Order blocks may be a useful tool for traders in identifying market trends and determining effective trading decisions.

Table of Contents

1. What Are Order Blocks?

A trading order block is a large number of assets that are being traded consecutively. Typically, it refers to a single transaction or series of transactions that reflect a significant amount of assets being purchased or sold on the market.

Big financial institutions use order blocks to execute large trades more efficiently and with less market effect in order to warrant their profit.

For retail traders, order blocks can provide information about potential price moves, or indicate potential support or resistance levels. You can use these confirmations to determine good trade setups.

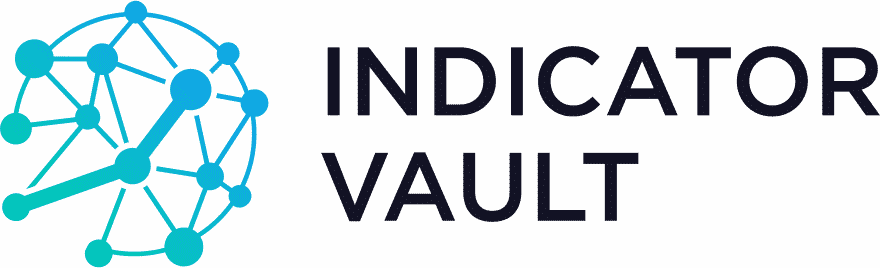

2. Bullish and Bearish Order Block

Most order blocks fall into two types:

Bullish order block: A large number of pending buy orders at a certain price level. This could mean that there is a lot of buying pressure in the market, which could cause the price to go up.

Bearish order block: A large number of pending sell orders at a certain price level. This may indicate strong market selling pressure and the potential for a fall in prices.

Most of the time, bullish blocks mark the start of a trend that goes up. And bearish blocks often signal the start of a downtrend.

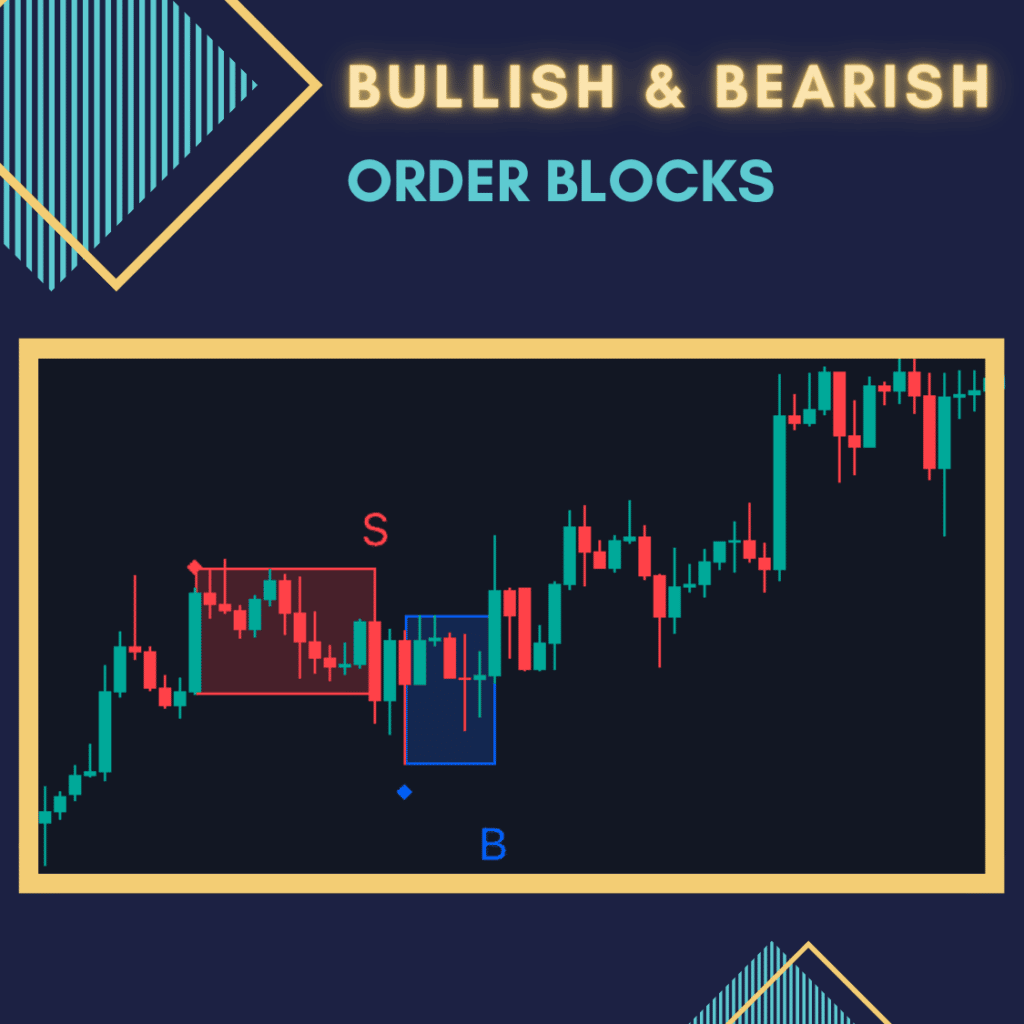

3. Order Blocks And Supply And Demand Zones

Supply and demand zones and order blocks are related concepts that provide information on market behavior and possible price levels. The blocks can be considered a special kind of supply and demand zone; therefore, trading them is similar.

While both order blocks and supply/demand zones can provide information on market behavior and possible price levels, order blocks focus on pending orders at a certain price point, whereas supply/demand zones examine the overall balance between buying and selling pressure in the market as a whole.

When the price moves to an area where a lot of traders have placed orders, this creates an imbalance between the pressure to buy and the pressure to sell. These blocks can tell you about these zones of supply and demand because a lot of pending orders at a certain price level can show where a lot of traders have put orders.

If you are looking for something that can work just like supply and demand zones, Order blocks can work just like these zones and let you find many trade setups. Moreover, you can use them in conjunction with supply and demand zones to find more winning trades.

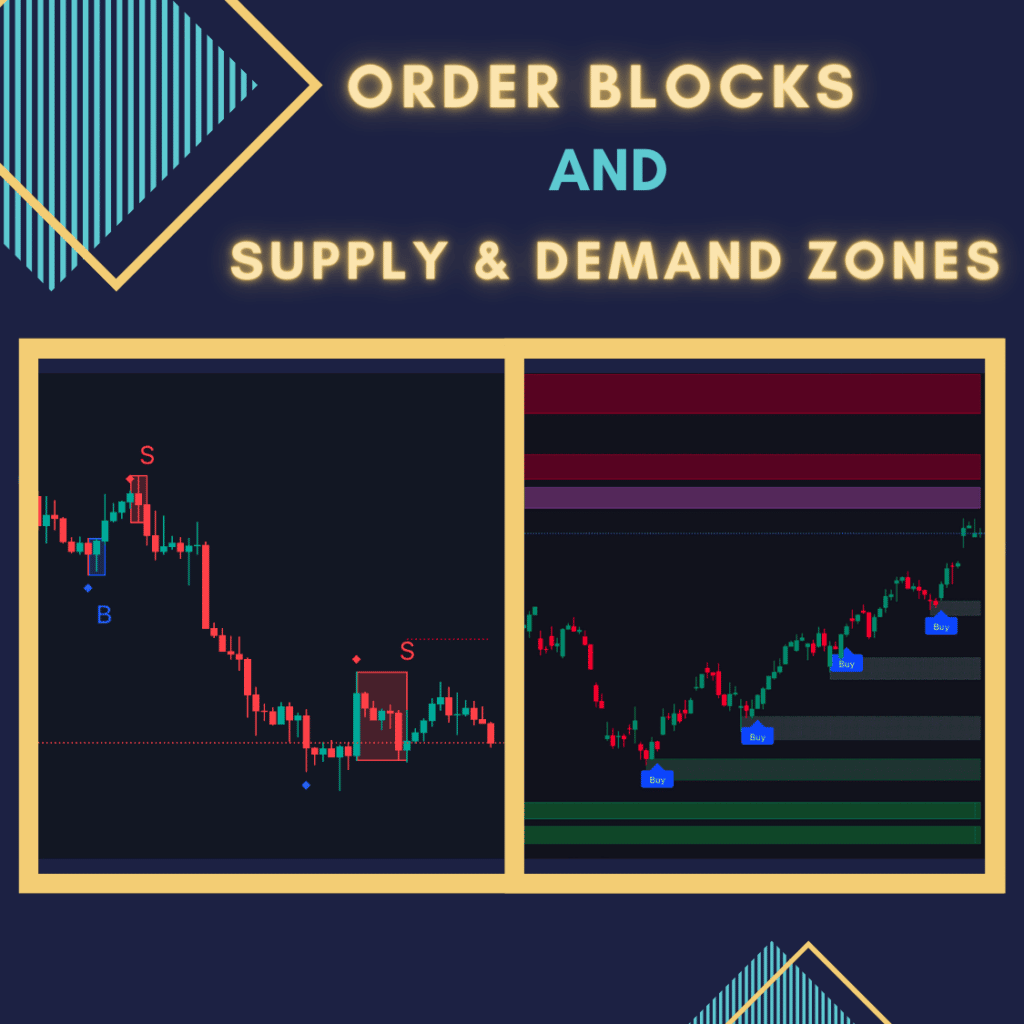

4. How To Find Order Blocks On The Chart?

You should know that order blocks are uncommon and don’t happen every day. It is also not easy to find these blocks and depends on your experience and what tools you are using.

Spotting a block requires the use of various technical analysis tools: such as price action, volume indicators, pivot points, and order flow indicators. These are the common tools and indicators that can help you spot a block, but they also require certain knowledge to be able to identify them accurately and effectively.

However, Indicator Vault has the key technique that can help you with these blocks. We made an indicator called Order Block Gen that is all about trading order blocks. Here are some of its key features:

- Detect all high-probability order blocks.

- Very customizable, allowing the setting for refined or larger zones.

- You can also use it in confluence with other indicators, such as the 3MA and Logic Trendline, for a better outcome.

Get an easier way to trade order blocks; catch up with big institutions’ activities; or use these blocks as supply and demand zones to find good trade setups. It is up to you how to take advantage of this indicator.

5. Conclusion

Order blocks can provide you with valuable information, and spotting these blocks easily allows you to find more winning trades.

With the features mentioned above, using Order Block Gen can greatly benefit you.

Also, follow us for all the promotions and other useful topics:

- Facebook: www.facebook.com/indicatorvault

- Instagram: www.instagram.com/indicator.vault

- Youtube: www.youtube.com/c/IndicatorVault