Missed Big Market Reversals? Try This New “Pivotal Reversal Pro Indicator” to Find TRUE Turning Points Using Pivots & Smoothed RSI Combo

Dear Trader,

Don’t you just HATE when this happens?

You’re in a trade. It’s going WELL. Then, as it nears a pivot point, doubt looms.

You get nervous. You don’t want to lose your gains. So, as soon as price hits the pivot and turns, you close.

Good call? Not really. Because, later, price races ahead. Uggghh!

Yep, YOU CLOSED TOO EARLY. You fell for the notorious “pivot fakeout”.

But there’s a way to stop this from ever happening to you again—a way to LOCK you in profitable trades if it’s determined the market will NOT reverse at pivots.

But that’s not all…

You will know the TRUE exit point price before any trend really dies—not when you think it will.

And you can only experience this by using the newly-released Pivotal Reversal Indicator for TradingView. First off, this amazing indicator gives you…

A Number Of Dead-On Accurate Trades

First, it detects custom pivotal points based on the proprietary algorithm. Next, at the position of a pivotal point, the indicator will check the smoothed RSI value to know whether the price is in an uptrend or downtrend and whether the price is overbought or oversold.

Qualified pivotal points will trigger bearish or bullish arrows such as you’ll see below.

If you’d used Pivotal Reversal Pro recently, you could have caught this “whale” of a trade before it happened:

…feast your eyes on this too …

What Causes Pivotal Reversal Pro To Work So Well?

Earlier, entry techniques were mentioned once the alerts were triggered. But what’s more interesting is the use of custom pivotal points to determine the exact right time to exit.

Smoothed RSI is less jumpy then the standard RSI, and it usually tells you more correctly when the price is in an uptrend or downtrend.

Then, our custom pivotal points signal that the uptrend/downtrend has come to an end. Knowing the TRUE end of a trend is valuable information—especially if you know that before other traders.

While other commonly used tools like moving averages and other technical indicators only signal a trend change after it has already begun a long time ago, Pivotal Reversal Pro is a LEADING indicator which predicts reversals before they happen.

Are You READY To Win More Trades? Get Started NOW, TODAY!

Like to trade lower time frames? You’ll get limitless opportunities to place trades like these:

You see, regardless of whatever instrument you trade or the time frame, the number trades you place is totally up to you!

Once you see how Pivotal Reversal Pro totally crushes any fear you have of the markets taking back your profit, you’ll want to put it through its paces.

Go ahead and win as many trades as you like!

But here’s what will make your experience even better:

This Is The Nearest You’ll Ever Get To An Automated Strategy

With each alert from Pivotal Reversal Pro, you’ll also get entries, stop loss and take profit levels printed in the top right hand corner of your chart.

There’ll be no need to search for the next support or resistance as a profit target. No need to define the nearest swing low for stop loss.

Those zones are irrelevant based on the custom pivots and TRUE exit prices calculated by the algorithm before any trend is over.

And be reminded that…

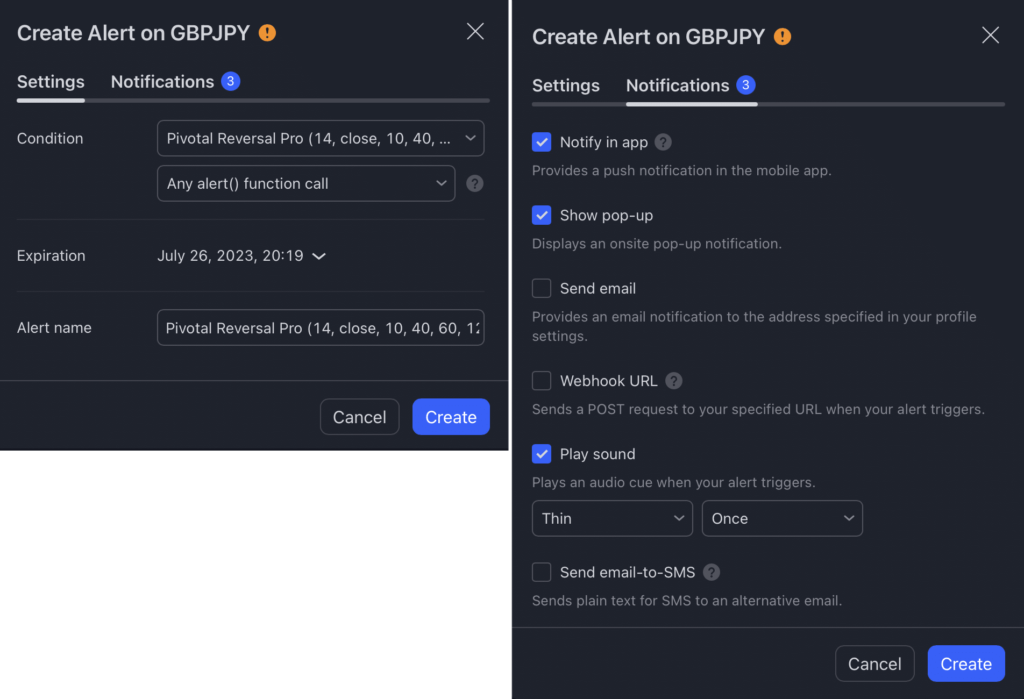

BOTTOM LINE: It doesn’t matter wherever you are… or however you want to customize the alerts… you’ll never miss out on some inevitably BIG trades!

Frequently Asked Questions

After purchasing, you’ll fill out a short form that asks for your Tradingview username. And then, we’ll grant your username access to all our indicators within 24 hours.

It works on ALL markets internationally that are available on Tradingview: FX, stocks, indices, commodities, futures, etc…