Pullback Factor for TradingView

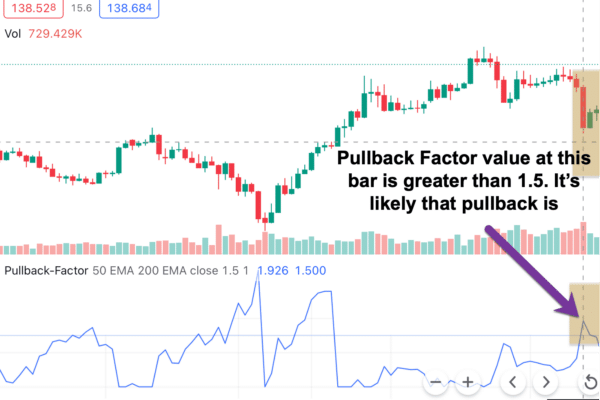

🔸 Once implemented, you can check the Pullback Factor indicator VALUE and presumably predict when the pullback will cease.

🔸 Simply keep an eye on the value and start trading once it peaks at a specific level.

🔸 Finally, it is applicable to any market and any timeframes.

$299.00

New “Pullback Factor for Tradingview” Indicator Lets You Enter The Trend With Near-Perfect Timing By Identifying With Great Certainty When A Pullback Is Going To End…

And it works in ANY market (whether it’s FX, stocks, or indices) and ANY timeframes (from 1-minute to monthly)

Hey there,

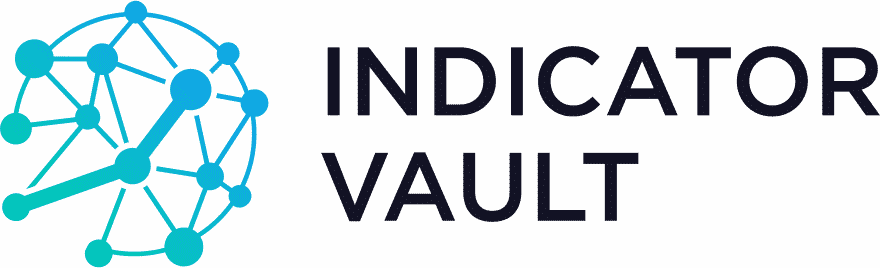

Does this sound familiar? Your trading system gives you a buy signal, telling you that an uptrend has just begun. So you enter a trade.

But then, as soon as you enter the trade, the market immediately reverses. You get stopped out.

To add salt to the wound, just as soon as your stop loss is triggered, you get a second buy signal. The first loss is so painful… you don’t want to take the second trade just yet.

But then, this happens:

A huge monstrous uptrend happens in the direction I originally predicted just after I got stopped out.

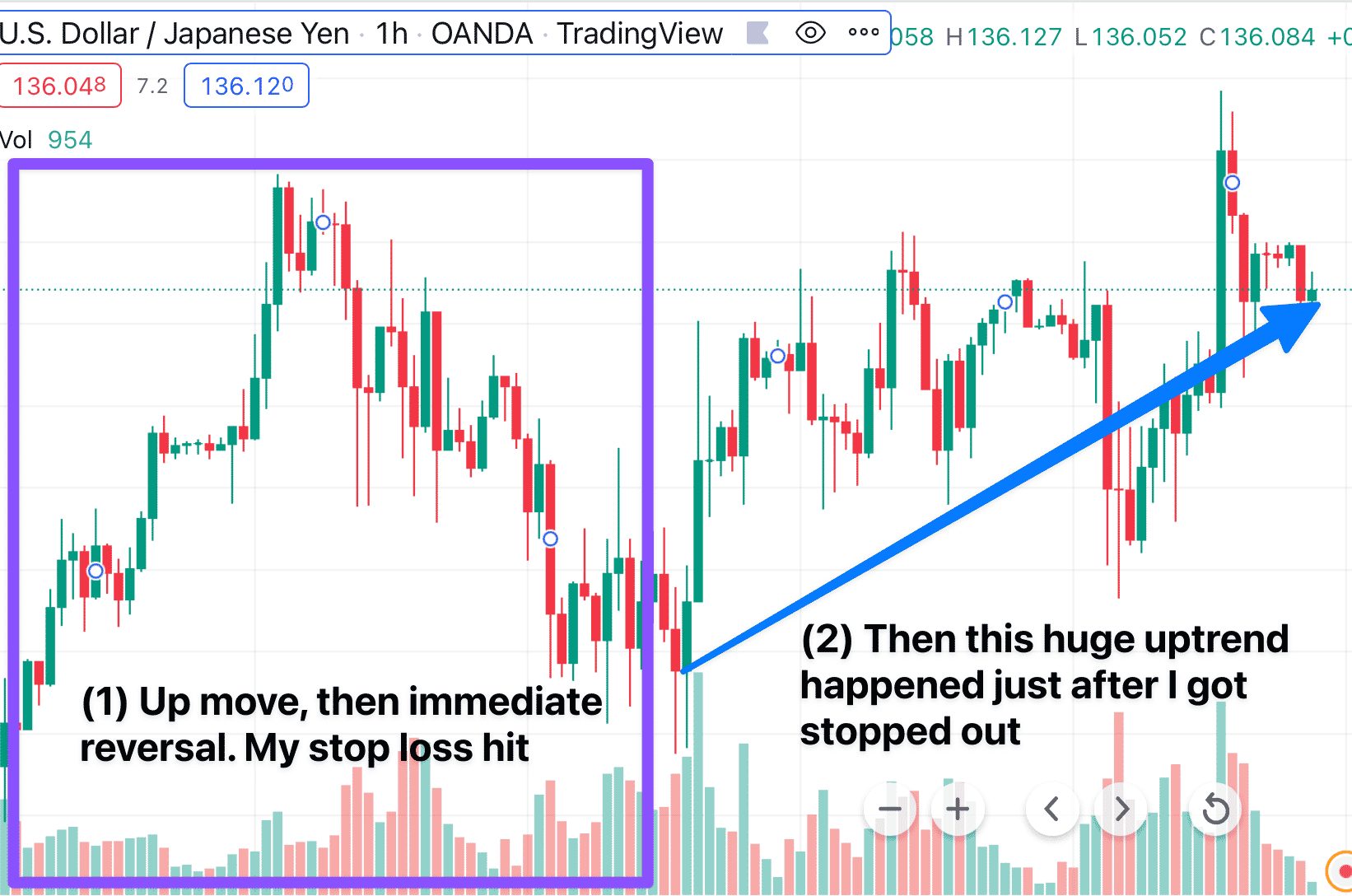

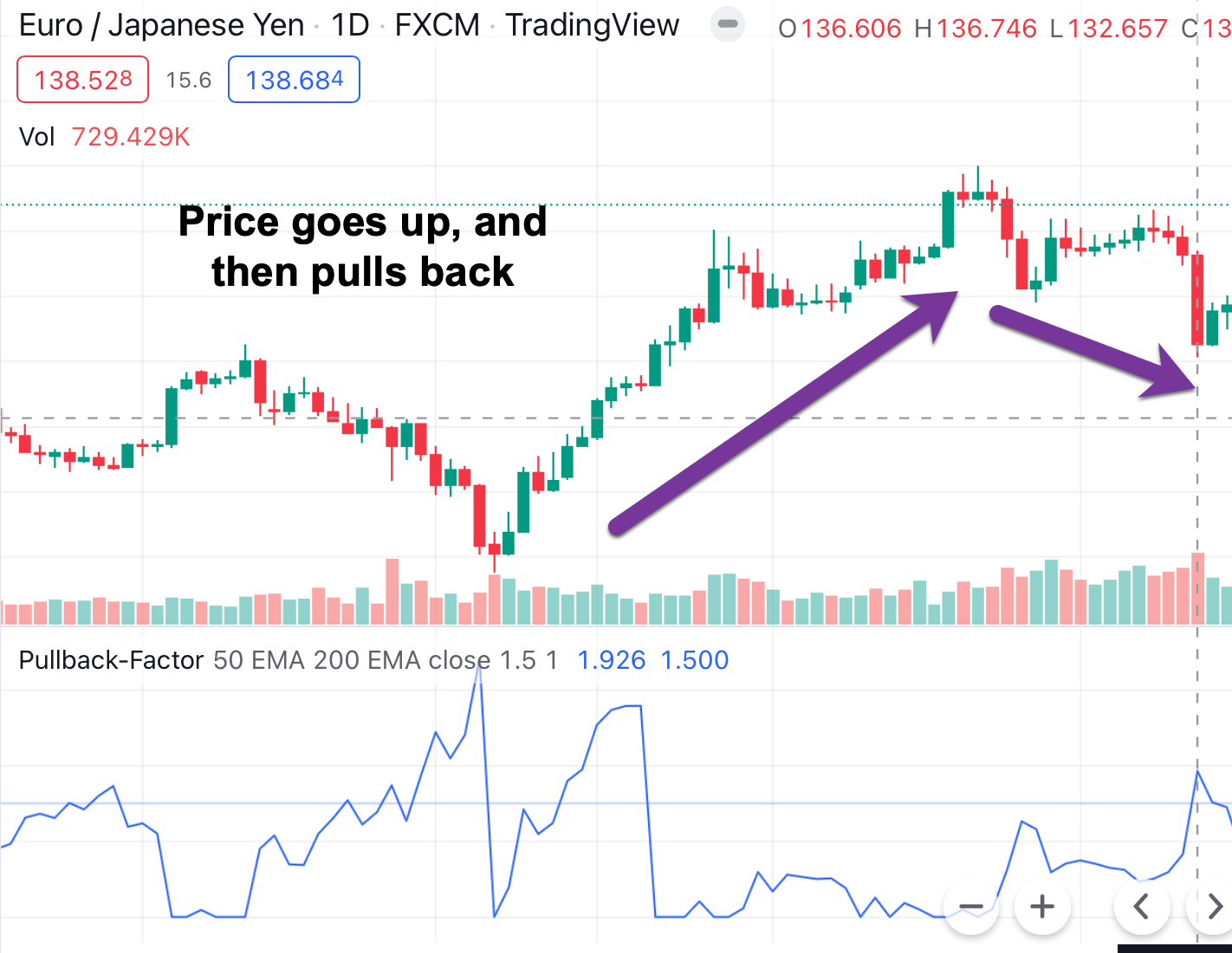

Or… maybe you’re more careful. And wait for the market to pullback. You know, the market goes up, pulls back, and goes up again, right?

I mean, something like this:

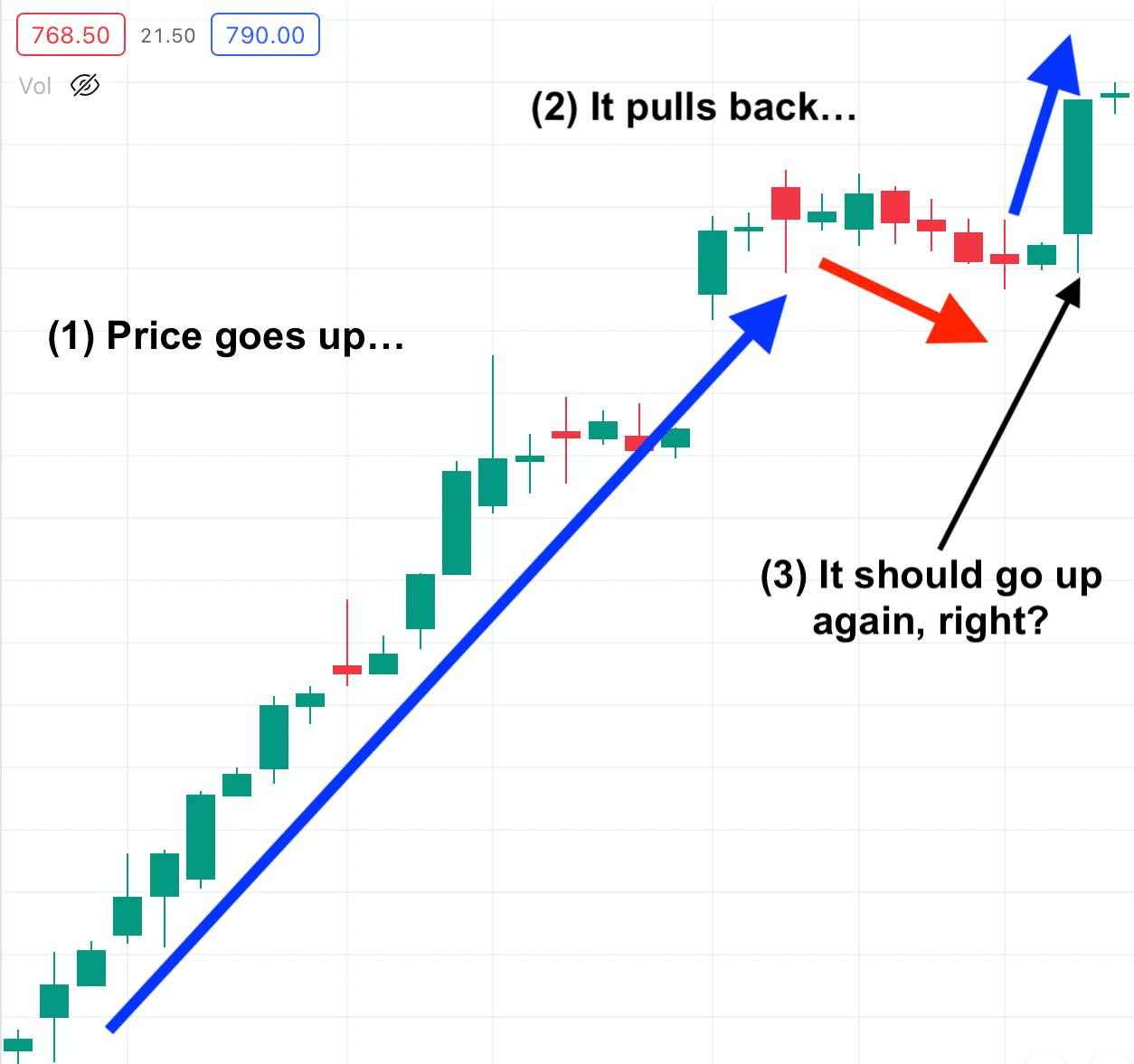

So, price goes up. Then it pulls back. Then the pullback seems to stop. This is where I’m supposed to buy, right?

Watch what happens

Argh, I’m going crazy…

How am I supposed to know when the pullback is done?

So I can avoid entering early and getting stopped out…

Or even better, how can I take advantage of the pullback to enter the trend with greater timing… and at the best price possible?

If that’s what you want, here’s the good news:

Our Pullback Factor Indicator for TradingView Solves This Problem For You…

Here’s why:

Pullback Factor indicator uses our volatility-based algorithm to identify whether or not the current pullback is about to end. When the pullback ends, that means… price is ready to CONTINUE its original trend.

In fact, statistical testing shows that: When the Pullback Factor indicator gives a signal that a certain pullback is complete, there’s a high probability the original trend will resume immediately afterward.

So you can be certain and confident placing a trade in the direction of the trend.

Let me show you how it works. Here’s a common scenario:

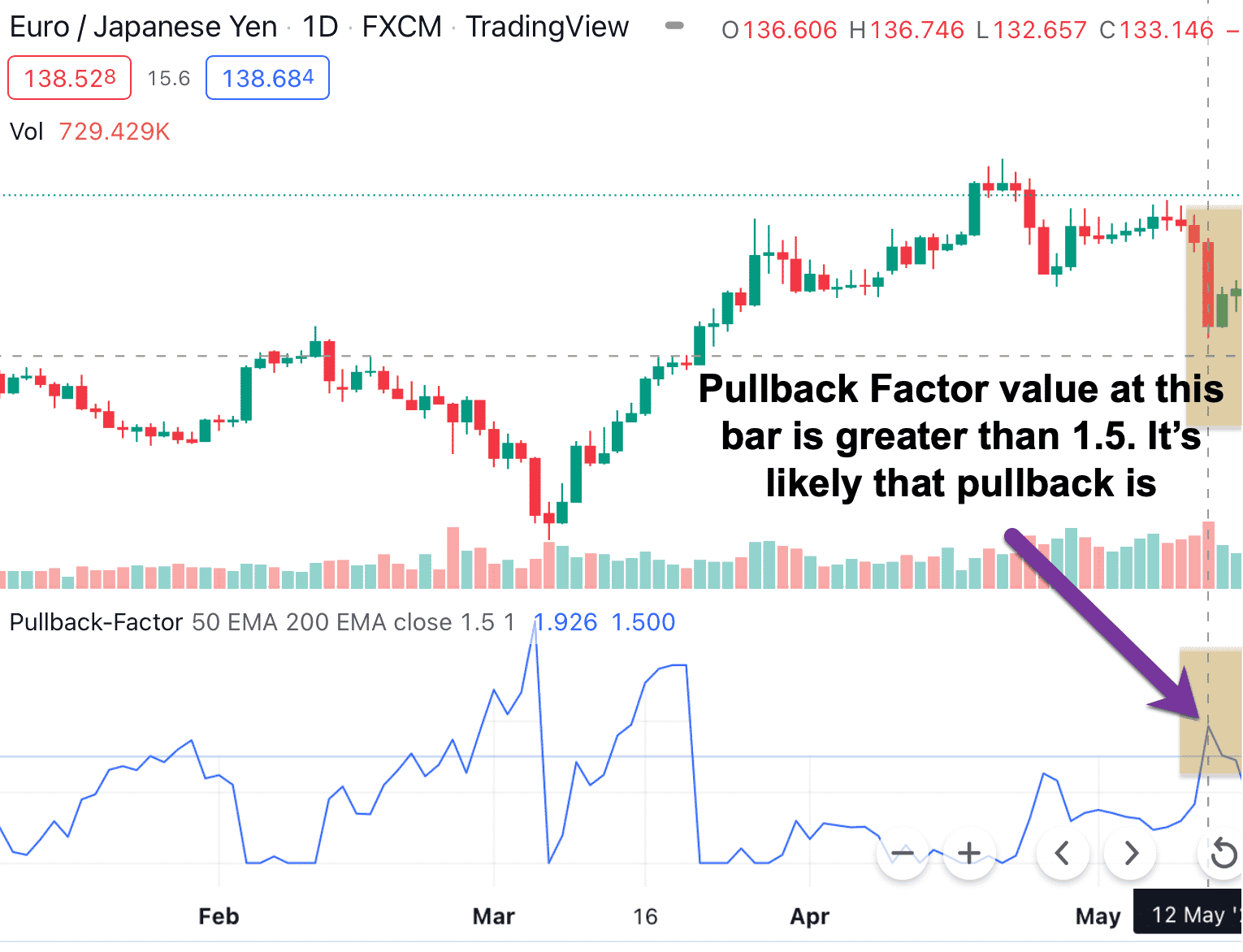

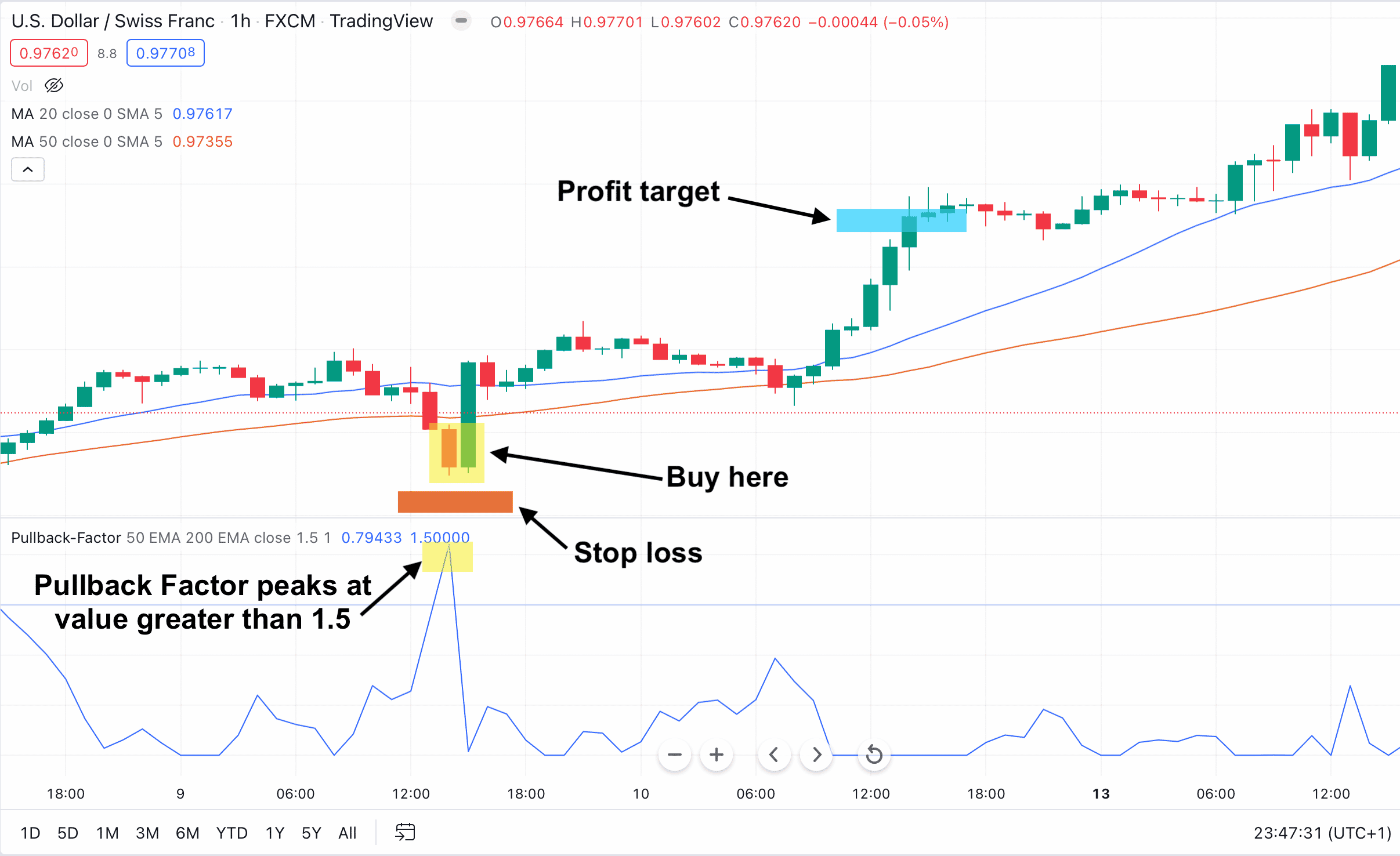

So the price goes up in an uptrend, then it pulls back. Now you’re wondering how long this pullback will last…

But then, you look at the Pullback Factor indicator value. And everything suddenly became clear.

No more uncertainty:

At this bar, the Pullback Factor value is 1.59 which is larger than 1.5. And a Pullback Factor value larger than 1.5 means that there’s a great probabiltiy that this pulback is coming to an end. And the price will continue its original trend (uptrend in this case) shortly.

So now you know with great certainty that this uptrend will likely continue.

And so, you enter a long trade…

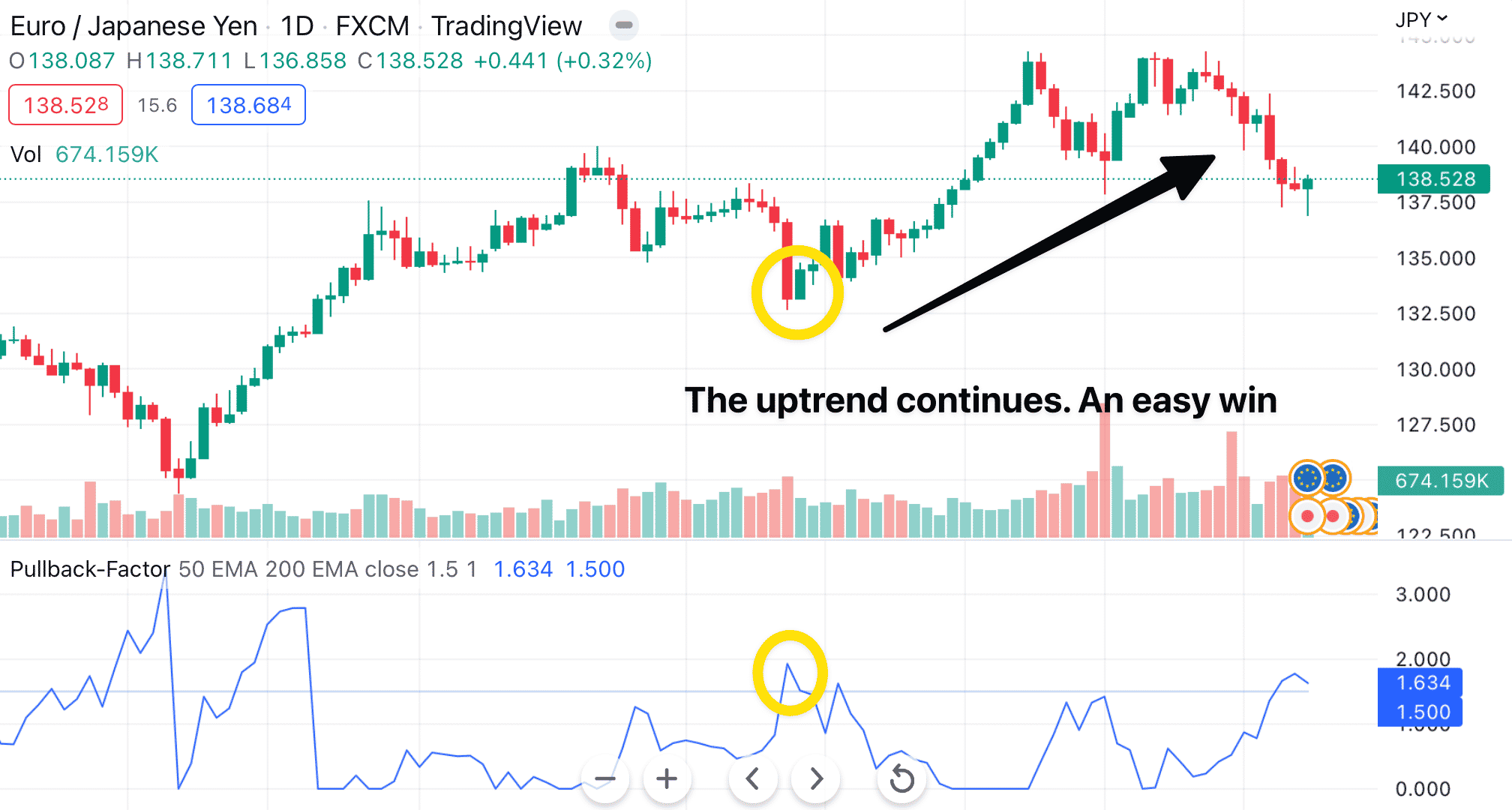

Let’s see what happens next:

This time, because you use Pullback Factor, your timing is perfect. And the price immediately shoots up in your direction. An easy win.

And it’s not stopping there…

Let’s take a look at how well Pullback Factor works in another market — Apple stock this time. Here you see another buy set-up when the Pullback Factor value exceeds 1.5. And you put on another long trade.

And…

Just as Pullback Factor predicted, price moves up aggressively in your favor again. So, the Pullback Factor indicator helps you place 2 long trades that result in 2 huge wins…

Moving on, let’s see how well Pullback Factor works in a downtrend.

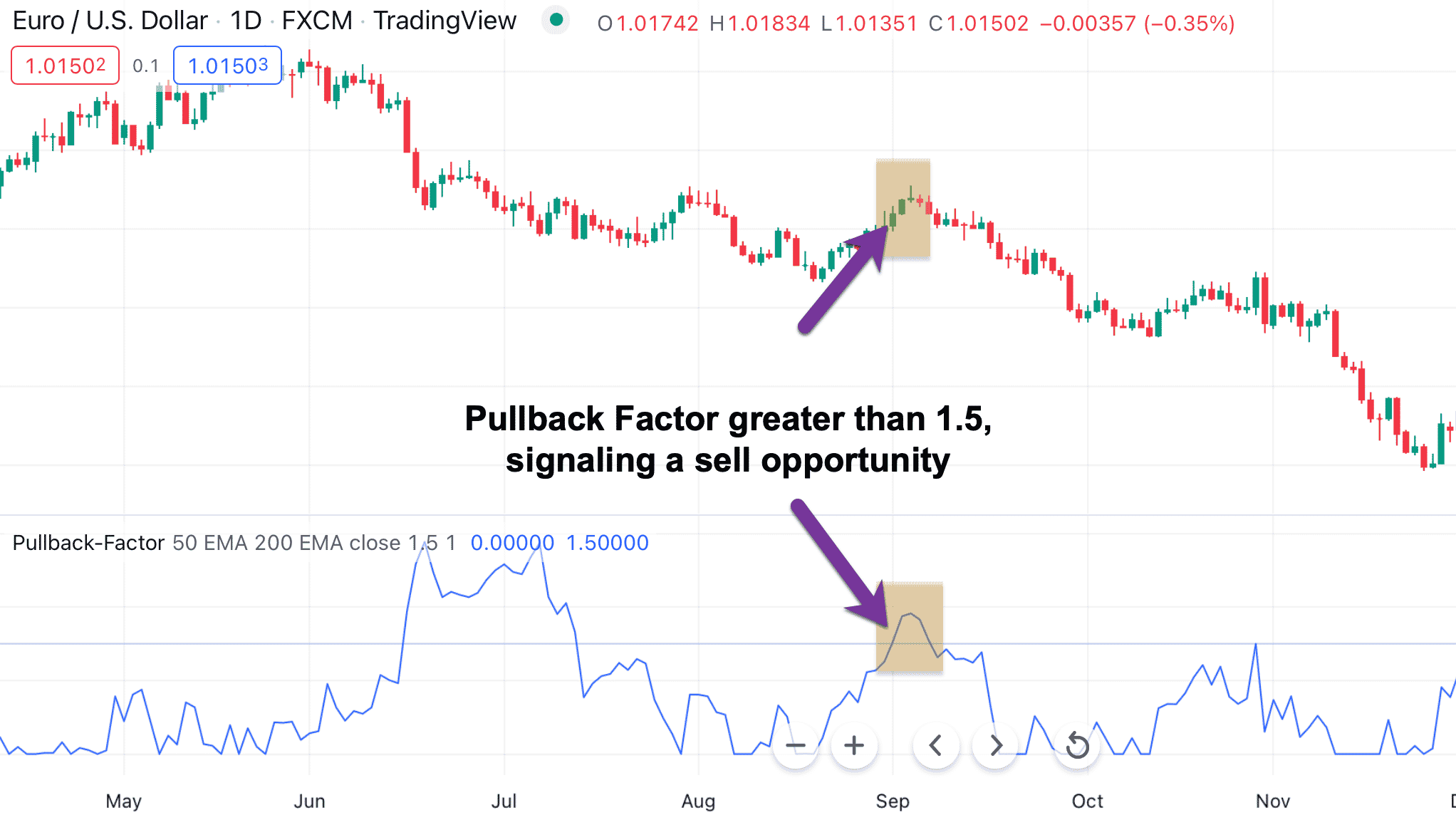

Here’s a EUR/USD chart:

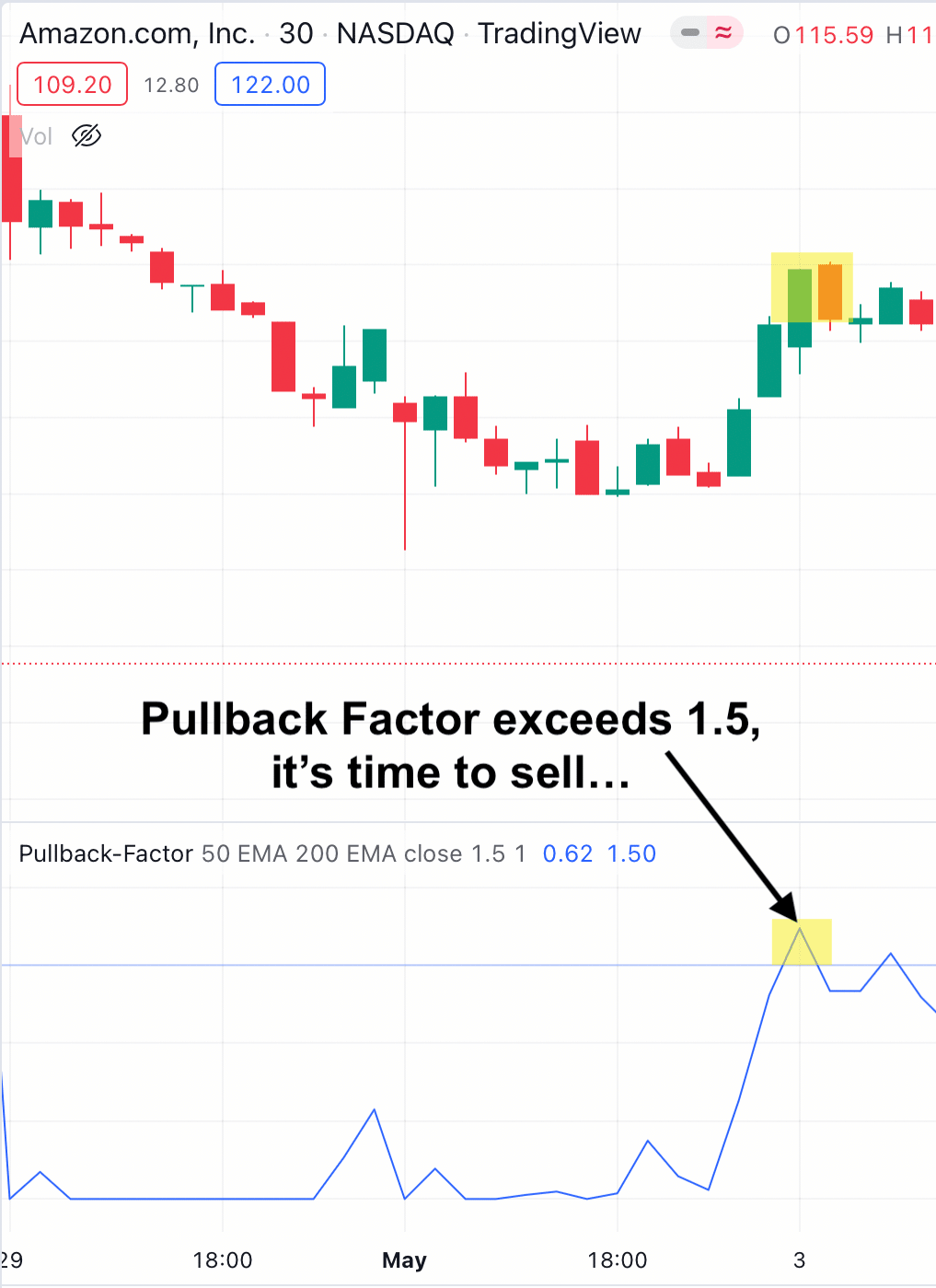

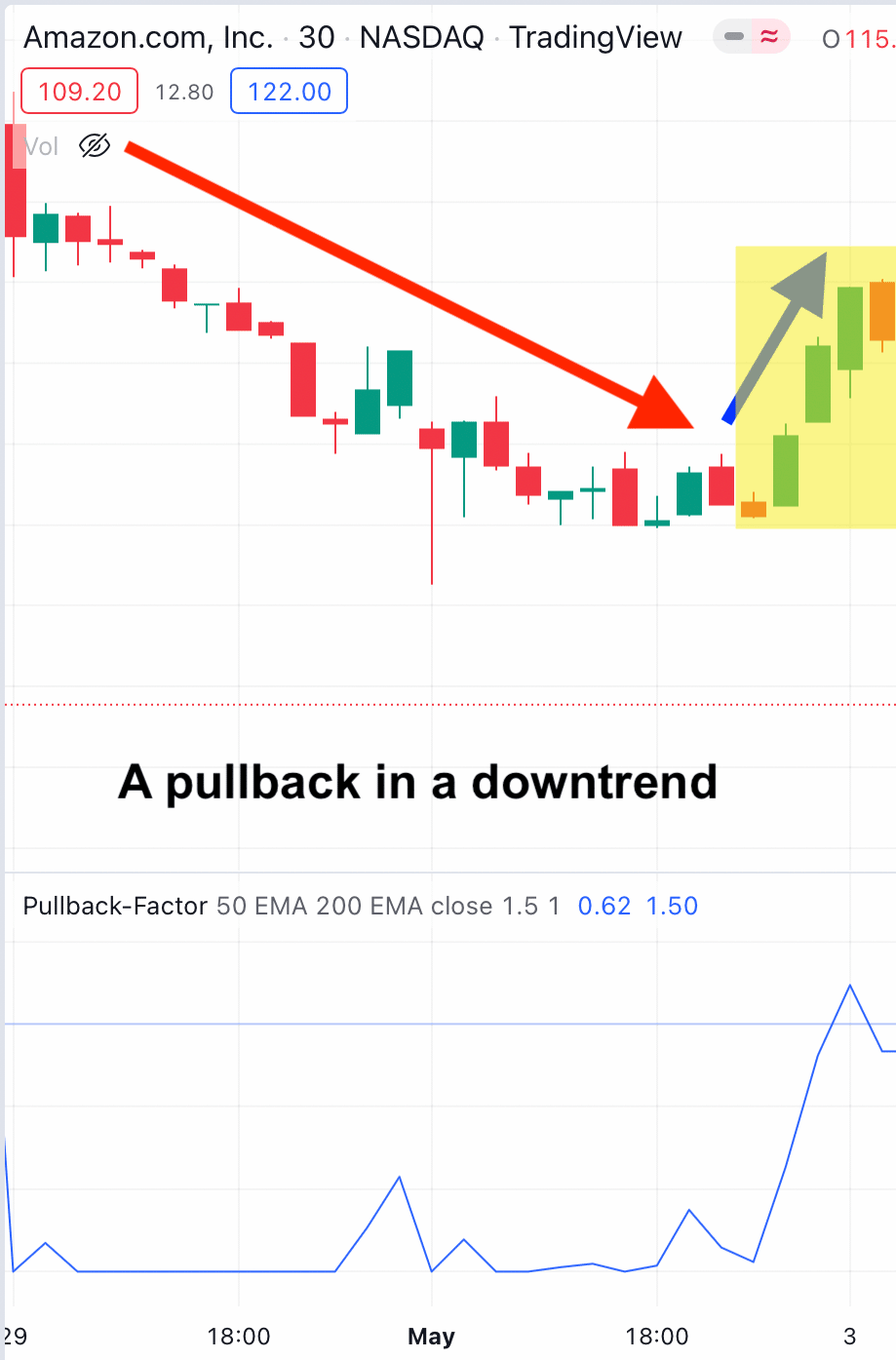

Now… switching to AMAZON stock. Look at this chart:

So the market goes down in a downtrend. Then it pulls back.

You know the drill. Now is the time to determine when this pullback will end, and when price will resume its trend direction:

You see that the Pullback Factor value is greater than 1.5 (at the bars highlighted in yellow). And so you sell.

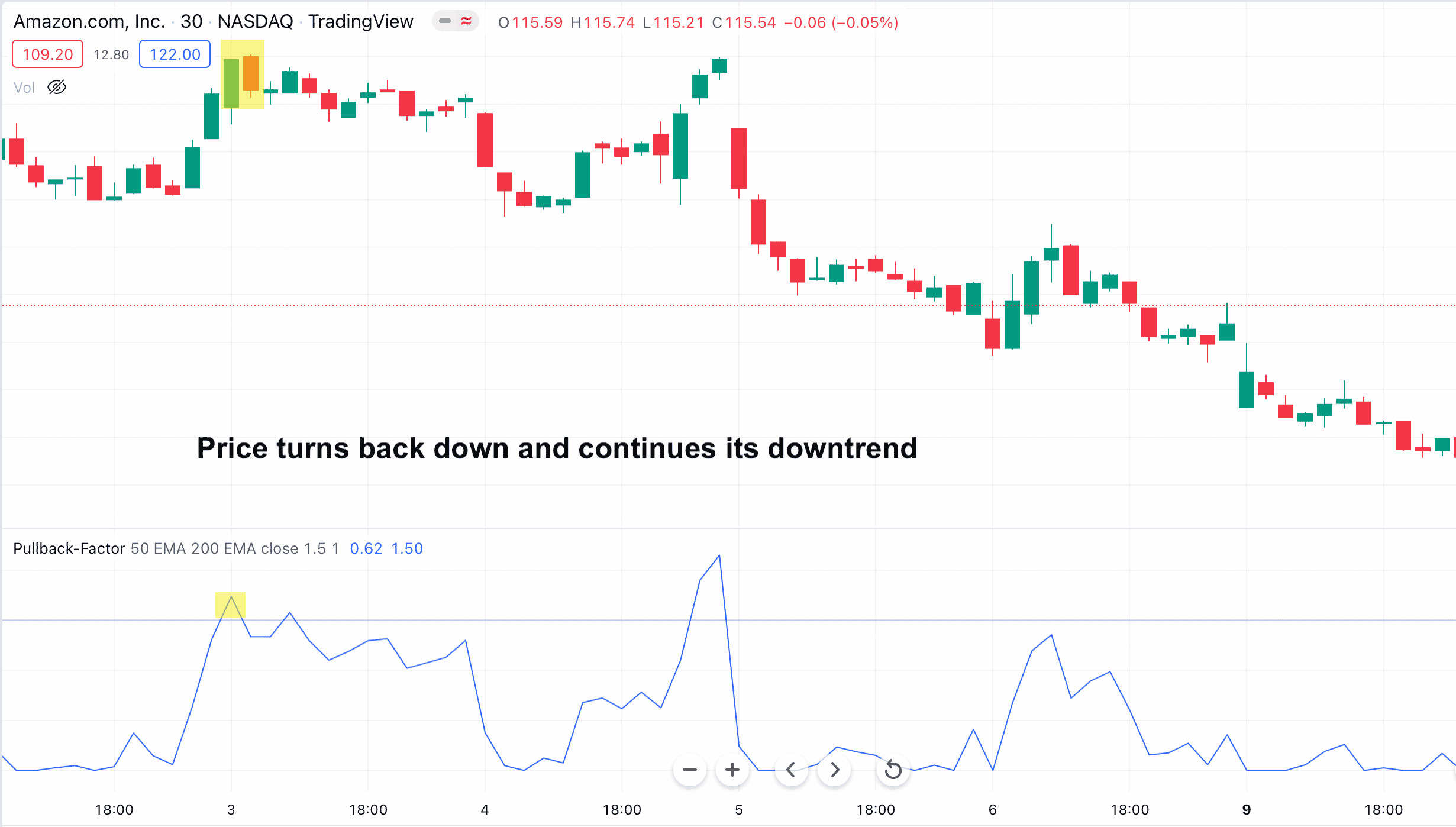

Watch how the price behaves after that:

You’re right again. As soon as you place your short trade, the market turns back down. And the downtrend continues.

And as a result, you’ve got a huge win.

But you’re not seeing everything yet. Now it’s time to take it up a notch…

Here’s my own trading system that incorporates the Pullback Factor indicator. And you have my permission to STEAL it…

Let me give you my own trading rules which are built upon the Pullback Factor indicator. You can steal these rules, and put them to work for you… immediately:

FIRST. You need to trade with the trend. To identify the trend, use 20-day moving average and 50-day moving average.

When the 20-day moving average is above 50-day moving average, the trend is up. And so we’re only looking for long trades.

When the 20-day moving average is below the 50-day moving average, the trend is down. And so we’re only looking for short trades.

SECOND. If the trend is up, enter a long trade when the Pullback Factor peaks at a level above 1.5. Conversely, if the trend is down, enter a short trade when the Pullback Factor peaks at a level above 1.5.

THIRD. Set your stop loss at the nearest support or resistance level. And your profit target would be two times (or three times) your stop.

Simple, right?

Well, let me show you how easy it really is. Look at this example on USD/CHF:

So here the 20-day moving average (red line) is above the 50-day moving average (blue line). And as such, we’re looking for buy opportunities.

The set-up is confirmed when Pullback Factor indicator peaks at a value greater than 1.5. So we place a long trade.

As expected, the indicator gives us a good trade. Price starts to move up in our favor immediately. And hit our profit target a few bars later.

Nice and easy, just the way I want it…

Do you think you can profit from these easy wins? I bet you could. Plus, the indicator is extremely flexible: Works on ANY instruments… ANY time-frame.

You can maximize your PROFITS with indices, stocks, commodities, and futures

… virtually any instrument you could think of.

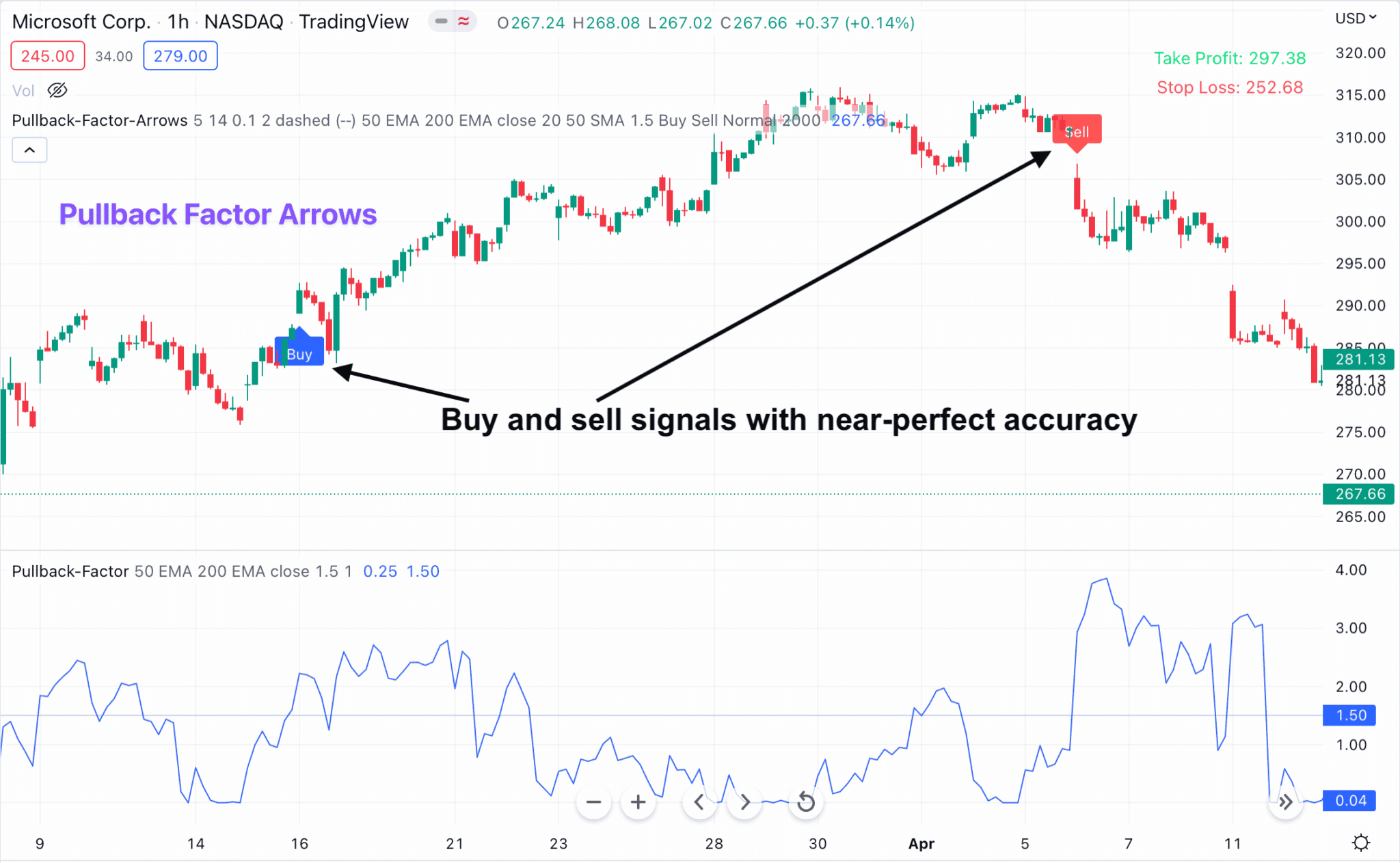

Near-automated Trading Indicator That Generates Buy and Sell Alerts with Laser Accuracy…

Useful Videos

Frequently Asked Questions

After purchasing, you’ll fill out a short form that asks for your Tradingview username. And then, we’ll grant your username access to all our indicators within 24 hours.

It works on ALL markets internationally that are available on Tradingview: FX, stocks, indices, commodities, futures, etc…

Customer Reviews

-

-

Sale!

Easy Wolfe Wave for TradingView

$299.00Original price was: $299.00.$269.00Current price is: $269.00. -

-