A pairs trading strategy is one of the most popular strategies when it comes to finding trading opportunities between the two stocks that are co-integrated.

How do the stocks co-integrate? How to take advantage of their co-integration with a pairs trading strategy? This blog discusses it all, check out this useful guide NOW!

Table of Contents

What is Pairs Trading?

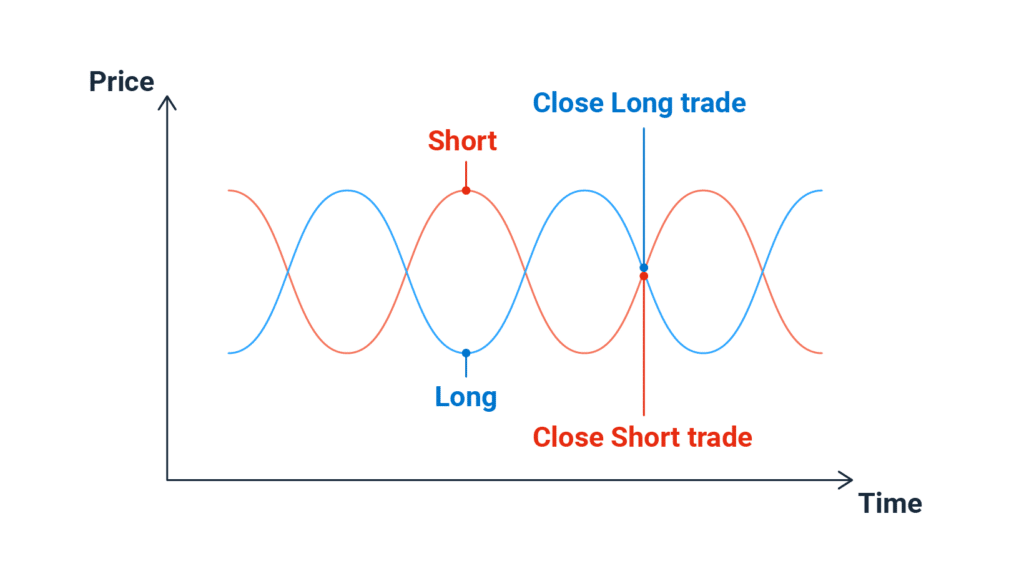

Pairs trading entails placing two (or more) wagers on unrelated but connected stocks. You typically purchase one security (go long) and short another.

Coke and Pepsi are the paradigmatic examples of pairs trades.

You would short Coke and buy Pepsi if the shares of Coca-Cola increased significantly while Pepsi remained stable. According to the argument, Coke and Pepsi both operate as mature businesses in the same sector, and their businesses are almost identical.

The two stocks’ performances ought to be comparable, barring extremely compelling circumstances. Of course, this is a fairly bold assumption, and the success of your transaction really depends on it.

A “pair” in the realm of pairs trading is Pepsi and Coke.

What is a Pair in Pairs Trading?

A pair is simply any two assets you trade against one another, one long and one short. The majority of the time, these securities are connected ones since they compete directly with one another or are in the same sector or business. Here are some examples of equity pairs:

- Coke and Pepsi

- GM and Ford

- Equifax and TransUnion

- S&P 500 and the NASDAQ 100

- Crude Oil and Natural Gas

- Gold and Silver

- Value and Growth

- Momentum and Mean Reversion

Though there are countless options, pair traders aren’t only confined to stocks. On the relative value of crude oil and natural gas, many commodities traders wager. Macro traders may wager on the S&P 500 outperforming the NASDAQ 100 or value stocks outperforming growth companies.

Early in 2021, the “reflation” trade—a wager that assets that profit from inflation, such as commodities, will beat those that don’t, such as bonds—was all the rage.

The Benefits of Pairs Trading

Pairs trading is a market-neutral approach, thus the success of your transaction is independent of whether the overall market is rising or falling in value. Consistent returns free of market fluctuations might appear to be the trading equivalent of the golden goose. However, because of the market’s relative efficiency, there are disadvantages, which we’ll discuss in the section below.

Pairs trading is a high sharpe ratio method that, when used properly, may protect you from market volatility.

What’s more, the approach does not depend on the market. Therefore, pairs trading might reduce portfolio volatility if you choose equities techniques that have a high market correlation.

The Drawbacks of Pairs Trading

Being a mean reversion strategy, the main disadvantage is that your average winning transaction will be modest and your average losing trade will be very high. Mentally, it’s also extremely difficult because averaging down makes more sense when the deal goes against you.

Additionally, popularity for couples fluctuates.

In a previous paragraph, we mentioned Coke and Pepsi. The most timeless pair is this one. Given how commonplace it is, you can find a mention of it in every pair trading book and course. A conventional pairs trading technique, however, has been losing money when trading Coke and Pepsi for years.

As a result, you’ll need to rotate the old pairings out of rotation while constantly looking for new pairs to trade. How do you decide whether to remove a pair from your trading universe when it may appear as simple as searching for stocks? How do you determine whether or not a couple is strong enough to be included in your universe?

Pairs Trading Strategy

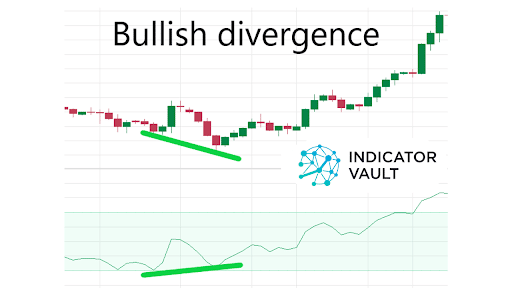

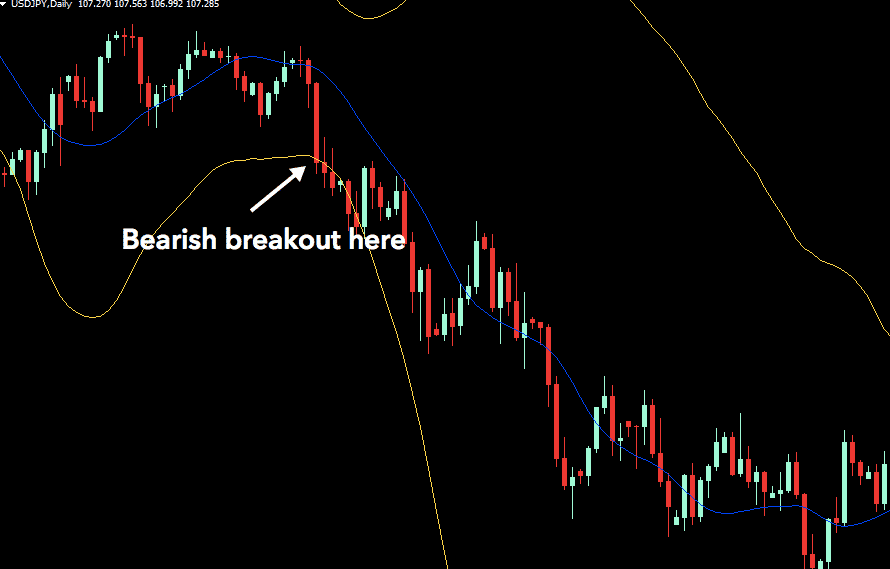

A trader needs the price information for the two markets in order to calculate a ratio (the price of one market divided by the price of the other). A trading opportunity arises when the ratio between the two goes outside of its typical range.

Bollinger Bands, an indicator with upper and lower bands that are two standard deviations from the ratio’s price, can be used by the trader to see this. A trading opportunity arises when the ratio crosses either the top or bottom of the Bollinger band.

But…

We believe we can make Bollinger Bands even better. We’ve pleased to introduce our brand-new Versatile Bollinger Bands indicator that lets you define a CUSTOM Moving Average to use in its core engine.

To put it simply: increased accuracy, increased versatility, and most importantly, LESS LAG.

Now, let’s see the Versatile Bollinger Bands indicator in action:

If you are interested, click here to see all the details…

Pairs Trading Summed Up

Pairs trading is a popular strategy, but like any strategy, it has dangers and doesn’t always work. The most crucial component of any strategy is risk management. No trader or investor can predict how a deal will turn out, therefore they must always be on the lookout for potential losses. Investors and traders can lessen the impact of any unsuccessful pair trades by adhering to the risk management guideline described above.

We’ve also put up the articles 3 Easy And Profitable Trading Strategies For Beginners and 3 Popular Forex Trading Strategies To Trade More Profitably to help you out a little. Check it out now!

Join Indicator Vault, utilise the variety of trading instruments offered, and establish yourself as a market power!

What do you think? How can you use a pair trading strategy to take advantage of their co-integration

Comment below to share your idea.

Find this article useful? Share this blog with your friends on social media!