Product Of The Week – 10% OFF

Featured as our Product of the Week, this indicator is now 10% OFF — but only for a short time.

Don’t miss your chance to save!

Don’t miss your chance to save!

Sale!

Top Bottom Reversal for Tradingview

Original price was: $299.00.$269.00Current price is: $269.00.

✅ Unique chart-pattern forces indicator to predict trend change with startling accuracy

✅ Beginners: WIN from the start. Veterans: QUIT SPECULATING when & where markets will turn

✅ Done-For-You entry price, stop loss and profit targets… An “almost” set & forget solution.

Product Details

| Feature | Details |

|---|---|

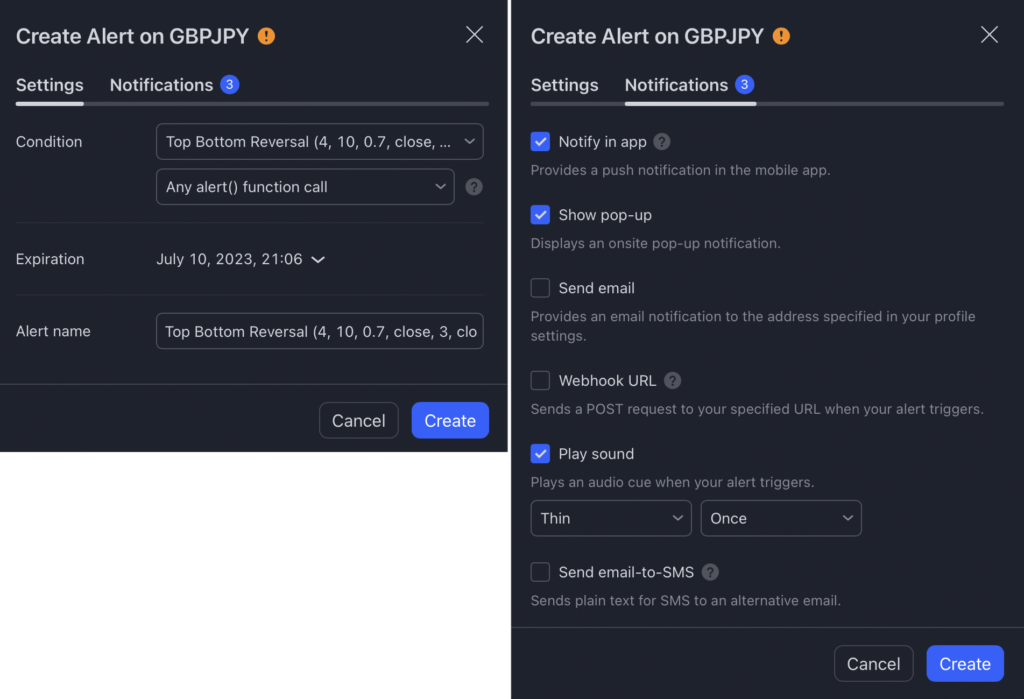

| Product Name | Top Bottom Reversal indicator |

| Platform | TradingView |

| Market Compatibility | Works on all markets available on TradingView: FX, stocks, indices, commodities, futures, etc. |

| Delivery | Submit your TradingView username after purchase. Access granted within 24 hours. |

| License | Lifetime – One-time payment |

| Usage Limit | 1 TradingView username per license |

| Updates | Free for life |

| Key Features | Detects top & bottom reversals using price action + RSI + Bollinger Bands, provides automatic entry, SL/TP, and alerts |

Frequently Asked Questions

You can get more! Introducing…

TV CHAMP MEMBERSHIP

Join our exclusive TV Champ membership and grab ALL our custom indicators for Tradingview. To see the full list of all indicators included in the TV Champ membership, click here…

Yearly

$2997

Platform: TradingView

Lifetime

$5997

Platform: TradingView

Our Customer Feedback

Don’t take our word for it, read our customers’ testimonials from Trustpilot.com