By applying technical analysis, you may use market structure breaks to your advantage and profit from trading opportunities.

Table of Contents

1. What Is Market Structure?

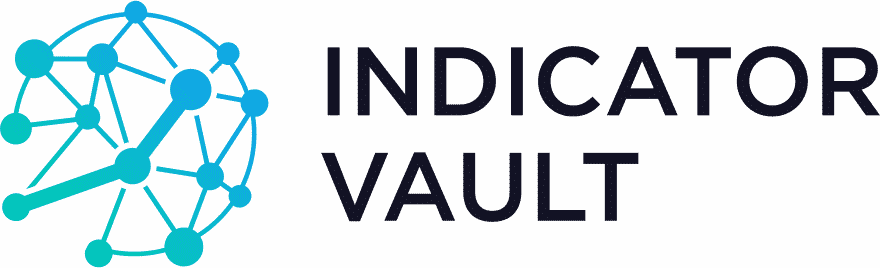

In every market, the price is inconsistent and moves up and down on the chart. These actions cause the market structures to be developed over time. Price charts, order flow information, and historical price data may all be used to visualize the market structure.

Market structure describes how a market is set up and its features, such as the number of buyers and sellers, the amount of rivalry, the volume of trading, and the kinds of assets that are exchanged.

You may better understand the market’s behavior, condition, and current flow by analyzing its structure. The swing highs and lows, as well as levels of support and resistance, can be highlighted.

2. What Causes Market Structure Breaks?

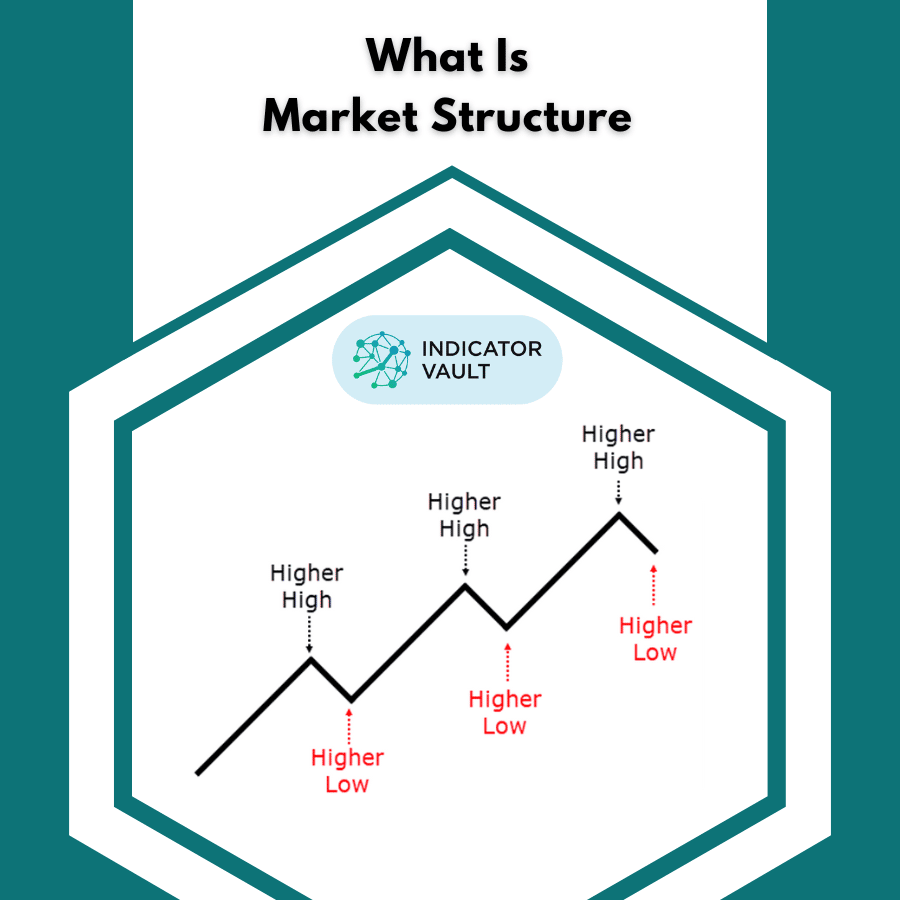

Market structure breaks happen when there is a big shift in the supply and demand of an asset, which leads to an imbalance in the market and a change in the direction of the current trend. These breaks can happen in the context of smart money when major investors or financial institutions execute trades that have an influence on the market and alter the direction of the market.

Market structure breaks are frequently recognized in advance by smart money investors. They may take positions to benefit from the predicted market change when they spot a probable break in the market structure.

As a retail trader, you might possibly benefit from market structure breaks and other market occurrences by being focused and sticking to a clearly defined trading plan.

3. Take Advantages Of Smart Money Concepts

The concept of market structure breaks is associated with Smart Money trading concepts. The term “Smart Money” refers to large institutional investors with enormous resources, such as hedge funds and investment banks, who may impact the market with their transactions.

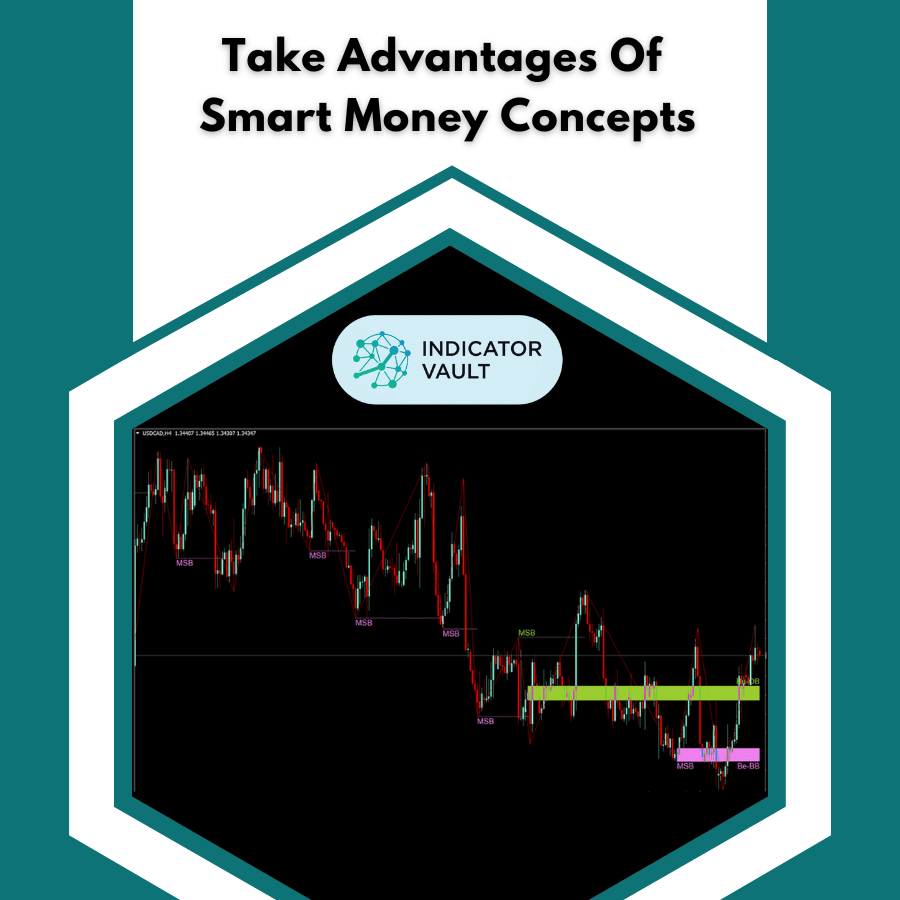

Both smart money traders and retail traders can analyze market structure and other technical indicators to make profitable trades. “All-in-one SMC” Indicator is an ideal solution for structure breaks, especially if you’re a “Smart Money Concepts” trader.

Here’s what All-in-one SMC can detect for you:

- Important breaks of structure.

- High-probability order blocks.

- High-probability breaker blocks.

- High-probability mitigation blocks.

This indicator only focuses on finding the strongest order blocks that form after a break of market structure. The price tends to gravitate toward these order blocks before STOP & REVERSE.

These blocks also have the same functions as regular support and resistance, but are MUCH MORE POWERFUL. You can use these high-probability order blocks as both entries and exits.

4. Trading Breaks Of Market Structure

Market structure breaks can create opportunities for retail traders to enter and exit trades based on changes in market sentiment. You can locate important levels of support and resistance and search for breakouts or reversals that can indicate a change in market dynamics by examining price charts and other technical indicators.

Weaker Markets or Reversals: A break in market structure can be a key indicator that the market is going to weaken or reverse. When market structure breaks, it means that the market has violated a key level of support or resistance that had previously held up prices. This might be a sign that the market’s dynamics of supply and demand are shifting and that there may be a change in market sentiment.

In Downtrend and Uptrend: A break in market structure during a downtrend would likely feature a lower low followed by a lower high. This suggests that the bears are in charge now and driving prices down. In contrast, a break in the market structure during an uptrend would feature a higher high followed by a higher low, suggesting that the bulls have gained the upper hand and are driving prices upward.

While making trading decisions, you should also take into account additional elements including trading volume, market volatility, and news events. Also, since there is always a chance of fakeouts or false breakouts in the market, it’s crucial to control risk by placing stop-loss orders and employing the right position sizing.

5. Conclusion

You can profit from market structure breaks by keeping up with market changes, utilizing technical analysis to spot potential trading opportunities, and risk-managing your trades with stop-loss orders and other risk-management strategies.

Using All-in-one SMC Indicator can significantly benefit you with structure break and other smart money concepts.