Two-legged Pullback For TradingView

📌 Identifies Pullback Trades with Unprecedented Accuracy, Eliminates Guesswork & Hands You Precise Entries that Could Make Your Trades Profitable Immediately

📌It uses slow and fast MAs to determine if the predominant price trend is currently up or down

📌 It validates every two-legged pullback by making sure the direction of the pullback is against the prevalent price trend.

$299.00

What is this indicator?

As its name suggests, the “Two-legged Pullback” indicator automatically detects a highly powerful pullback trade setup called two-legged pullbacks.

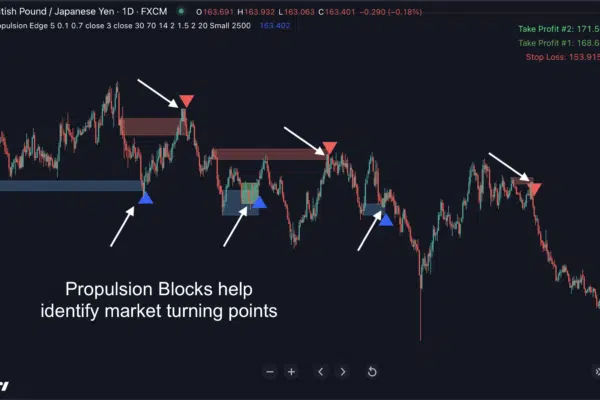

The two-legged pullback is a trade setup that capitalizes on temporary corrections or pullbacks in an ongoing market trend. Let’s first take a look at a two-legged pullback setup in action, and then I’ll explain its numerous benefits:

As you can see, the two-legged pullback trading strategy is considered to be accurate due to its systematic approach to capturing trends and price corrections.

This strategy leverages the inherent nature of markets, where prices do not move in a straight line, but tend to move in waves.

It aims to take advantage of these temporary price retractions (or “pullbacks”) in an ongoing trend.

The mechanics of the strategy are relatively simple:

We wait for a two-step correction or pullback in the existing trend. And enter the trade in the direction of the trend on the second pullback.

This method allows traders to participate in the market with a higher degree of certainty about the direction of the trend.

Now let’s go over some of the key advantages this kind of trade setups offer:

High Reliability

The two-legged pullback strategy is one of the most reliable ways to trade the trend. This is because it is based on established market dynamics, specifically the continuation of a trend after a temporary correction.

It requires a lot of patience, as traders must wait for a two-step correction or pullback in the trend before entering a trade.

The reward for that patience is a high degree of accuracy, as you can see in this example:

Versatile Entry Point

The two-legged pullback offers a good entry point in the ongoing trend. Traders enter in the direction of the trend on the second pullback, which means they’re buying when the price of the security is “on sale” and likely to rebound:

Great Profit Potential

Traders can profit from two-legged pullbacks by taking advantage of temporary price corrections within an ongoing trend. By entering the market after a pullback and before the continuation of the trend, traders have the opportunity to profit from the subsequent price movements

Lower Risk

The two-legged pullback strategy can lower the risk of entering into a losing trade.

It does so by ensuring that traders enter the market at a time when the trend is likely to continue, reducing the chance of entering a trade that moves against the trend.

To sump up…

Two-legged pullbacks are one of the most reliable methods to trade the trend and price corrections. But here’s the thing:

There is no trading tool nor indicator out there that could automate the process of spotting this kind of high-probability pullbacks.

Until now…

Introducing… “Two-legged Pullback for Tradingview” indicator

Let’s take a look at this amazing indicator in action. And then, I’ll explain all of its mouth-watering features:

Boost Your Trade Accuracy With Confidence

By detecting the optimal entry and exit points for your trades, this remarkable tool equips you with the confidence and precision you need to make informed decisions and maximize your profits.

Starting as soon as your next trading session, you could begin replicating mind-blowing results like this:

And wouldn’t you like to accomplish this also?

Here’s What Makes Two-Legged Pullback Indicator So Reliable & Dependable

Unlike other indicators that rely on lagging indicators, the Two-legged Pullback Indicator is built on the principles of price action.

In order to weed out false alerts, it validates every two-legged pullback by making sure the direction of the pullback is against the prevalent price trend.

What Exactly Does It Do?

First, it uses slow and fast MAs to determine if the predominant price trend is currently up or down. When price is in an uptrend, only look for bullish patterns; when price is in a downtrend, only look for bearish patterns.

Bullish two-legged pullback patterns can be identified as follows:

- The first leg (a series of consecutive bearish candles) is followed by an internal pullback, which is then followed by the second leg (a series of consecutive bearish candles).

- The internal pullback must not exceed the mid point of the first leg.

- After the second leg, price reverses and moves up. The indicator then evaluates the price action at this point to trigger a bullish entry.

Logically, it’s vice versa for bearish two-legged pullback patterns and bearish entries.

Say Goodbye To Guesswork & Make Accurate Pull Back Entries Based On Price Action Only

Imagine having a tool like this that not only identifies crucial price action patterns but also precisely pinpoints high-probability entry and exit points with unrivaled accuracy!

Use it to trade the lower time frames—whether it be 1 min up to 15 minute—with impunity; you, too, could soon be pulling in gains like this:

This Is The Nearest You’ll Ever Get To An Automated Strategy

You’ll enjoy the ease of copying auto-generated trade data from the top right hand corner once Two-legged Pullback identifies a potential winner on the time frame you’ve chosen: You’ll get entries, stop loss and take profit levels.

Every time this happens…

Two-legged Pullback For TradingView

One-time payment. Lifetime access.

Frequently Asked Questions

After purchasing, you’ll fill out a short form that asks for your Tradingview username. And then, we’ll grant your username access to all our indicators within 24 hours.

It works on ALL markets internationally that are available on Tradingview: FX, stocks, indices, commodities, futures, etc…