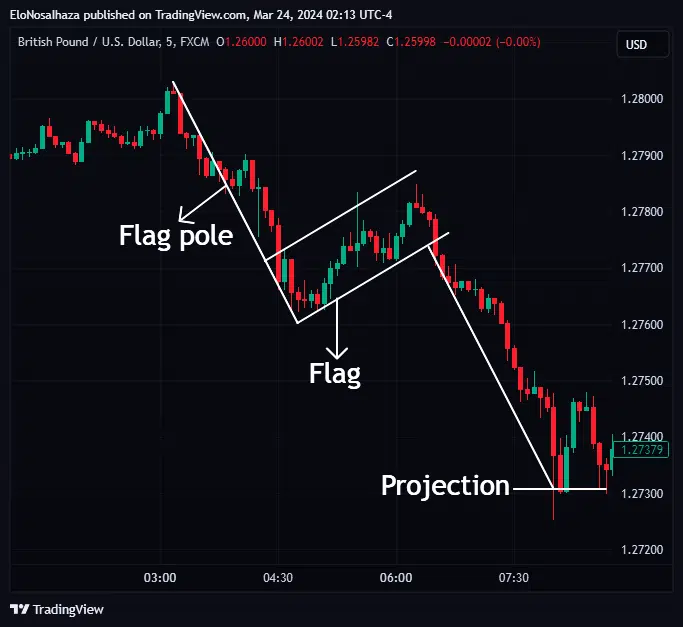

Unlike candlestick pattern studies, chart pattern analysis considers several candlesticks in the market simultaneously. The shape formed signals the next most probable direction.

For instance, in the flag pattern, as seen below, proponents agree an initial price surge and brief consolidation (known as the pole and flag) signifies a trend continuation.

Many more chart patterns exist, including Head and Shoulders, Double Tops, Wedges, and Triangles.

1.2 Volume Trading & Recommended Indicators

Trading Volume (or simply Volume) refers to the number of shares or contracts exchanged in a specified period. Analysts use the most recent data for forecasts in any financial market.

Here are two over-simplified ways it can work in a merged trading strategy:

1.2.1 Volume Rise & Fall Correlations with Price

These metrics help confirm the strength of a trend due to the close volume-price correlation.

During significant market activity (bullish or bearish), the volume typically increases as long as the move lasts. Thus, traders become more confident in trading with the trend.

Many expect significant consolidations or reversals during decreased volume (market activity).

1.2.2 Volume Indicator Signals

Trading Volume gives rise to notable indicators, including the Volume Oscillator, On-Balance Volume (OBV), and Chaikin Money Flow (CMF). Each has its peculiarities, mode of operations, pros, and cons.

Regardless, employing any such indicator relies indirectly on the volume reported by the exchange on one’s trading platform.

1.3 Momentum Trading Approach & Its Benefits

Momentum trading is one of the most straightforward technical strategies. It simply entails going long or short in the market based on the prevailing trend.

Therefore, discovering such contemporary trends poses the main challenge. Many employ various tools (even fundamental) for more accuracy and quicker results.

Consequently, below are some of its perks users will enjoy when done right:

- Directness: For a market approach that can be highly profitable, momentum trading is simple and appeals to all traders, from the newbies to the elites.

- Versatility: The nature of momentum trading allows ambitious traders to test the waters in various markets and timeframes effortlessly.

- Speed: The simplicity of this strategy uncovers multiple possible opportunities in the shortest duration. It is most exciting to scalpers who desire quick returns ASAP.

2. Going Deeper in Market Analysis with The Double Triple Momentum for TradingView

A strategy combo of price action, volume, and momentum theories will easily be among the most formidable tools in any trader’s arsenal. Each entity plays an integral role from the initial discovery of an opportunity to the final trade exit signal.

Fortunately, anyone can access such potency stress-free with Indicator Vault’s Double Triple Momentum.

The ground-breaking innovation meticulously scans for hidden chart and candlestick patterns guided by volume correlations and momentum concepts for high-probability signals.

Below are a few of several advantages this trading system offers:

- Early awareness of imminent breakout opportunities

- Improved forecast precision with little to no required effort/knowledge

- Freedom to explore any desired market on any timeframe

- Ability to customize your trading experience and receive prompt signal alerts from within and outside TradingView

Still in doubt? Click here and prepare to be blown away by the results.

3. Summary

Mixed strategies will always win in technical analysis.

One of the numerous possibilities features price action, volume, and momentum disciplines, each having a unique role to secure every user’s success.

Fortunately, Indicator Vault has developed this blend into a practical trading tool for TradingView – The Double Triple Momentum.

Please share this article with close friends, acquintances, or any ambitious trader, and feel free to leave feedback for engaging discussions below.